Current market commentary

Nothing can be trusted in capital markets these days. The typical recovery rally after a big Fed meeting did not even last a day. Further rises in bond yields have spooked investors and weighed on interest rate sensitive assets such as tech stocks. Moreover, concerns about a recession continue to grow, especially as a (quick) resolution to Putin's war is not in sight and Chinese economic data has also weakened signifi-cantly. Investors have to deal with a multitude of worries and problems at the same time. Investor sentiment and positioning is correspondingly negative. Another sharp sell-off therefore seems unlikely without an external trigger. Nevertheless, as long as the problems persist, we do not expect a big recovery and have used the relief rally to move our equity exposure to neutral. If worse comes to worse, gold, a small US government bond position and a hedge against extreme risks should help.

Short-term outlook

The Q1 reporting season is coming to an end. More than 400 companies in the S&P 500 have already reported and on average surprised to the upside in both sales and earnings growth. Looking ahead, however, earnings growth is likely to become more challenging due to rising costs, as reflected in the recent negative earnings revisions. The market is likely to remain focused on recession, inflation and geopo-litical risks.

Industrial production data (Mar.) for Italy and German ZEW economic expecta-tions (May) are due on Tuesday. On Wednesday, inflation data (Apr.) for the US and China will be released. Preliminary Q1 UK economic growth and US producer prices (Apr.) follow on Thursday. Eurozone industrial production data (Mar.) and US consumer confidence (May) will be released on Friday. The following week, US retail sales (Apr.) and economic indicators will be released.

Equity markets likely to remain erratic for the time being

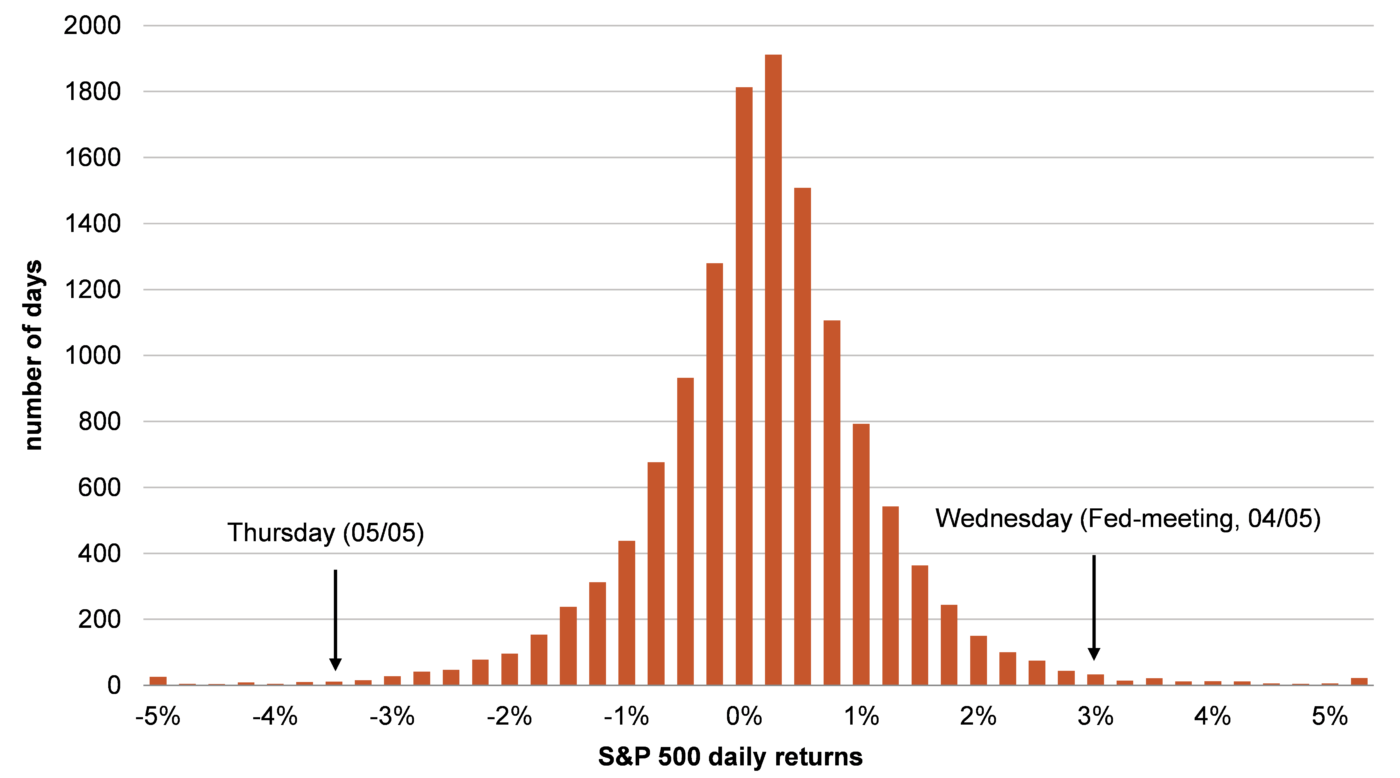

- Stock markets are currently extremely erratic. The daily moves we have seen around the Fed meeting are in themselves very rare by historical standards. But even more extraordinary is the combination of extreme upward and downward movements (>±3%) on consecutive days. This has only happened 31 times in over 13000 trading days since 1970.

- Volatility is likely to remain high for the time being given the many risks (Putin's war, restrictive central banks, high infla-tion and China lockdowns).