Current market commentary

While US equities are close to their all-time highs, European equities have recently declined slightly. In addition to a weaker reporting season than in the US, this was also due to political distractions such as discussions about new bank taxes and the budget dispute in France. US equities, on the other hand, have not lost more than 2.7% since the beginning of May. Every minor correction has been used as a buying opportunity. Accordingly, the VIX fear gauge has also fallen significantly and recently traded below 15, close to its low for the year. One reason for this is that the market now firmly expects the Fed to cut interest rates in September, as Jerome Powell indicated during the Jackson Hole meeting. Of course, this carries the risk that a robust US labour market report or significantly higher-than-expected inflation could lead to a repricing of interest rate cut expectations. This could then weigh on risky assets, at least in the short term. However, we remain constructive and therefore overweight equities. Many investors missed the rally and are therefore likely to use a countermovement to increase their holdings. This should limit the downside potential in the short term.

Short-term outlook

Following the Jackson Hole meeting and Fed Chairman Powell's speech last Friday, the markets are eagerly awaiting the central bank meetings in September. The ECB will meet on 11 September, followed by the US Fed and the Bank of England on 17 and 18 September. The Fed's decision will be particularly exciting. President Trump has been putting increasing pressure on the Fed to cut interest rates in recent weeks. In addition to the purchasing managers' indices (August) for the eurozone manufacturing sector published today, data for the US is expected tomorrow. The preliminary consumer price index (August) for the eurozone will also be published on Tuesday. This will be followed on Friday by the US labour market report (August). The following week, the Chinese consumer price index (August) and the US producer price index (August) will be announced on Wednesday. The US consumer price index (August) will follow on Thursday. The Michigan Consumer Sentiment Index (September) is expected on 12 September.

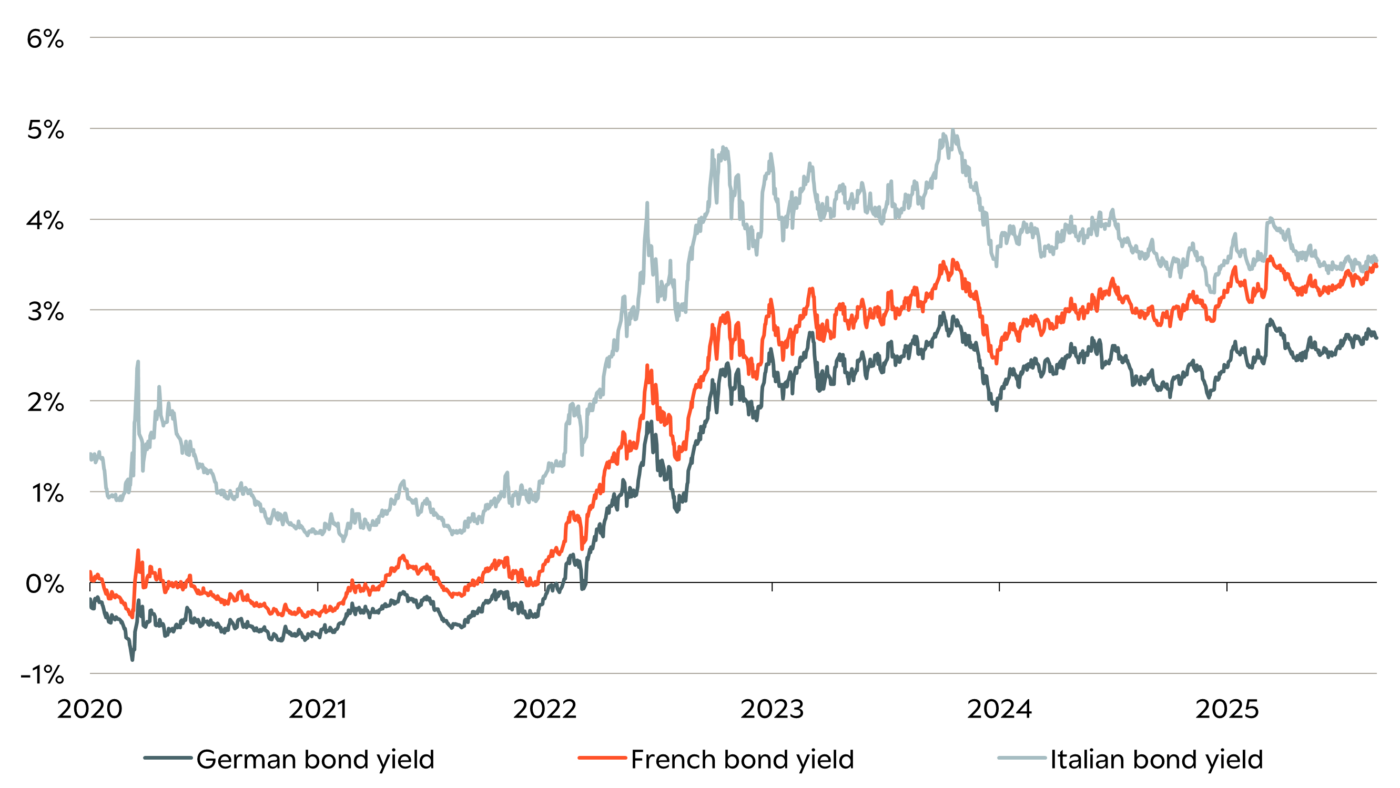

Political concerns weigh on French government bonds again

- With public debt at 114% of GDP, French Prime Minister Bayrou is planning savings of EUR 44 billion in the 2026 budget. To push this through, he will put the question of confidence to Parliament on 8 September.

- The markets fear that he will lose confidence. 10-year French yields rose.

- With a yield of 3.5%, they are now trading just below Italian government bonds. The spread to German government bonds rose to up to 77 basis points.