Why profitable growth companies can still offer high returns - even in phases of value outperformance

The new year began on the stock markets with a noticeable correction of higher-valued growth stocks, while value stocks were able to gain due to the threat of interest rate increases and more restrictive rhetoric from the US Federal Reserve. Since the beginning of the year, growth stocks have lost about 15% compared to value stocks in Europe. Previous years' winners were sold off, while more favourably valued losers from previous years rose. In this Spotlight, we explain why we believe that profitable growth companies can offer attractive returns even when interest rates are rising and why solid growth led to outperformance even in higher valued stocks after the tech bubble burst in 2000. Our analysis shows that even in such an environment, earnings growth, positive returns on equity, and the attractiveness of the business model remain the key drivers of long-term share price performance.

From 2000 to 2003, profitable profit growth made the difference

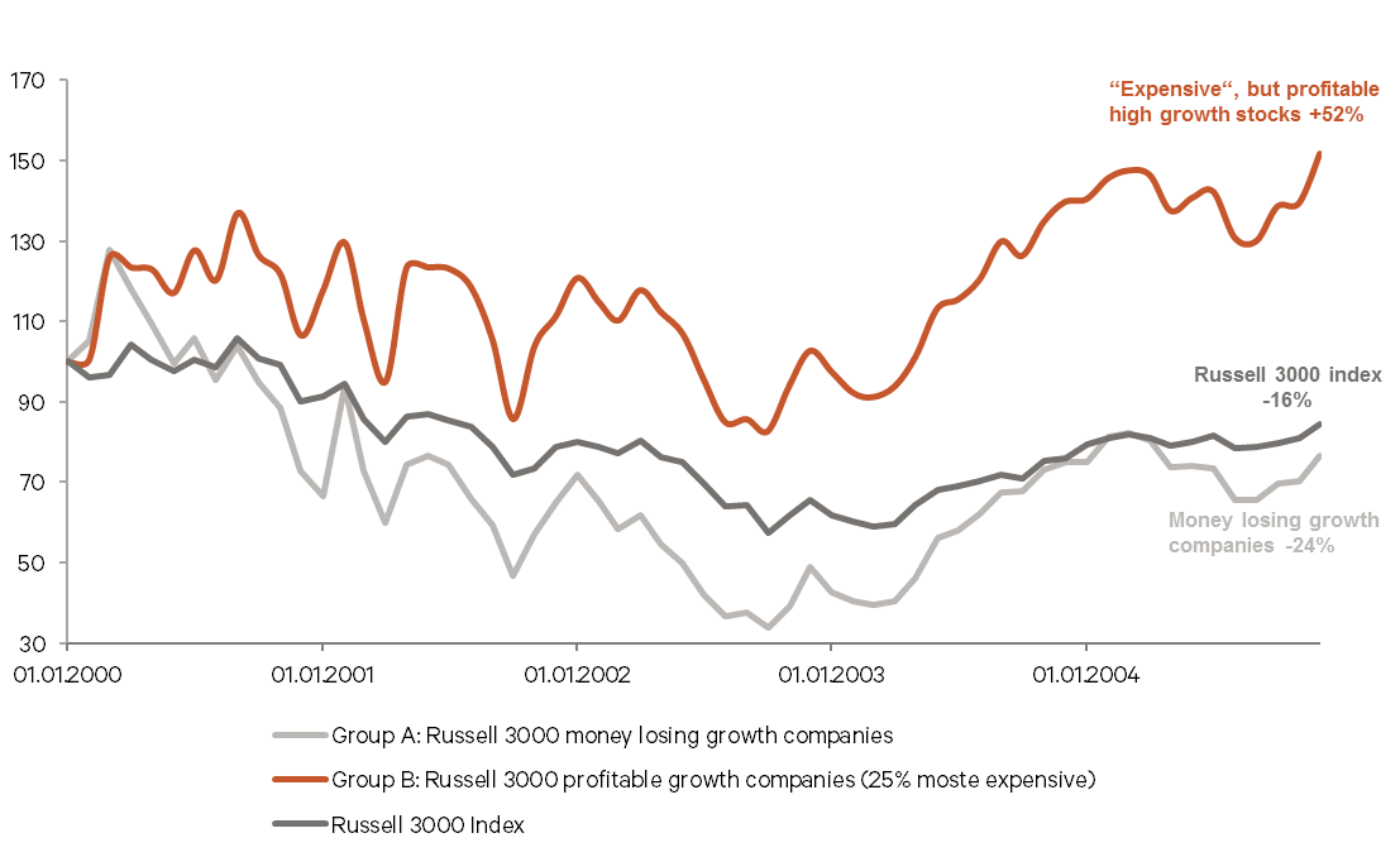

The "New Economy Crash" from 2000 to 2003 was one of the worst market phases for growth stocks over the last decades. Measured by the Russell 3000 Growth Index, growth stocks lost more than 20% of their performance compared to the overall market and suffered a drawdown of more than 60% in dollar terms. Under the surface, however, the picture was very heterogeneous: While non-profitable growth companies lost over three quarters of their value at the peak (Group A), the most expensive 25% of profitable growth companies were able to generate significant excess returns and outperformed the overall market by over 60% (Group B). This was mainly driven by earnings growth, as companies in Group B grew their earnings by an average of 15% p.a. from 2000 to 2003, while the overall market only posted earnings growth of 4% p.a. A high valuation (53x previous year's earnings in 2000 for Group B) did not per se result in a poorer share price performance, but rather the profitability of the growth was what mattered most.

Fig. 1: Comparison of highly valued profitable and unprofitable growth companies during the "new economy" crash

In the current market phase, it can also be observed that unprofitable growth companies are losing particularly strongly, but these are hardly represented in our portfolios. Profitable growth companies with high quality have also lost value in recent weeks, but we believe that the share price development of these companies will be oriented towards earnings growth in the long term.

