Current market commentary

The tightening of Russia sanctions has led to further moderate losses in European equities, driven by strong outflows from European funds. Investors sold European equity funds worth more than 20 billion US dollars over the last two weeks - a record. In the capital markets, however, there are usually not only losers, but also relative winners: and these currently clearly include direct and indirect commodity investments. Our multi-asset portfolios benefited from the fact that we had already increased our commodity exposure. In the current environment, this clearly reduces portfolio volatility, as do US investments. The US dollar has appreciated significantly in the wake of the Putin war. We continue to expect increased volatility in markets in both directions in the short term due to headline risk, thin liquidity and current option positioning. However, we consider the risk-reward ratio to be good for the coming months.

Short-term outlook

After the ECB's unexpectedly tightening stance last week, the market is focusing this week on the Fed meeting on 16 March and the BoE meeting on 17 March. The market expects a rate hike of 25 basis points from the Fed. On 24/25 March, the EU/Euro summit will take place in Brussels, where the Russia-Ukraine war and the Covid 19 situation will be key topics.

Preliminary US Consumer Confidence (Mar.) will be released today and Eurozone and Chinese Industrial Production data (Jan., Feb.), German ZEW Economic Sentiment (Mar.) and US Empire State Index (Mar.) will be released on Tuesday. US retail sales (Feb.) will follow on Wednesday and US industrial production (Feb.) on Thursday. Next week, the ifo Business Climate Index (Mar.) for Germany and the preliminary Markit Purchasing Managers' Indices (Mar.) for Europe and the US are due.

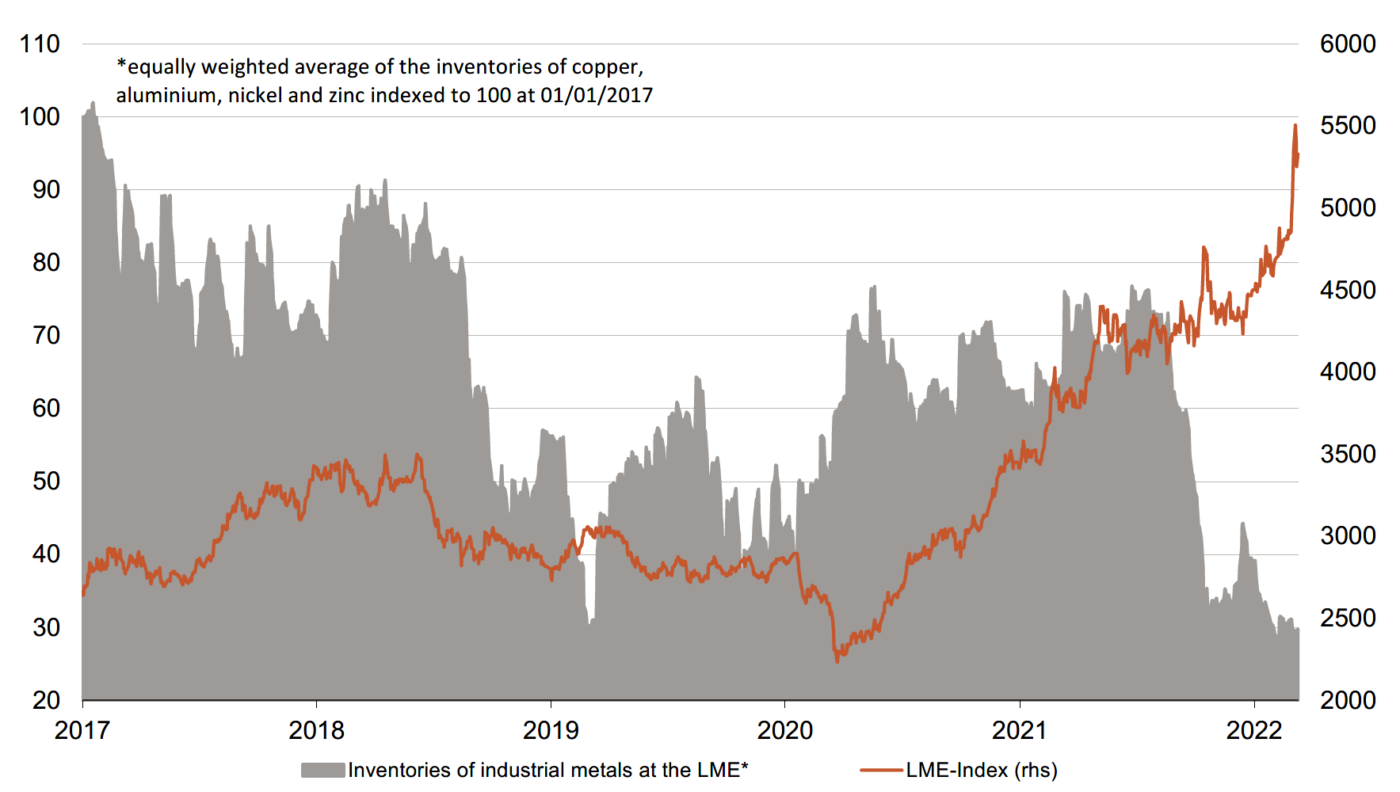

Metals fundamentally supported, but more vulnerable after price rally

- If you look at past geopolitical conflicts, stock markets usually fell before war broke out. Immediately after the escalation, markets usually rose again.

- This is because while markets have already priced in potential damage to society and the economy beforehand, there is increasingly more clarity about the effects after the outbreak of war.

- In the following 2 to 6 months, the S&P 500 even recorded a positive return in very case of the conflicts shown here.