Current market commentary

The global equity markets experienced a positive first half of July in line with historical seasonality. The first results of the reporting season are solid. However, the outlook for companies remains cautious due to the US trade war. The macro data has also hardly shown any signs so far following the US tariff chaos: US inflation surprised to the downside once again and the US labor market remains robust. The markets were therefore not bothered by the fact that Trump once again increased the pressure on his trading partners - this time by letter. What investors did not like at all, however, was the supposed letter of resignation to Powell. Equities, bonds and the US dollar fell sharply, but recovered just as quickly following the denial. The coming weeks are likely to be more volatile. The positioning of discretionary and, above all, systematic investors has increased considerably in recent weeks, which has increased the risk of falls in the event of bad news. In addition, we believe that the equity markets are still (too) relaxed about the postponed deadline for the tariff break. The negotiations to date show that even if a deal is reached, a significant portion of the US tariffs will often remain in place.

Short-term outlook

The current reporting season for the second quarter of 2025 is overshadowed by Trump's tariff policy and the weak dollar. The latter could lead to positive earnings surprises for US companies. Things also remain exciting on the customs front - the US government's tariffs will come into force on August 1. Donald Trump recently announced tariffs of 30% on goods from the EU. Monetary policy will also be interesting. The ECB meets on July 24, the Fed just under a week later on July 30.

The preliminary purchasing managers' figures (July) for the eurozone, the UK and the US will be published on Thursday. We are also expecting the Japanese consumer price index (Jul). The retail sales figures (Jun) for the UK will follow on Friday. The following week will see the GDP data for the second quarter of 2025 for Germany, the eurozone and the US on Wednesday. This will be followed on Thursday by the German consumer price index (Jul) and the inflation figures for the eurozone (Jul) and the USA (Jun).

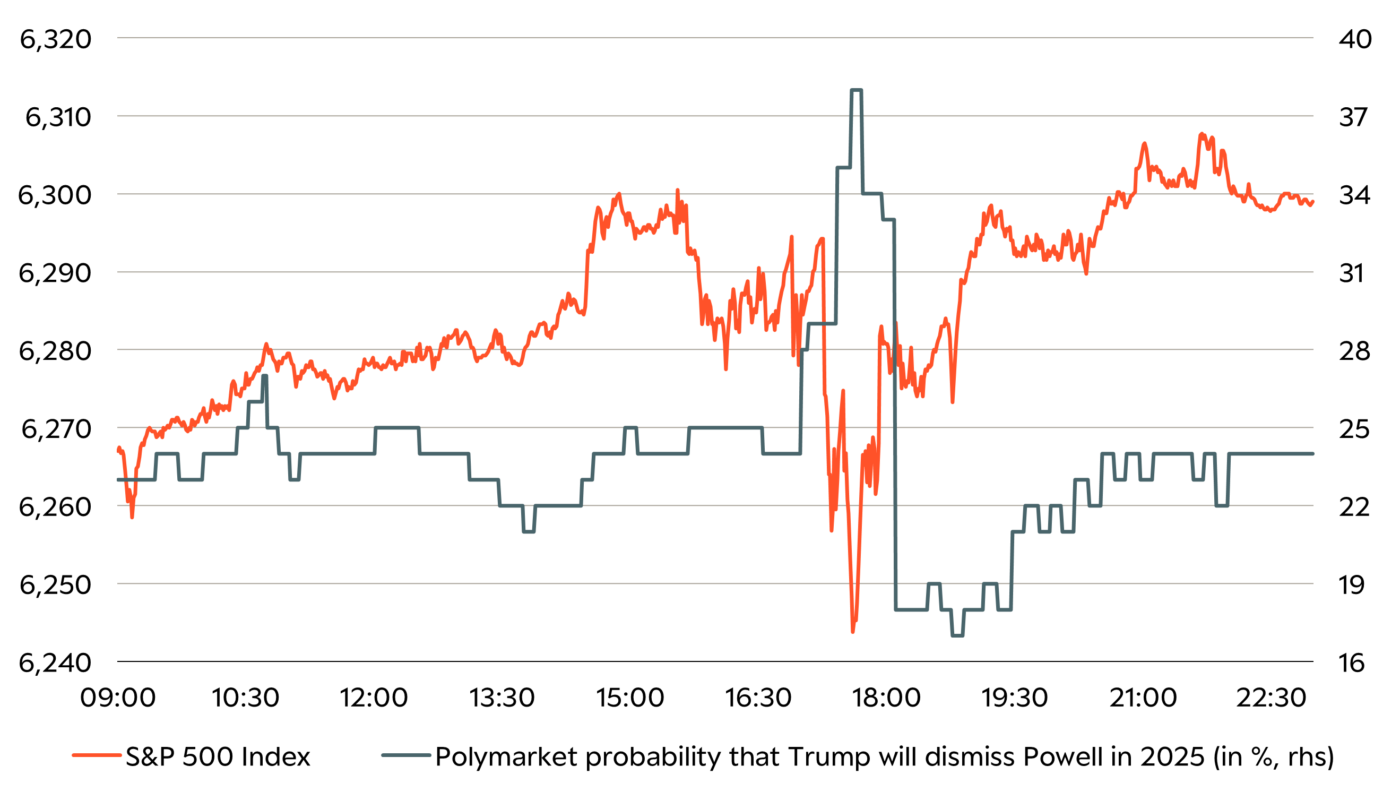

Rumors of the Fed chair's dismissal moved the markets on Wednesday

- Trump's trial balloon? Reports about the possible dismissal of Fed Chairman Powell by Donald Trump triggered strong market reactions.

