Current market commentary

Central banks continue to be restrictive. Last week, for example, the ECB raised its key interest rates by 75 basis points – the largest rate hike in the ECB's history. Equity markets digested the move well. After all, the ECB made it clear that fighting inflation is important. Short-dated bond yields in the Eurozone, on the other hand, have reached new highs for the year. Coupled with the lower and thus more favourable equity prices this year, this has significantly improved the return prospects for multi-asset strategies over the next few years. Not least because commodities are also likely to experience a super cycle due to the energy transition and tight supply. In the short term, the market is likely to remain macro- and inflation-driven and thus volatile. In the medium term, the outlook for investors is currently improving every week.

Short-term outlook

The next two weeks will be dominated by the central banks. After the ECB meeting last week, the Bank of England will meet on 22 September and the Fed on 21 September. The market expects both central banks to raise interest rates by 50 and 75 basis points respectively. The Italian parliamentary elections on 25 September will be a political event.

On the economic front, the ZEW economic expectations (Sep.) for Germany and the inflation data (Aug.) for the US are likely to be decisive on Tuesday. On Wednesday, inflation figures (Aug.) for the UK, industrial production data (Jul.) for the Eurozone and producer prices (Aug.) for the US will be published. The Empire State Index (Sep.), Philadelphia Fed Index (Sep.), retail sales (Aug.) and industrial production data for the US will follow on Thursday. The preliminary purchasing managers' indices (Sep., S&P Global) for Europe and the US will then be announced the following week.

Better prospects for multi-asset portfolios after a weak 2022

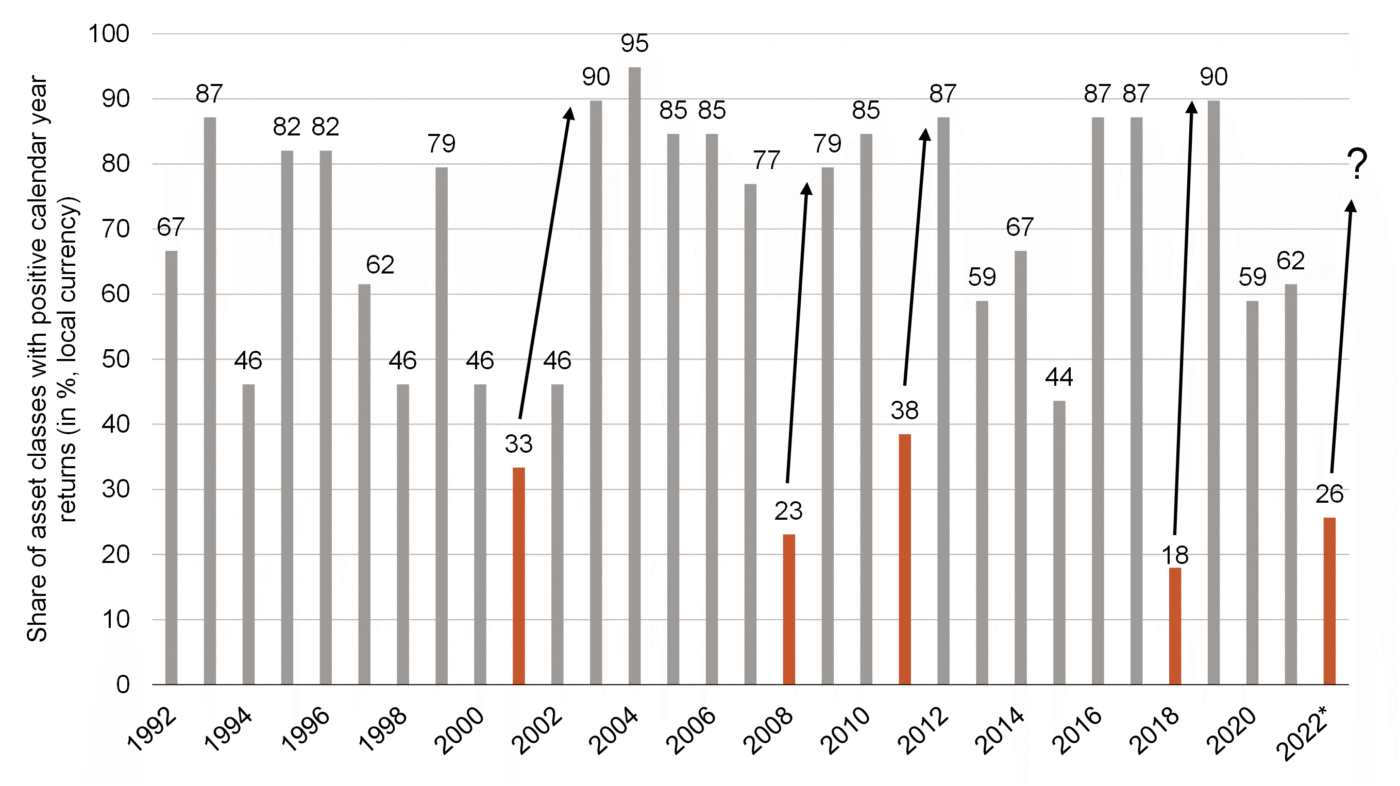

- 2022 has been a challenging year for multi-asset investors so far. Only a few asset classes have been able to generate positive returns so far.

- For 2023, however, the signs are point-ing to a much better position for multi-asset investors. Bond yields are clearly in positive territory for the first time in several years and equity valuations have fallen significantly. Historically, too, there is much to be said for this. Bad years for investors have often been fol-lowed by very good years: