Current market commentary

After stock markets had recovered strongly in March, they went downhill in April to date. One reason for this, besides Putin's ongoing war, is that the Fed has increasingly prepared investors for quantitative tightening. A balance sheet reduction has a direct impact on financial markets, as the money from maturing bonds is partly no longer reinvested and liquidity is thus withdrawn from the market. In contrast, key interest rate hikes often have a longer time lag – moreover, the effects tend to affect the economy and only indirectly financial markets. As markets are also less supported by share buyback programmes in the context of the upcoming reporting season, we have reduced our equity exposure after the strong rally at the end of March. However, we remain slightly overweight. This is supported by the positive seasonality and the still pessimistic investor sentiment and positioning. Without an external shock, the downside potential should be limited in the short term.

Short-term outlook

With the upcoming Q1 reporting season, investor focus is likely to return to corporate fundamentals and thus the impact of the significant increase in input costs on earnings. Over the next two weeks, more than 25% of the Stoxx 600 and 50% of the S&P 500 report by market cap. Politically, the French presidential election (second round held on 24 April) and, in terms of monetary policy, the ECB meeting on 14 April are likely to keep markets busy. This Tuesday, the ZEW economic expectations (Apr.) for Germany and inflation data (Mar.) for the US are due. This will be followed on Wednesday by inflation data (Mar.) for the UK, producer prices (Mar.) for the US and industrial production data (Feb.) for the eurozone. Retail sales (Mar.) and consumer confidence (Apr.) for the US will be published on Thursday and industrial production (Mar.) on Friday. Preliminary Purchasing Managers' Indices (Apr.) for Europe and the US will be published the following week.

April historically tends to be the best month for global equities

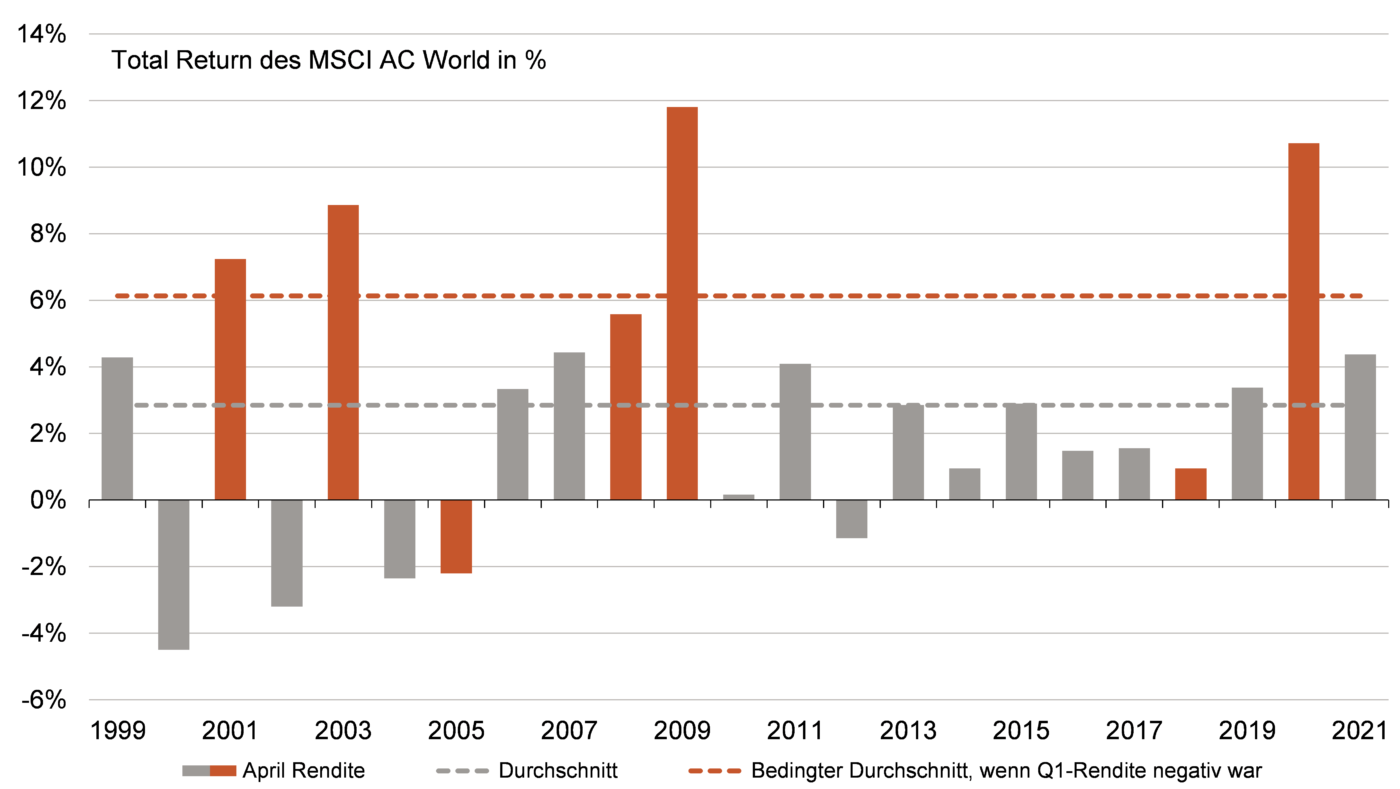

- April was historically the best month for global equities. Since 1999, they have averaged almost 3% in April (vs. 0.4% in all other months) and the last negative April was 10 years ago.

- Historically, performance has been even better when the previous quarter had a

negative return – just like this year. Then global equities returned 6% on average. - One reason for this could be the dividend payments.