- Until the denial, shares and the US dollar fell sharply, 30-year US yields rose above 5% and yield curves steepened noticeably. Only gold made gains.

- Investors seem to fear that if Powell is dismissed, the US will not only pursue an irresponsible fiscal policy, but also an irresponsible monetary policy.

Equities

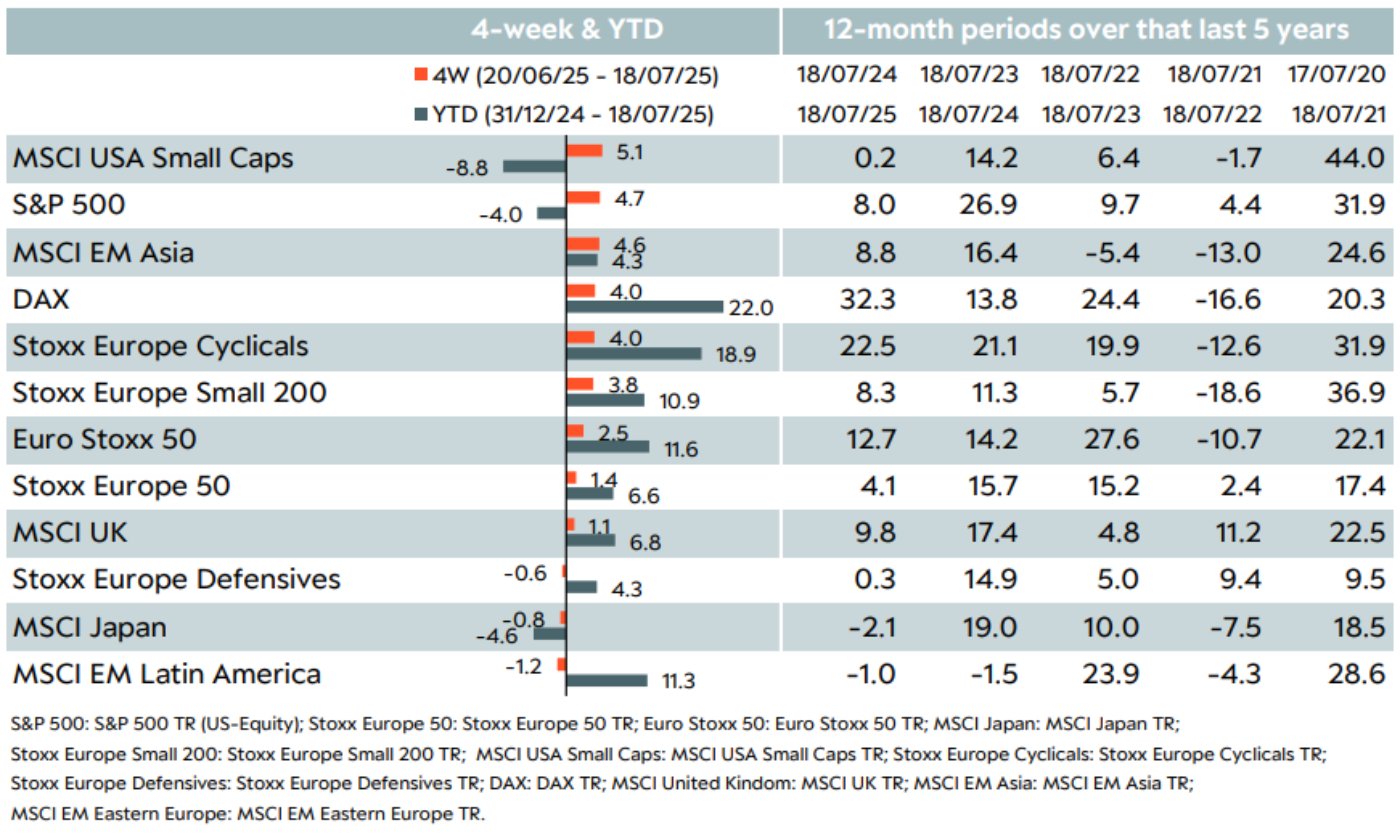

- Almost all stock markets have performed positively over the past four weeks. US equities, which have been trending negatively in euros since the beginning of the year, performed best.

- Small caps once again performed well and recently outperformed their largecap counterparts in both Europe and the US.

- Japanese and Latin American equities have recently lagged behind.