Investment Strategy

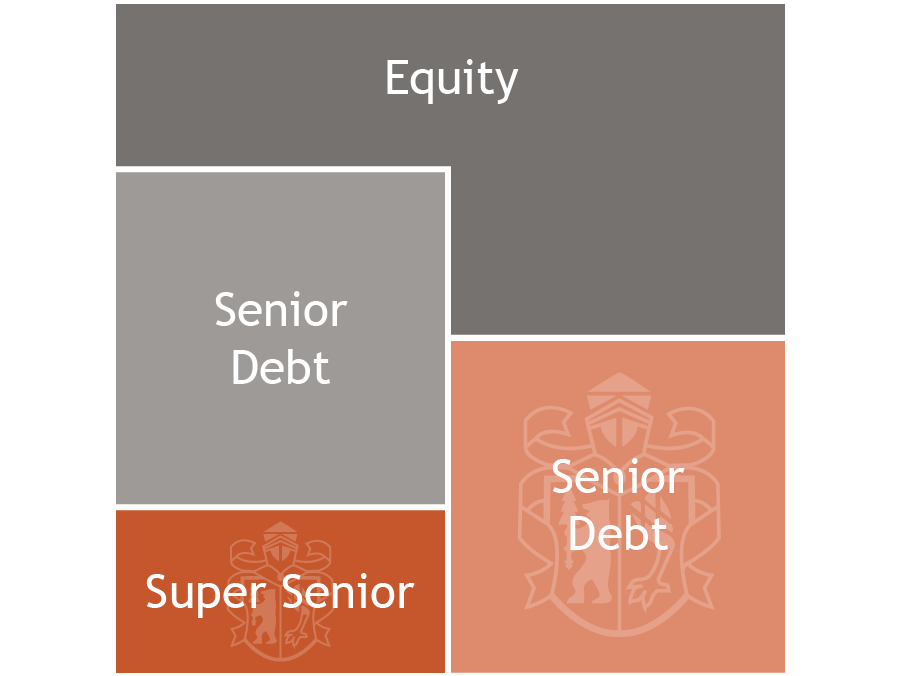

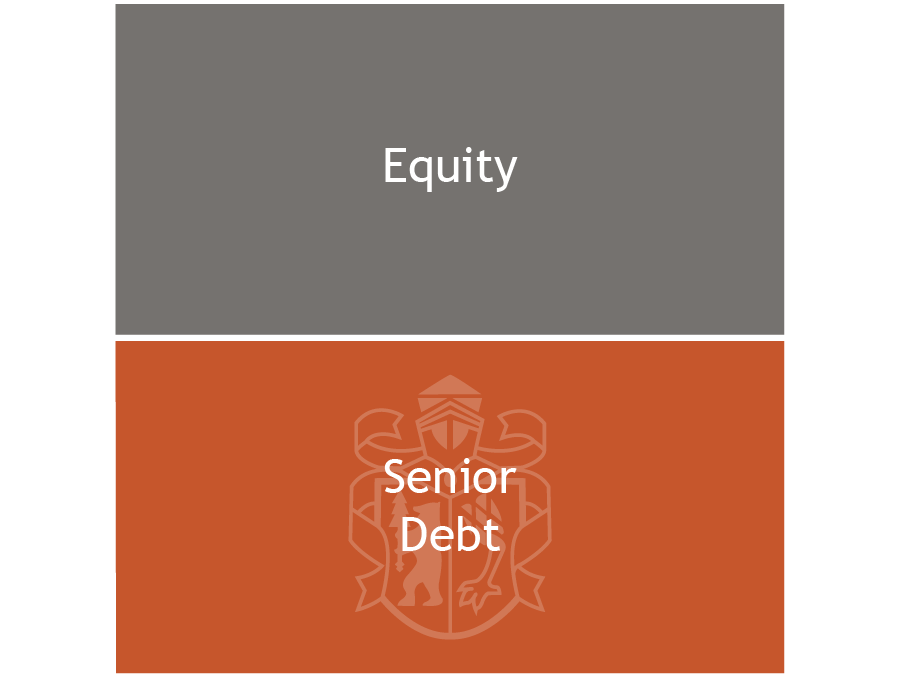

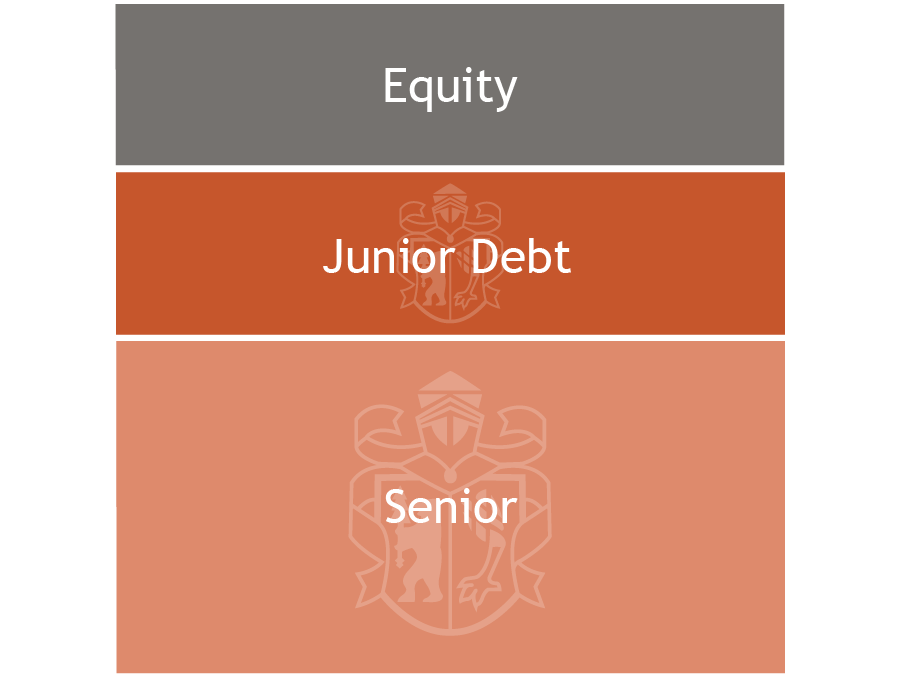

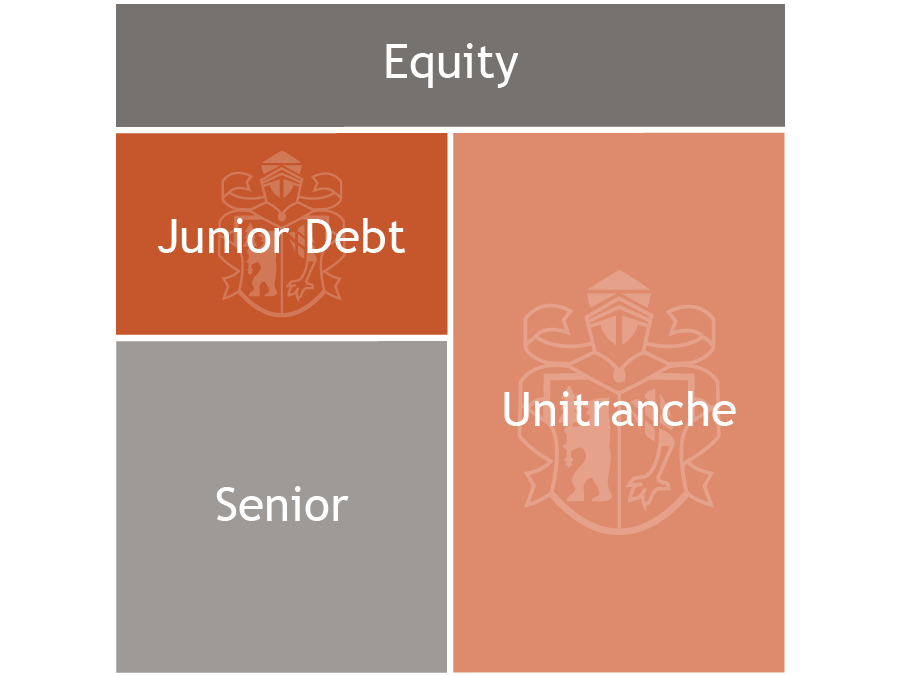

The Berenberg Green Energy Debt Funds invest in junior debt or unitranche financings of the attractive asset class Renewable Energy for the production types solar, wind onshore and wind offshore in OECD countries. Financings of Renewable Energy projects are characterised by robust, predictable cash flows and an attractive risk/return ratio.

By focusing on secured junior debt, equity-like returns can be achieved with ranking prior to the owners' dividends. At the same time, junior debt and unitranche financings have an ongoing, constant interest rate from the beginning and no successive ramp-up of returns as equity investments usually have. Unitranche financings enable a senior secured ranking with a higher investment volume while offering attractive return opportunities. Both forms of financing make an important contribution to the expansion of sustainable energy production.

