Current market commentary

The US Federal Reserve signalled to investors last week that it is comfortable with interest rate cuts and an imminent slowdown in balance sheet reduction despite rising inflation risks. This should not only have pleased US Treasury Secretary Janet Yellen, who is struggling with an increase in new debt. Risk assets also celebrated the dovish Fed. Equities and commodities were among the big winners. The fact that the Swiss National Bank surprised investors with its first interest rate cut of 25 basis points, thereby setting itself apart from the Fed, ECB and BOE, also had a supportive effect. The Brazilian central bank (BCB) also lowered its key interest rate last week, by a further 50 basis points. Since the start of its monetary easing cycle in August last year, the BCB has cut interest rates by 300 basis points. The preliminary purchasing managers' indices for March also fuelled hopes of a cyclical recovery in the global economy.

Short-term outlook

After the major central bank meetings, things are now becoming quieter in terms of (monetary) policy. The OPEC+ meeting will take place on 3 April, but little new impetus is expected from this meeting until the end of the second quarter due to the cuts that have already been agreed. The minutes of the ECB's March meeting will be published on 4 April. In the US, new home sales (Feb) will be published today and preliminary durable goods orders (Feb) and Conference Board consumer confidence (Mar) tomorrow. On Wednesday, ESI economic confidence (Mar) for the eurozone is on the agenda. GDP figures (Q4), the Chicago PMI (Mar) and consumer confidence from the University of Michigan (Mar) will follow for the US on Thursday and US household income and spending (Feb) on Friday. In the following week, investors will focus on the US and European purchasing managers' indices (Mar), US labour market data (Mar) and European inflation data (Mar).

Europe shines even without glitter

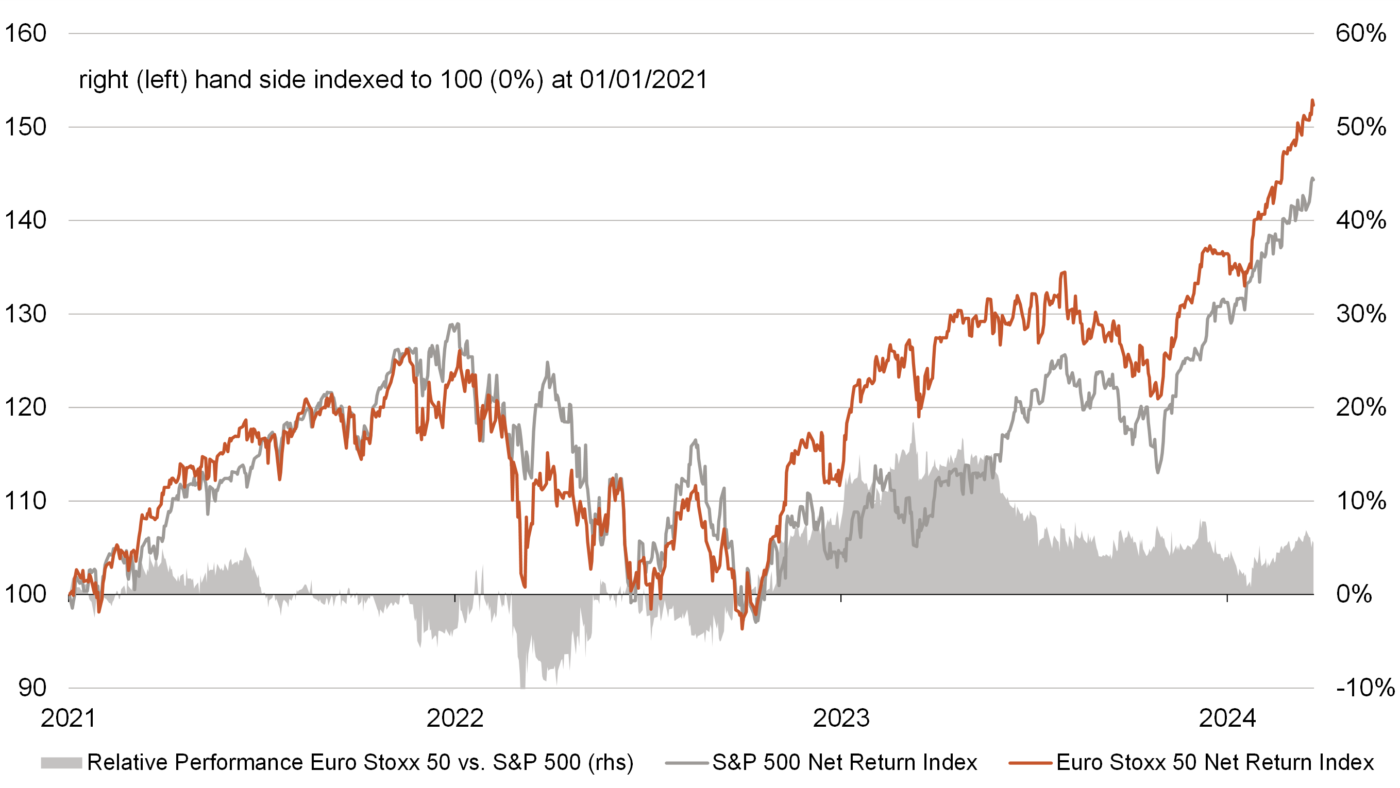

- While the "Magnificent 7" have been on everyone's lips lately and the S&P 500 is synonymous with innovation and strong growth among investors, the European stock market is no slouch compared to its US counterpart.

- In fact, despite the war, the energy crisis and dependence on Chinese exports, the Euro Stoxx 50 has slightly outperformed the S&P 500 in local currency terms since 2021. This is because there are leaders in growing sectors (semiconductors, healthcare, etc.) whose weight in the main indices is increasing.