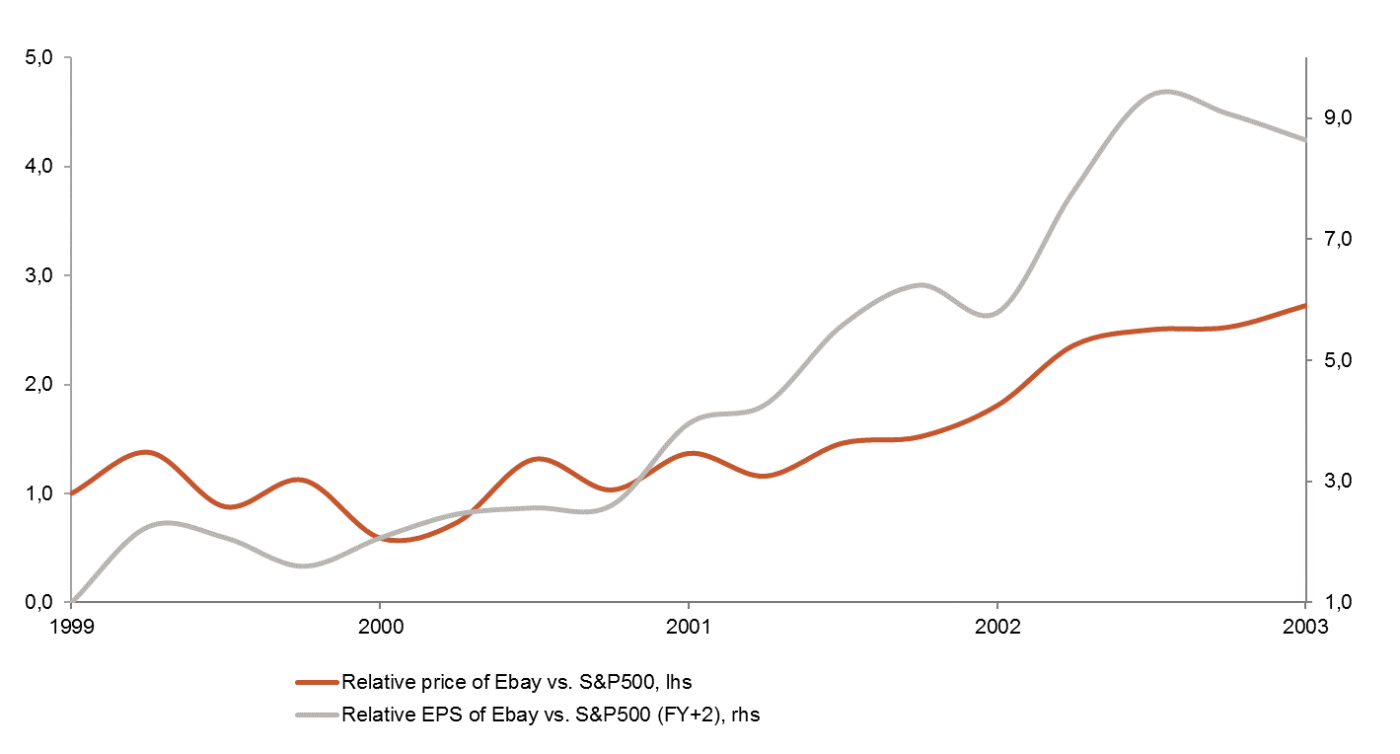

Fig. 2: Relative share price and earnings development of eBay

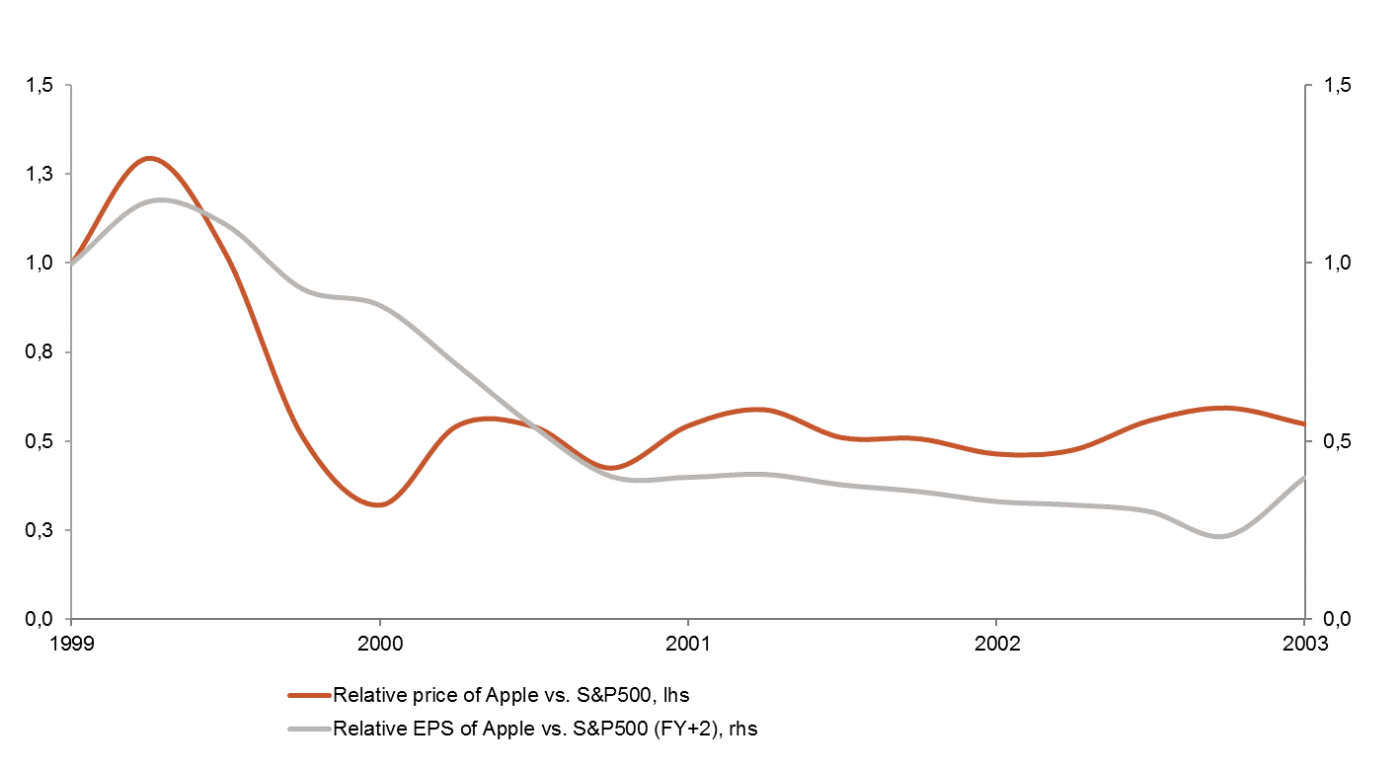

This is well illustrated by various examples from the difficult market phase at the beginning of the millennium. For example, the online marketplace eBay was able to steadily increase its profits relative to the S&P500, which was rewarded for investors with a clear excess return compared to the index despite a high valuation (60x 2002E earnings in spring 2000) (Fig. 2). This is remarkable because eBay was already performing very well before the Nasdaq collapse from 1998 to the beginning of 2000, with a share price increase of over 700%. Yet eBay was even able to extend this outperformance during the ensuing bear market thanks to steadily rising earnings estimates. For another growth company from this period, Apple, the reverse case can be shown. While the Apple share price also multiplied from 1998 to 2000, this was followed by a significant sell-off from 2000 to 2003 (Fig. 3), which was mainly related to falling earnings estimates.