As the funds’ investment advisor, Berenberg accompanies the projects in various phases, starting with late-stage development phases, through construction phases to operating phases, always secured by a comprehensive collateral concept.

Important information

This information is a marketing communication. It is intended exclusively for clients in the »professional investors« or »semiprofessional investors« client category pursuant to section 1 (19) nos. 32 and 33 KAGB. This information and references to issuers, financial instruments or financial products do not constitute an investment strategy recommendation pursuant to Article 3 (1) No. 34 Regulation (EU) No 596/2014 on market abuse (market abuse regulation) nor an investment recommendations pursuant to Article 3 (1) No. 35 Regulation (EU) No 596/2014, both provisions in connection with section 85 (1) of the German Securities Trading Act (WpHG). As a marketing communication this document does not meet all legal requirements to warrant the objectivity of investment recommendations and investment strategy recommendations and is not subject to the ban on trading prior to the publication of investment recommendations and investment strategy recommendations. This document is intended to give you an opportunity to form your own view of an investment. However, it does not replace a legal, tax or individual financial advice. Your investment objectives and your personal and financial circumstances were not taken into account. We therefore expressly point out that this information does not constitute individual investment advice. Any products or securities described may not be available for purchase in all countries or only in certain investor categories. This information may only be distributed within the framework of applicable law and in particular not to citizens of the USA or persons resident in the USA. The statements made herein have not been audited by any external party, particularly not by an independent auditing firm. Any future returns on fund investments may be subject to taxation, which depends on the personal situation of the investor and may change in the future. Returns on investments in foreign currencies may increase or decrease due to currency fluctuations. The purchase, holding, conversion or sale of a financial instrument, as well as the use or termination of an investment service, may give rise to costs that affect the expected income. Only the offering document (including the sub fund appendix if applicable), the Articles of Association of the Company and the subscription form (hereinafter referred to collectively as the »Sales Documents«) are authoritative for a decision on this investment. The Sales Documents are available free of charge in German from the Fund‘s Distributor. The business address of the Distributor is: Joh. Berenberg, Gossler & Co. KG (Berenberg), Neuer Jungfernstieg 20, 20354 Hamburg. A fund investment involves the purchase of shares in an investment fund, but not a specific underlying asset (e.g. shares in a company) held by that fund. The statements contained in this document are based either on own company sources or on publicly accessible third-party sources, and reflect the status of information as of the date of preparation of the presentation stated below. Subsequent changes cannot be taken into account in this document. The information given can become incorrect due to the passage of time and/or as a result of legal, political, economic or other changes. We do not assume responsibility to indicate such changes and/or to publish an updated document. Please refer to the online glossary at https://www.berenberg.de/en/glossary/for definitions of the technical terms used in this document. The images used in this document are for illustrative purposes only. They do not refer to specific products, services, persons or actual situations and should not be used as a basis for decisions or actions. Date 02.06.2025

Success story Renewable Energy

The worldwide expansion of installed capacity through Renewable Energy shows that the long-term upward trend of newly installed capacities for power generation from Renewable Energy is continuing as expected.

Favouring factors of this growth are amongst others an increased speed of expansion and the further realisation of cost reduction potentials. In addition to the increasing competitiveness of the electricity production costs of Renewable Energy compared to fossil energy sources, especially the continuing increase of the public awareness of climate change has a positive effect on the current and expected framework conditions.

The mentioned factors contribute to the fact that the worldwide long-term climate targets are still possible to achieve and thus support the global energy transition, for which the continued expansion of renewable energies is urgently needed.

The ongoing expansion of capacities in a large number of markets, both in the wind and solar sectors, creates a massive ongoing need for capital, especially for project developers. This demand covers Berenberg in a targeted way with junior debt and unitranches through the Berenberg Green Energy Debt Funds with a balanced risk-return profile.

Berenberg’s USP

Focus on financing niches by segments, financing ranks and structures

Experienced asset manager with banking licence

Structuring of complex financing solutions

High transaction speed

Broad network and strong industry know-how in various asset classes

In addition to the opportunity for an attractive return, the investment also entails risks which are described in detail in the section "Special Risks" in the issuing document. For example, but not exclusively, the following risks exist:

- Risks from participation in Financings

- Dependence on Berenberg

- Risk from possible conflicts of interest

- Inflation risk

- Interest rate risk

- Investment risk

- Payment obligation arising from financings

- Risk relating to collateral sharing

- Risk of the borrower

- Risk from the general economic situation

- Liquidity risk