Current market commentary

The escalation of the Middle East conflict took the markets by surprise. However, the immediate market reaction was merely a sharp rise in oil prices. Since June 10, the price of Brent crude oil has risen by more than USD 10 per barrel. Even the direct intervention by the US over the weekend has not led to widespread market panic so far. However, if Iran actually closes the Strait of Hormuz, as already approved by parliament, which would affect 20% of global oil and 30% of LNG supplies, this would lead to a sell-off on the stock markets and stagflation risks. However, this is not our base scenario, as it would also anger ally China, which is dependent on energy imports. The US and Saudi Arabia would also likely join forces to suppress such an attempt by force. Given its weakened defense capabilities, Iran is unlikely to be able to withstand such pressure for long. Geopolitical stock market turmoil is usually short-lived, but a residual risk remains. In any case, the rise in oil prices complicates the situation for the Fed, as it weakens growth and increases inflation.

Short-term outlook

After the recent focus on the many central bank meetings, attention is now likely to shift back to the economic data being released in Europe and the US. The NATO summit in The Hague on Tuesday and Wednesday and the subsequent EU summit will also be in the spotlight. In addition to the war in Ukraine and the Israel-Iran conflict, the main topic of discussion is likely to be Trump's demand for defense spending of 5% of GDP. Today, the purchasing managers' indices (June) for the eurozone will be published. Several sentiment indicators and GDP (Q1) for the US economy will follow in the course of the week. On Friday, we will receive the US PCE deflator (May). The following week will see the release of GDP figures (Q1) for the United Kingdom, German retail sales (June), US purchasing managers' indices (June), and European consumer (June) and producer prices (May).

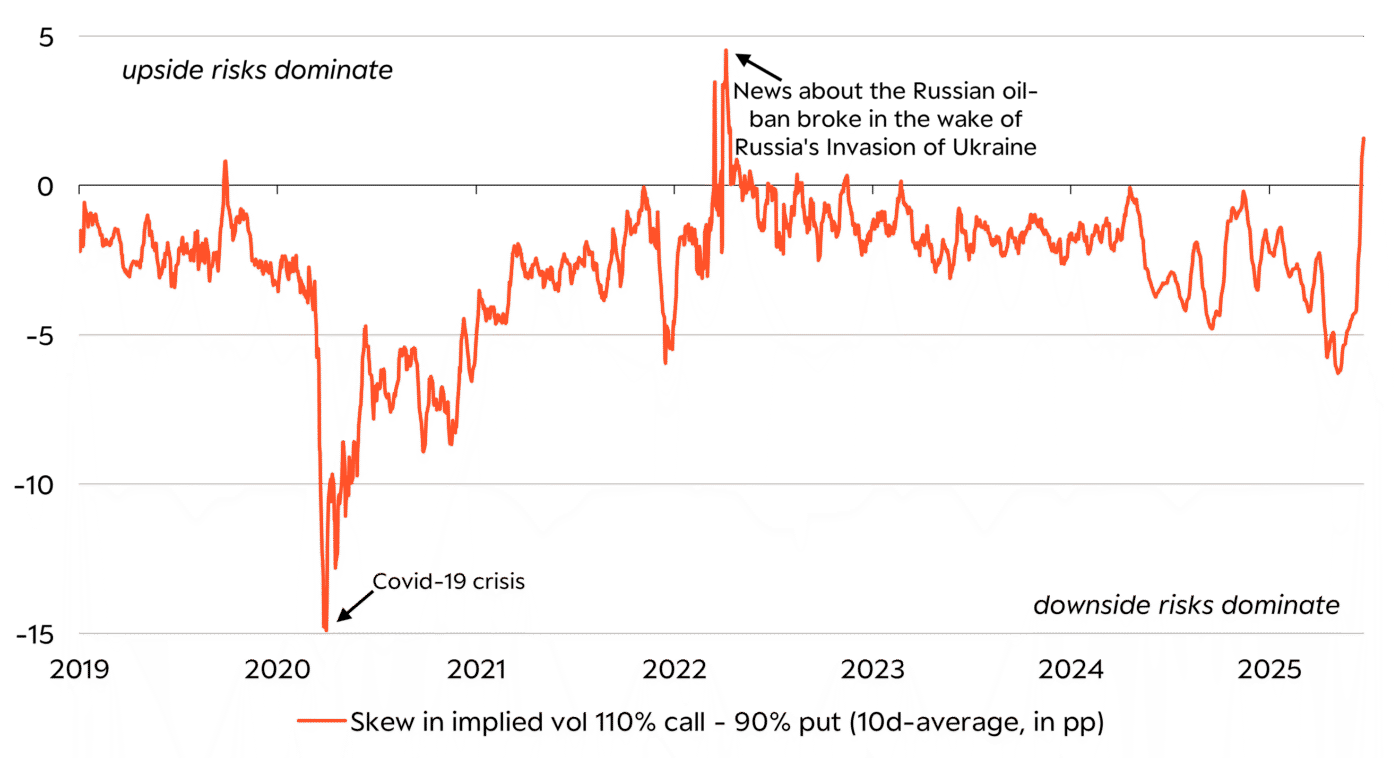

- At the beginning of the month, the oil market was still very pessimistic about the coming months due to OPEC+ production increases.

- With the escalation between Israel and Iran, the mood has recently taken a 180-degree turn - upward risks now predominate. However, the past shows that geopolitical uncertainty only provides temporary tailwinds. Only if the conflict actually restricts oil production is the oil price likely to remain higher in the long term.