Current market commentary

The S&P 500 posted in Q2 its worst quarterly performance since the peak of pandemic concerns in Q1 2020 and its most negative H1 result since 1970. The support of rebalancing flows towards the end of the quarter from pension funds lasted only briefly. The recent spate of central bank comments at the ECB's Sintra conference made it clear once again that policymakers are prioritising the fight against inflation, even if this carries the risk of recession. The bulk of recent economic data has already disappointed. In addition, more market participants are taking a critical view of analysts' very optimistic earnings estimates after more companies recently lowered their earnings forecasts for this year. This is likely to put further pressure on risk assets. Against this background, we have tactically increased our equity underweight again in the recent rally, even though we see a good chance that the equity markets will find a bottom in H2.

Short-term outlook

In the coming weeks, corporate earnings are likely to be the focus of investors as the Q2 reporting season picks up significantly with the major US banks starting next week. Against the backdrop of elevated inflation and an already slowing economy, disappointments are bound to happen. Today, US markets are closed for Independence Day.Tomorrow, the Caixin Service Purchasing Managers' Index (PMI, Jun.) for China, French Industrial Production (May), the Service PMI (Jun.) for the Eurozone and US new orders (May) will be released. On Wednesday, German new orders (May) and the ISM service PMI (Jun.) will follow. German industrial production data (May) will be released on Thursday and US labour market data (Jun.) on Friday. Next week, the German ZEW index (Jul.) is due, as well as consumer confidence (Jul.), retail sales (Jun.) and inflation data (Jun.) for the US.

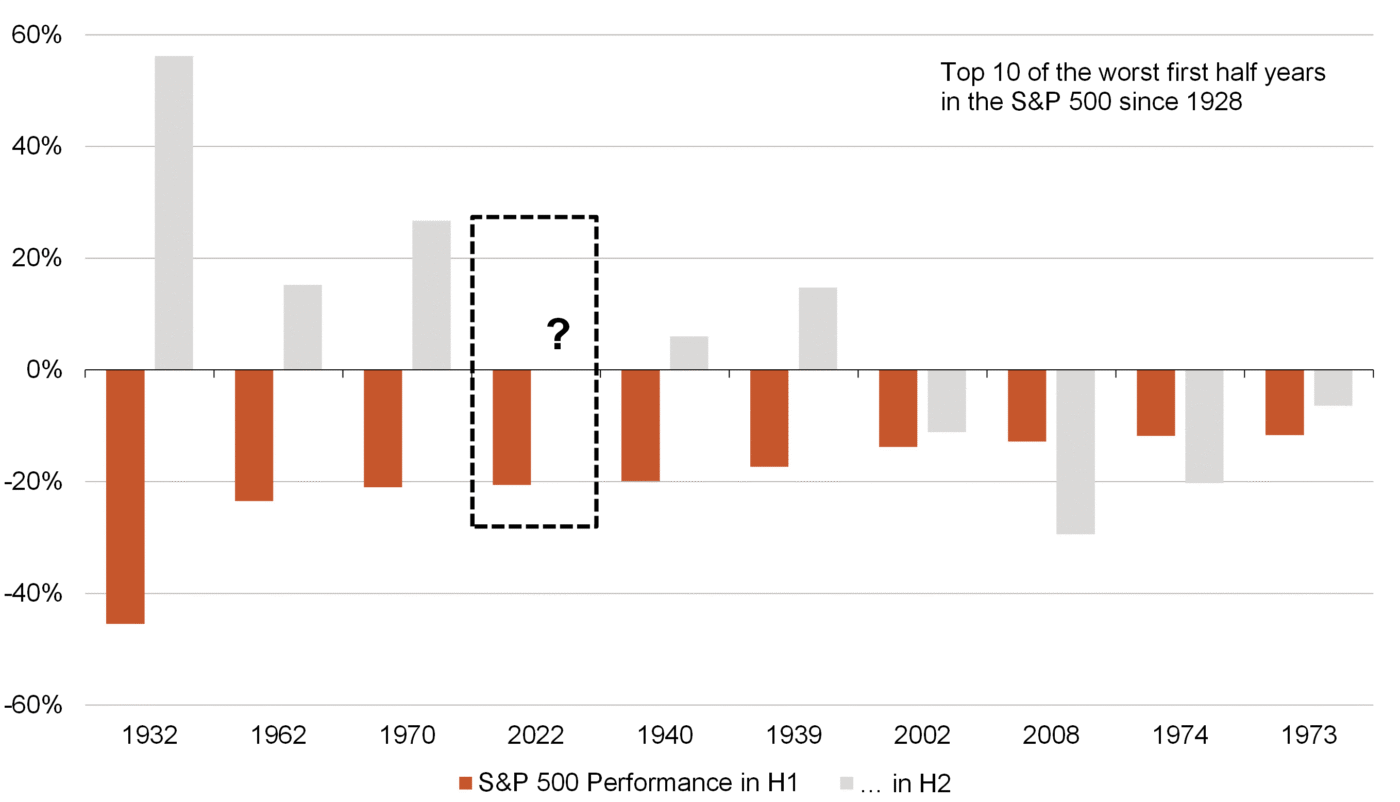

One of the historically worst first half years is behind us

- In the last 100 years, there have only been 3 years in which the S&P 500 posted a worse performance in the first half of the year than in 2022.

- In all three cases, US equities posted a significantly positive performance in the second half of the year. However, there are also contrary examples, such as 2008

or 1974, where the S&P fell even more in H2 than in H1. - The rest of the year is therefore fraught with uncertainty. However, we see a good chance that the markets will end the year higher than they are today.