Fig. 3: Relative share price and earnings development of Apple

As the two examples show, while changes in valuation levels can always occur in the short term, for investors with a medium to long term horizon, earnings growth, rather than changes in valuation levels, is ultimately the key driver for generating superior returns.

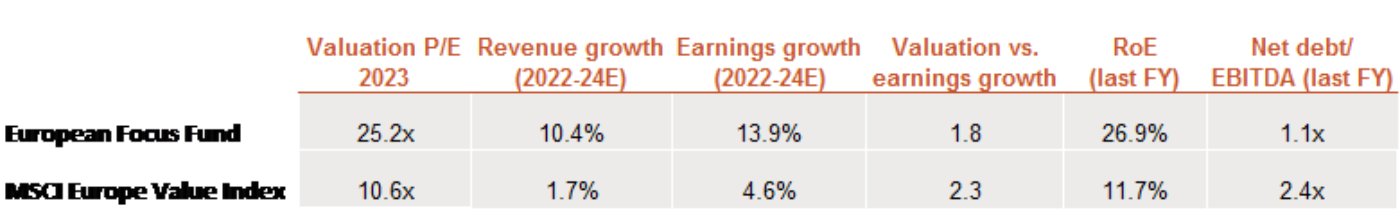

Value stocks hardly show sustainable earnings growth

While the companies in our funds are growing profitably at well into double-digit rates on average and benefiting from structural trends, most companies in value sectors lack earnings growth, and have done so over a long period in most cases. For example, financials, basic materials, and energy stocks have reached pre-crisis levels in both valuation levels and their earnings estimates and show only low single-digit and in some sub-sectors even negative earnings growth over the next two years. This also becomes clear in a direct comparison with our portfolio: according to Bloomberg, the earnings of the average company in the European Focus Fund are expected to grow almost three times as fast as the MSCI Europe Value Index from 2022 to 2024 (cf. Figure 4). In this respect, the companies in our portfolios are not dependent on an expansion of their valuation levels but can achieve excess returns over the market based on sustainable and high profit increases. In addition, the quality of our companies is significantly higher, which is illustrated by better returns on equity and debt ratios in Figure 4. Especially since the average valuation of our portfolios has moved back to the level of 2019 - the Corona-related valuation premium has thus been reduced - the focus should once again be on the growth of the individual companies. (see our publication "Rotation impacting our portfolios", 4th of February 2022)

Abb. 4: Wachstums- und Qualitätskennzahlen unserer Unternehmen im Vergleich zu Value-Aktien

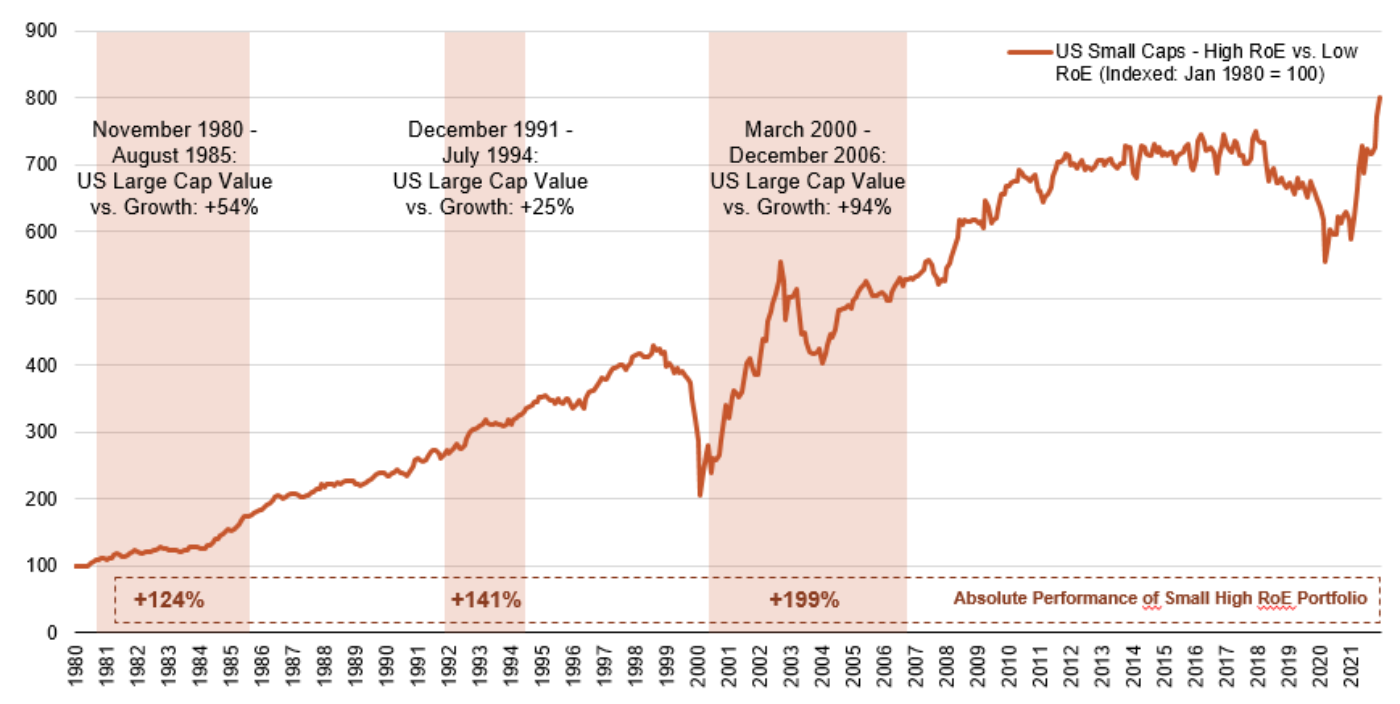

High returns on equity as a supporting factor for our portfolios regardless of market rotations

As already described, sustainable earnings growth is decisive for us when selecting stocks. For us, the ability of a company to reinvest at high returns on equity is particularly important. In this context, it is striking that companies with high returns on equity in past market phases with value outperformance were able to do significantly better than companies that hardly or not at all earn their cost of capital (often found in the value segment due to low valuations). This is contrasted in Figure 5 for small caps, a particularly broad universe of stocks. The red line shows the outperformance of companies with high returns on equity (top 30%) compared to companies with low returns on equity (bottom 30%). Overall, the outperformance of companies with high return on equity is very consistent over time and is a structural driver for our portfolios. We can also see that the outperformance has persisted even during periods of significant value outperformance. For example, from March 2000 to December 2006, value stocks outperformed US growth stocks by an average of 94%. Nevertheless, companies with high returns on equity outperformed companies with low returns on equity by almost 200% overall over this period. In summary, our focus on quality stocks with high returns on equity thus provides a kind of protective shield during periods of prolonged value outperformance.

The return on equity of the companies in our portfolios is currently about twice as high as the benchmark, which is why we believe that our companies can continue to grow profitably in the future and generate an excess return compared to the overall market.

Fig. 5: Long-term excess returns of small caps with high returns on equity

In summary, we believe:

- That the medium to long-term share price performance is primarily determined by a company's earnings growth.

- That companies with a solid market position, cash flows and high returns on equity can generate a sustainable outperformance compared to the overall market, regardless of the market phase, as has been shown in the past.

- That the current market environment with significantly reduced valuation levels and unchanged good earnings prospects for our companies offers attractive entry levels.

Authors

Matthias Born

Matthias Born has been CIO Equities since 2017 and Head of Investments of Wealth and Asset Management since 2019. He started his career in 2001 at Allianz Global Investors (AGI), where he managed portfolios for European Small Caps, European growth stocks and German equities from 2002 to 2017. In his 16 years at AGI, he has built two very successful equity franchises and was responsible for client assets in the double-digit billions. Matthias Born has an excellent track record over two decades and received several awards for his outstanding and consistent performance. He studied at the University of Wuerzburg and holds a degree in Business Administration.

Tim Gottschalk

Tim Gottschalk has been a Portfolio Manager at Berenberg since January 2022. He started his career in the Berenberg International Graduate Program with assignments in Asset Management, Wealth Management and Equity Research. Tim Gottschalk holds a Bachelor of Science in Business Administration and a Master of Science in Finance with Distinction from the University of Cologne with stays abroad in Dublin and Stockholm.