Current market commentary

The stock markets have recovered significantly. The DAX recently reached several all-time highs and US equities in USD terms are also not far off their all-time highs. The market recovery was driven by massive share purchases by private investors, Trump's turnaround on customs policy and the reversal in fiscal policy: instead of budget deficit reductions, there will now be even greater US debt if Trump's tax plans are implemented. This has led to a sharp rise in long-term interest rates worldwide and a steepening of yield curves. In combination with Moody's rating downgrade of the USA, this has prompted us to further increase our gold overweight in the multi-asset strategies. After all, real assets should benefit from the rising money supply and higher inflation in the medium term. In the short term, there is a good chance that the equity markets will be supported by share buyback pro-grams and purchases by underinvested investors. However, we expect more volatility again from the summer onwards when the tariff breaks expire, macro data deteriorates and liquidity decreases.

Short-term outlook

The Q1 reporting season is drawing to a close. 79% of S&P 500 companies have so far exceeded earnings expectations. Nevertheless, earnings estimates outside the emerging markets have been reduced further (see p. 9). Over the next two weeks, reporting will focus primarily on companies from the technology and consumer sectors. On the monetary policy front, the ECB's interest rate meeting on June 5 will be exciting. The OPEC+ meeting on future oil production policy will also take place on June 1.

On Tuesday, US durable goods orders (Apr.) and Conference Board consumer confidence (May) will be published. On Wednesday and Thursday, the minutes of the last Fed meeting (May) and the US GDP figures (Q1) are due. This will be followed on Friday by preliminary inflation data (May) for Germany, the US core PCE deflator (Apr.) and consumer confidence from the University of Michigan (May). The following week will see the purchasing managers' indices (May) for the US and Europe as well as US labor market data (May).

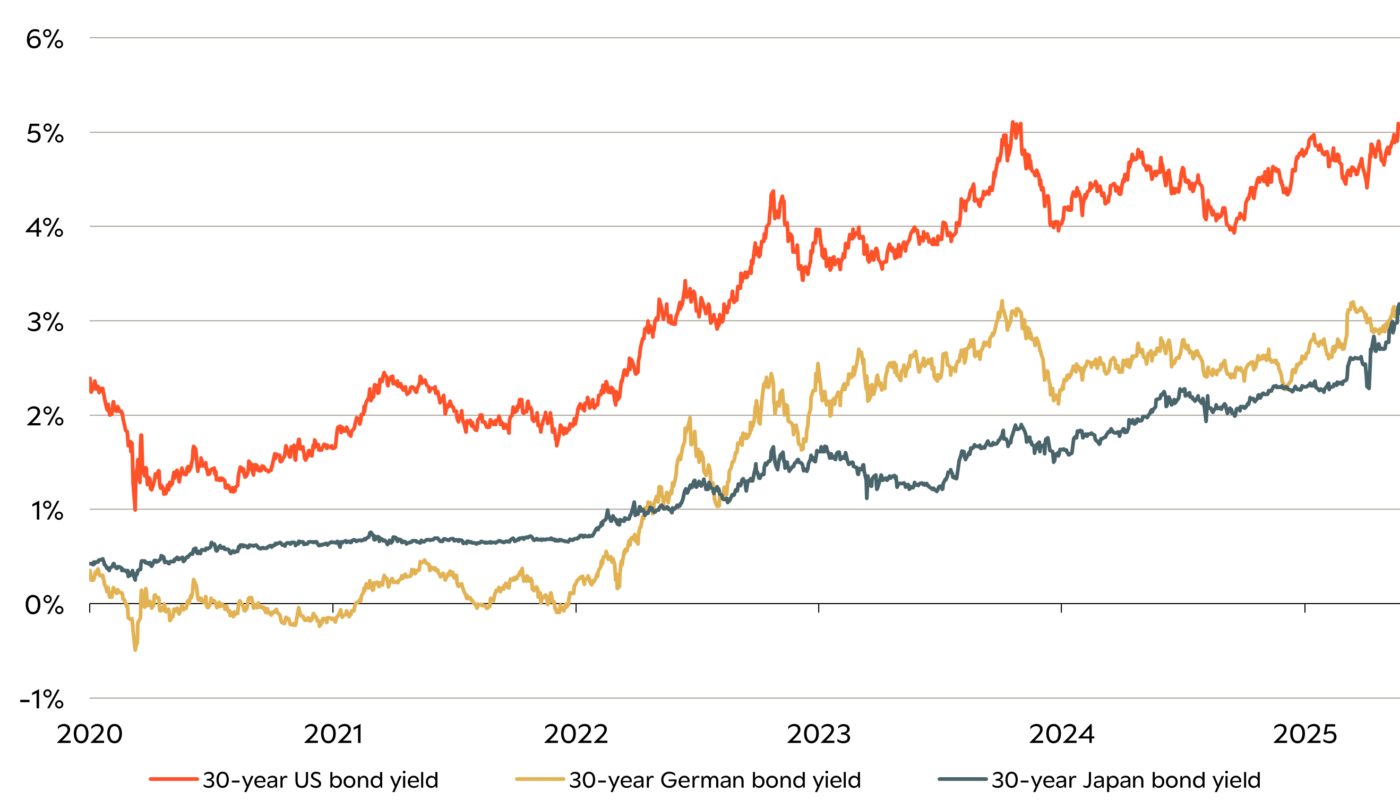

Escalating government debt drives 30-year yields ever higher

- Yields on long-term government bonds rose significantly around the world. In the USA in particular, the downgrade by Moody's and Trump's planned tax cuts weighed on bonds. The most recent Treasury auctions were also moderate. International investors in particular are increasingly demanding a higher risk premium for holding long-dated US government bonds.

- At the same time, yields on 30-year government bonds in Japan rose above the 3 % mark for the first time.