Current market commentary

In the US, the June inflation rate of 9.1% was again higher and stronger than expected. The market is now even pricing in a 20% chance that the Fed will raise rates by 100 basis points at its July meeting. A Fed Funds Rate of just above 3.5% at the peak is implied until early 2023. For 2023, however, 2-3 rate cuts by the Fed are then priced in. The market expects a "Fed pivot", i.e. that the Fed will quickly reverse its monetary policy in view of weaker growth and easing inflation concerns (high inventories, falling commodity prices, less demand). Equity analysts, on the other hand, are still far from factoring a significant economic slowdown into their earnings estimates. For example, they forecast earnings growth of a good 10% for Europe in 2022. There have been slight reductions in earnings estimates recently, but with the Q2 reporting season now underway, there are likely to be more significant downward adjustments.

Short-term outlook

The Q2 reporting season has picked up steam. In the next two weeks, more than 50% of the companies by market capitalisation in the S&P 500 and the Stoxx 600 will report. But it is not only fundamentals that will be exciting, as the ECB is expected to announce its first interest rate hike since 2011, according to market expectations, at its monthly meeting on 21 July. For the Fed meeting on 27 July, the market expects a rate hike of between 75 and 100 basis points. Geopolitically, it is important to observe whether operations will resume after the planned end of Nord Stream 1 maintenance on 21 July.

US housing market data (Jun.) are due on Tuesday and Wednesday. The French Business Climate Index (Jul.) and the Philadelphia Fed Index (Jul.) will follow on Thursday. On Friday, the preliminary Purchasing Managers' Indices (Jul.) for Europe and the US will be released. The ifo Business Climate (Jul.) and US Consumer Confidence (Jul.) are due the following week.

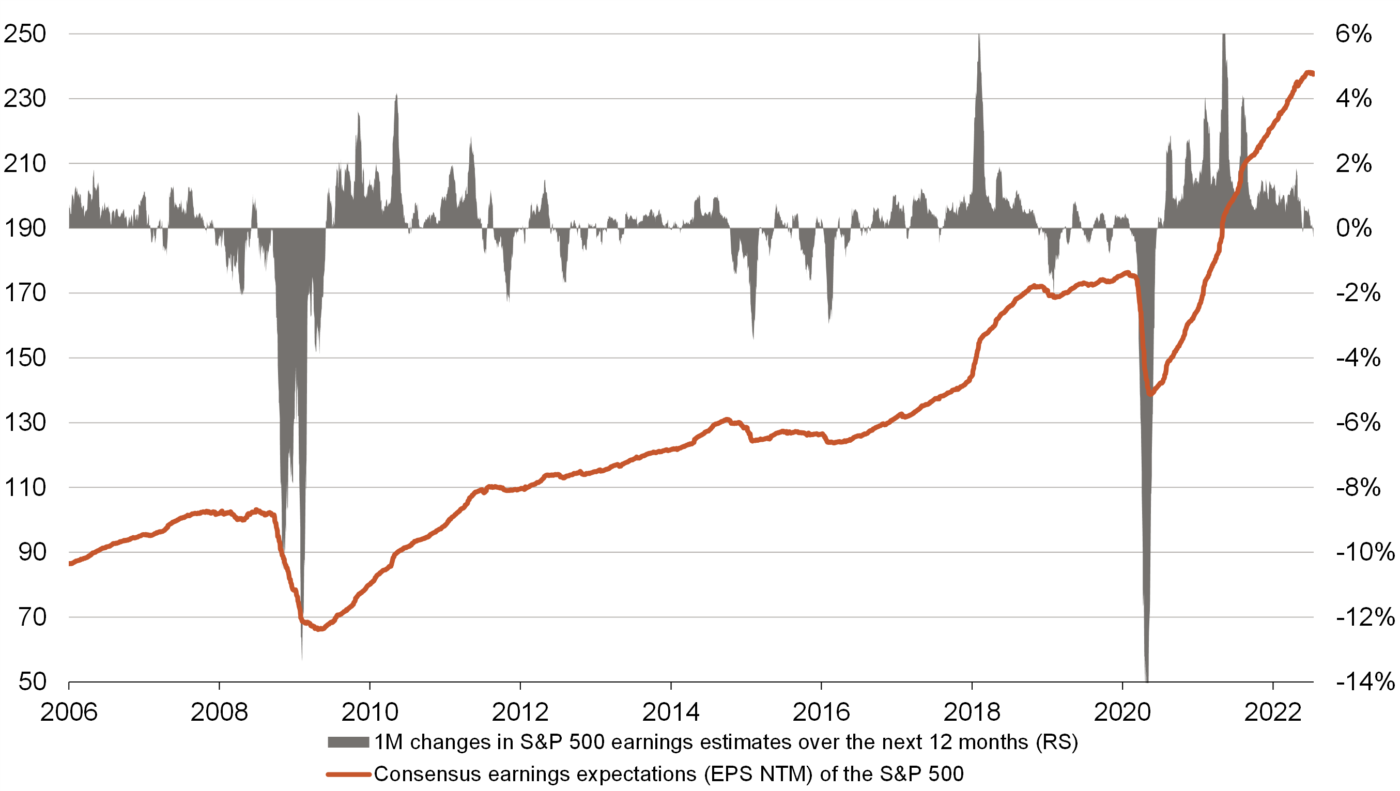

Earnings expectations likely to come under pressure

- The Q2 reporting season has started with the first negative surprises. This is hardly surprising as analysts' earnings expectations have continued to rise since the beginning of the year despite signs of recession, input cost inflation and supply chain problems.

- Despite this, negative profit revisions have hardly been observed so far. However, these are likely to pick up considerably, as historical comparisons show. After the valuation correction in H1, investors are likely to focus more on fundamentals again.