Current market commentary

The market has recently priced in a lot of hope again. Although analysts have at least slightly reduced their earnings estimates for this year due to the increased economic risks and heightened uncertainty for companies, the stock markets have recovered significantly. They are now even higher again than before Liberation Day on 2 April, when Trump surprised the world with his much higher than expected tariffs. Private investors in particular have bought the stock correction and pumped massive amounts of money into the market, supported by Trump's partial backpedalling on the tariffs. The improved price momentum and lower volatility have also recently pushed more systematic investment strategies back into the market. Although equity positioning is not as optimistic as it was at the beginning of the year, the market's vulnerability has nevertheless increased significantly. And this at a time when many market participants are expecting significantly worse macro data over the coming months.

Short-term outlook

The next two weeks will be quieter when it comes to central banks. The Q1 reporting season, which is drawing to a close, is likely to remain the focus of investors. Around 81% of S&P 500 companies have already reported. Over the next two weeks, primarily companies from the technology and consumer sectors will report.

On Tuesday, the ZEW economic expectations (May) for Germany and the consumer price inflation data (Apr.) for the USA are due. This will be followed on Thursday by GDP figures (Q1) for the UK and the eurozone, as well as retail sales (Apr.), industrial production data (Apr.) and producer prices (Apr.) for the USA. Friday sees the release of GDP figures (Q1) for Japan and housing data (Apr.) as well as preliminary consumer confidence (May) from the University of Michigan for the US. The following week will see the preliminary purchasing managers' indices (May) for the USA and the eurozone.

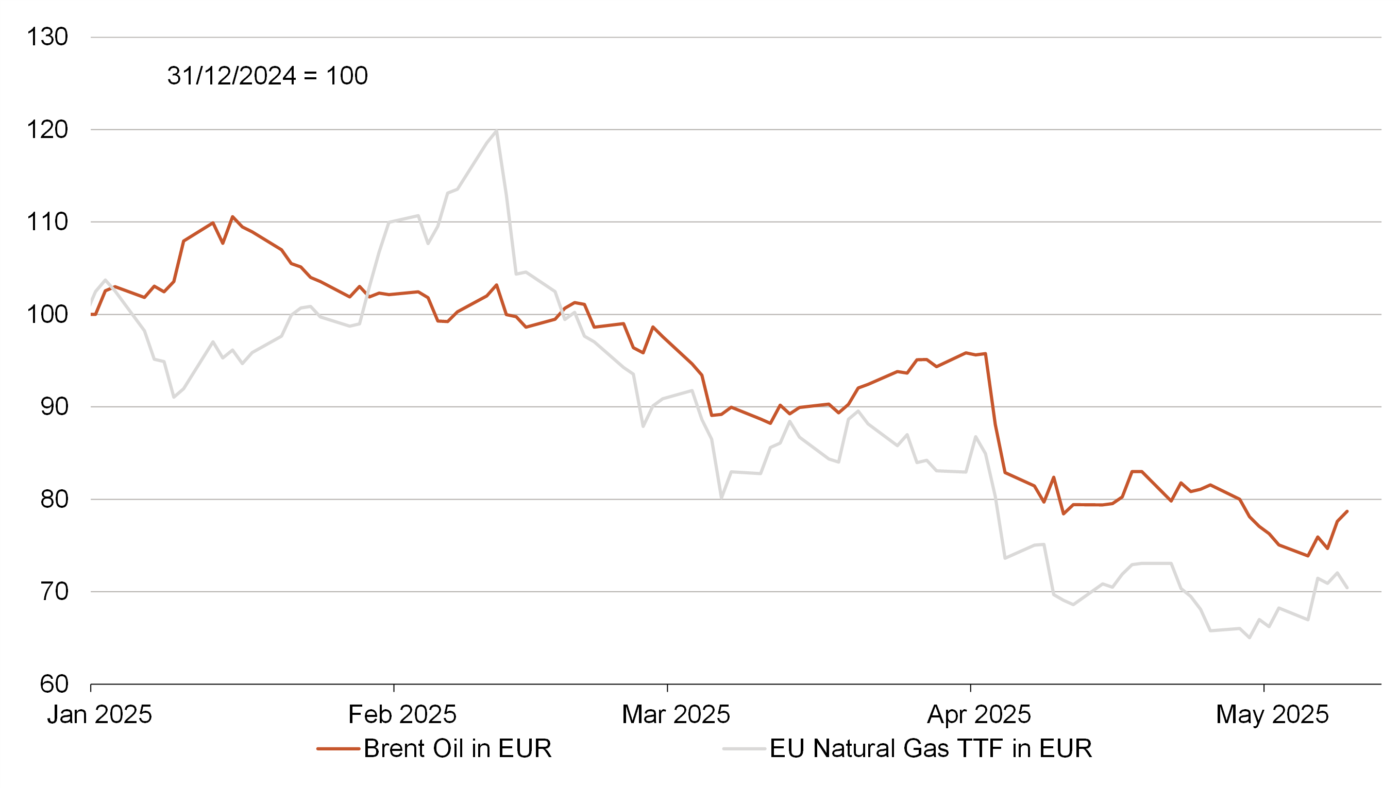

Energy costs in Euro fall with US dollar and oil and gas prices

- European consumers and companies are benefiting twice over: from falling energy prices and the weak US dollar.

- The euro price for Brent oil has fallen by around 20% this year, while the price of natural gas for delivery in the Netherlands has fallen by 31%. The latter is around 90 % below its peak in 2022.

- The cost of European natural gas has now fallen back to 2018 levels: Fears of the death of the European industry were greatly exaggerated