Current market commentary

Global equity markets are continuing their upward trend after the latest US consumer price inflation data confirmed expectations of a Fed rate cut in September. The strong Q2 reporting season in the US has also reassured investors about the resilience of the economy, thanks in particular to strong results from large technology companies. Sentiment (see IPOs) and investor positioning have become more optimistic in August as investors appear to be assuming a ‘Goldilocks’ scenario in which controlled inflation could pave the way for monetary easing, accompanied by robust economic growth driven by AI. Nevertheless, there is a risk that the markets have dismissed the ‘tariff shock’ too quickly, as its economic impact has not yet been fully felt. The tariffs are probably not strong enough to cause a recession, but they could dampen purchasing power in the coming months and make consumers and companies cautious. In addition, the question re-mains as to how robust the US labour market really is. Recently, the likelihood of a stock market setback has increased.

Short-term outlook

The reporting season for the second quarter of 2025 is drawing to a close. In recent weeks, 90% of S&P 500 companies have reported their results. Of these, 81% reported positive EPS and revenue surprises. The S&P 500's year-on-year earnings growth rate is 11.8%. In terms of monetary policy, the focus is on the release of the Fed's minutes from its July meeting on 20 August and the Jackson Hole meeting from 21 to 23 August. The Chinese and British consumer price indices (July) will be published on Tuesday and Wednesday, respectively. The producer price index (July) for the UK and Germany is expected on Wednesday. This will be followed on Thursday by the preliminary purchasing managers' indices (August) for the eurozone, the US, Germany and the UK. The following week, US GDP (Q2) will be announced on Thursday. On 29 August, the consumer price index (August) and retail sales figures (July) for Germany and the PCE price index (July) for the US will be published. This will be followed by the Chinese PMI (August) on 31 August.

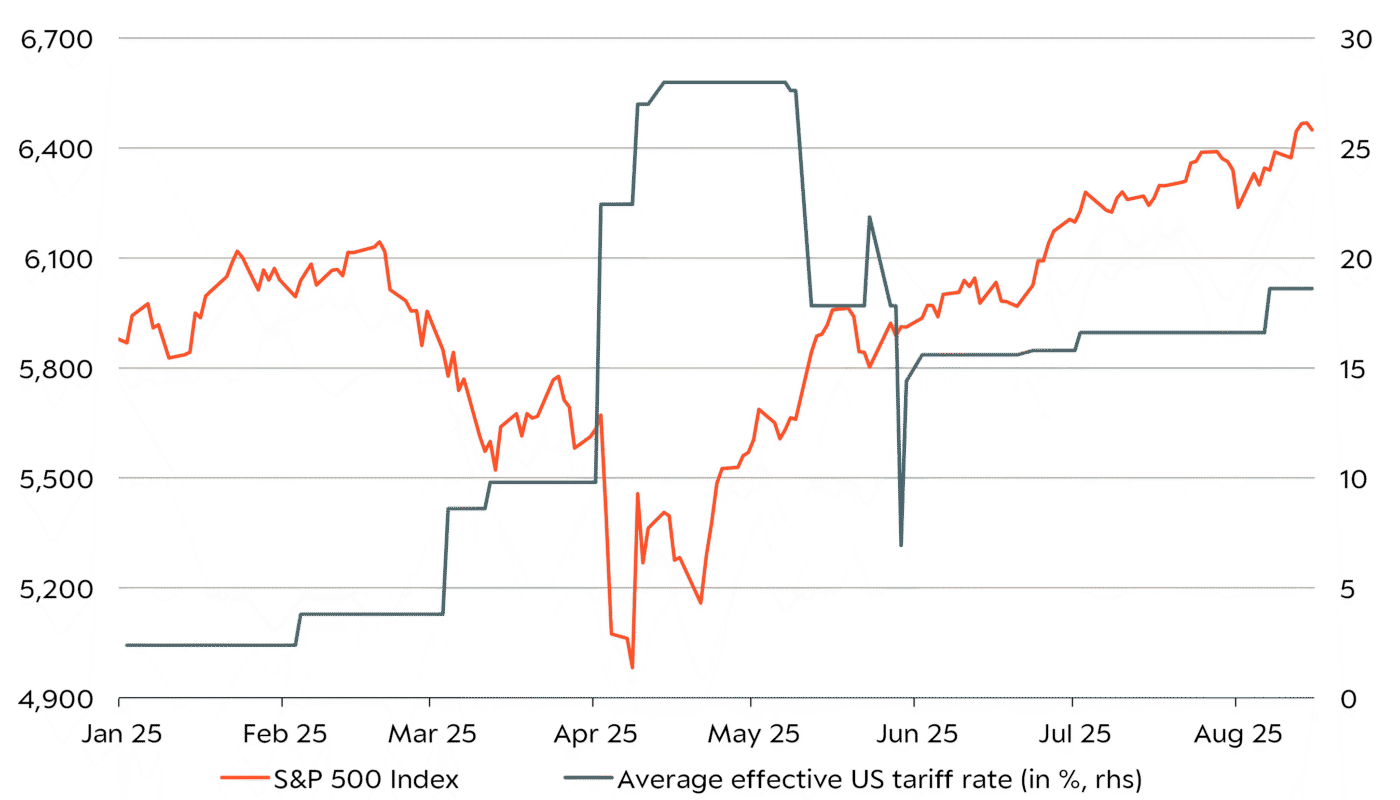

S&P 500 (still) immune to high punitive tariffs

- The S&P 500 is hitting all-time highs, even though the average US tariff rate has risen significantly again after Trump's initial backtracking.

- So far, US consumers have been spared thanks to the frontloading of imports. However, higher prices are now likely to gradually weigh on consumption and thus the economy.

- With strong market concentration and high positioning of systematic investors, the market is now more susceptible to a set-back.