Current market commentary

The stock markets initially continued their upward trend despite political turmoil. The S&P 500 and Euro Stoxx 50 reached new all-time highs. Meanwhile, the US shutdown is entering its third week. In France, the fiscal crisis has further intensified. Following his resignation, Lecornu is now to make another attempt to negotiate a budget for 2026. Japan, meanwhile, is getting its first female prime minister in history. Sanae Takaichi is considered a nationalist and stimulus-friendly. Japanese stocks rose and the yen depreciated. It was not until Friday that Trump's new tariff threats against China disrupted the calm on the markets. Volatility jumped significantly and stock indices fell. Highly positioned systematic strategies are likely to continue selling equities in the short term. However, discretionary investors who are significantly less exposed to equities and are not caught up in the euphoria are likely to use the setbacks to buy. This should limit the potential for further declines. Recently, however, the action has been mainly in precious metals. Gold broke through USD 4,000 per ounce and silver rose above USD 50 per ounce for the first time. We remain structurally bullish on precious metals but have taken our first profits after the strong rally.

Short-term outlook

The US government shutdown that came into effect on 1 October and the associated closure of non-essential institutions meant that important eco-nomic data was not published – most notably the monthly US labour market report. According to the Bureau of Labour Statistics, the publication of consumer prices will initially be postponed until 24 October. Investors are now likely to turn their attention increasingly to the start of the reporting season. On Tuesday, the ZEW economic expectations for Germany (Oct) are expected first. On Wednesday, consumer prices from France (Sep) and the US (Sep) will follow, as well as data on industrial production in the eurozone (Aug). On Thursday, retail sales (September) and producer prices from the US (September) are scheduled to be released. At the end of the week, the Eurozone consumer price index (September) and US industrial production data (September) will follow. In the following week, inflation data from the UK (September) and the purchasing managers' indices of some G8 countries (October) are expected.

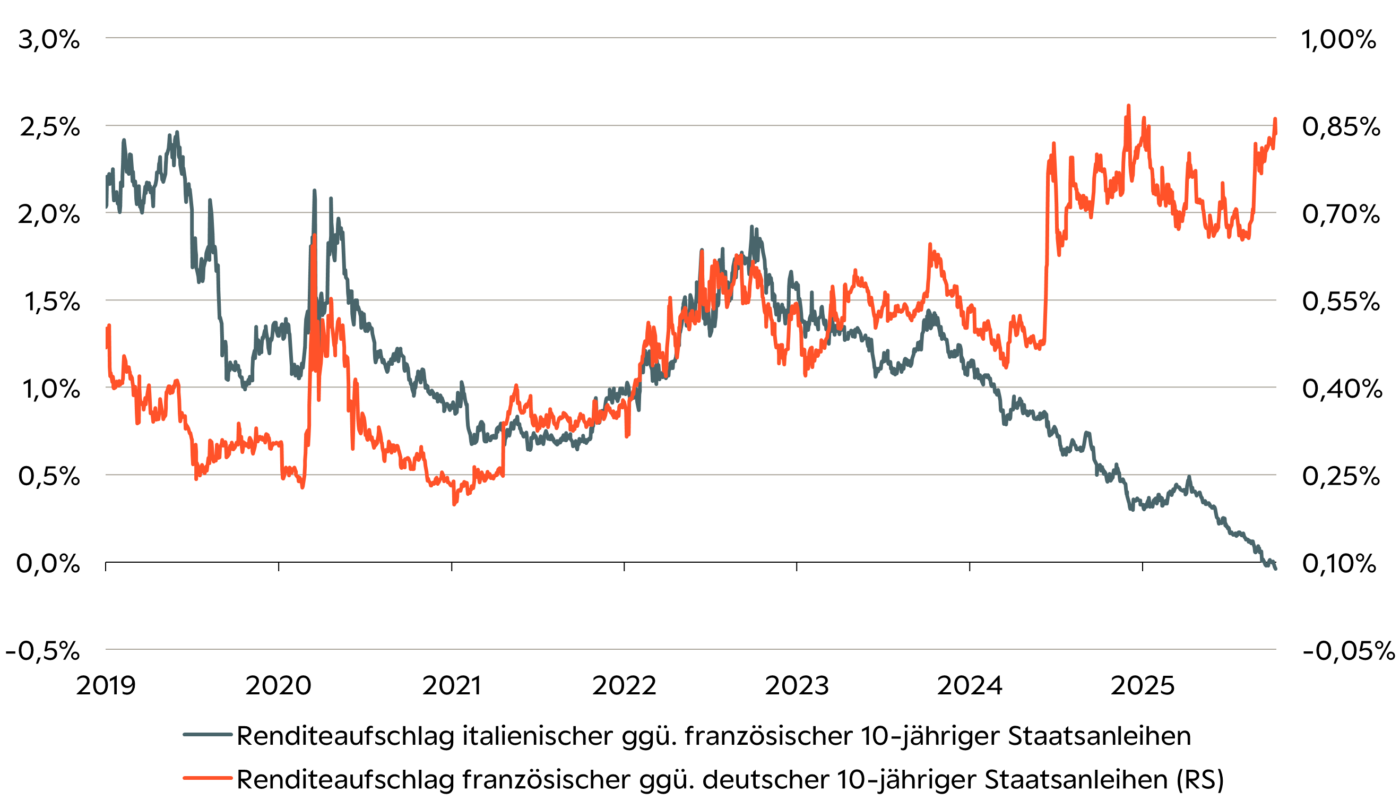

Political chaos: French government bonds ‘riskier’ than Italian ones

- The resignation of French Prime Minister Lecornu triggered another selloff of French government bonds. This is because there is one thing that the right and left wings of the deeply divided parliament agree on: spending less money is out of the question. This means that the urgently needed fiscal discipline is unlikely to materialise.

- The yield premium over German federal bonds widened once again, and OAT yields are now even higher than those of Italian government bonds.