Current market commentary

The high uncertainties regarding monetary policy and the economic effects of the war are causing increased stock market volatility in both directions. After stock markets fell until mid-March in the wake of the tightened sanctions, they have since recovered even more strongly than we expected. The drivers of this recovery rally were, in addition to the already extremely pessimistic investor sentiment, primarily the covering of short positions and hedges - especially since some uncertainty also waned after the first Fed interest rate hike by 25bp during its March meeting. With better price momentum and lower volatility, more systematic strategies are now likely to ramp up their equity exposure. However, after the strong rally, we see the upside potential as limited in the short term, as many analysts are likely to reduce their earnings estimates and share buyback programmes will be scaled back as we approach the reporting season.

Short-term outlook

With the major central bank meetings behind us, the next two weeks will be a little quieter. On 4 April, the economic and finance ministers of the Eurozone will meet. The main topics to discuss are likely to be the energy crisis and the high inflation rates. The presidential elections in France begin on 10 April. Currently, the incumbent President Macron is leading in the polls.

Tomorrow, the consumer confidence for Germany and the US will be published. Inflation data (Mar.) for Germany will be released on Wednesday, followed by figures for France and Italy on Thursday. Then retail sales (Feb.) for Germany and the manufacturing PMI (Mar.) in China will also be published. On Friday, US labour market data (Mar.) and the ISM Manufacturing PMI (Mar.) will follow. On 4 April, Factory Orders will provide further insight into the US manufacturing sector following the outbreak of the Russia-Ukraine war.

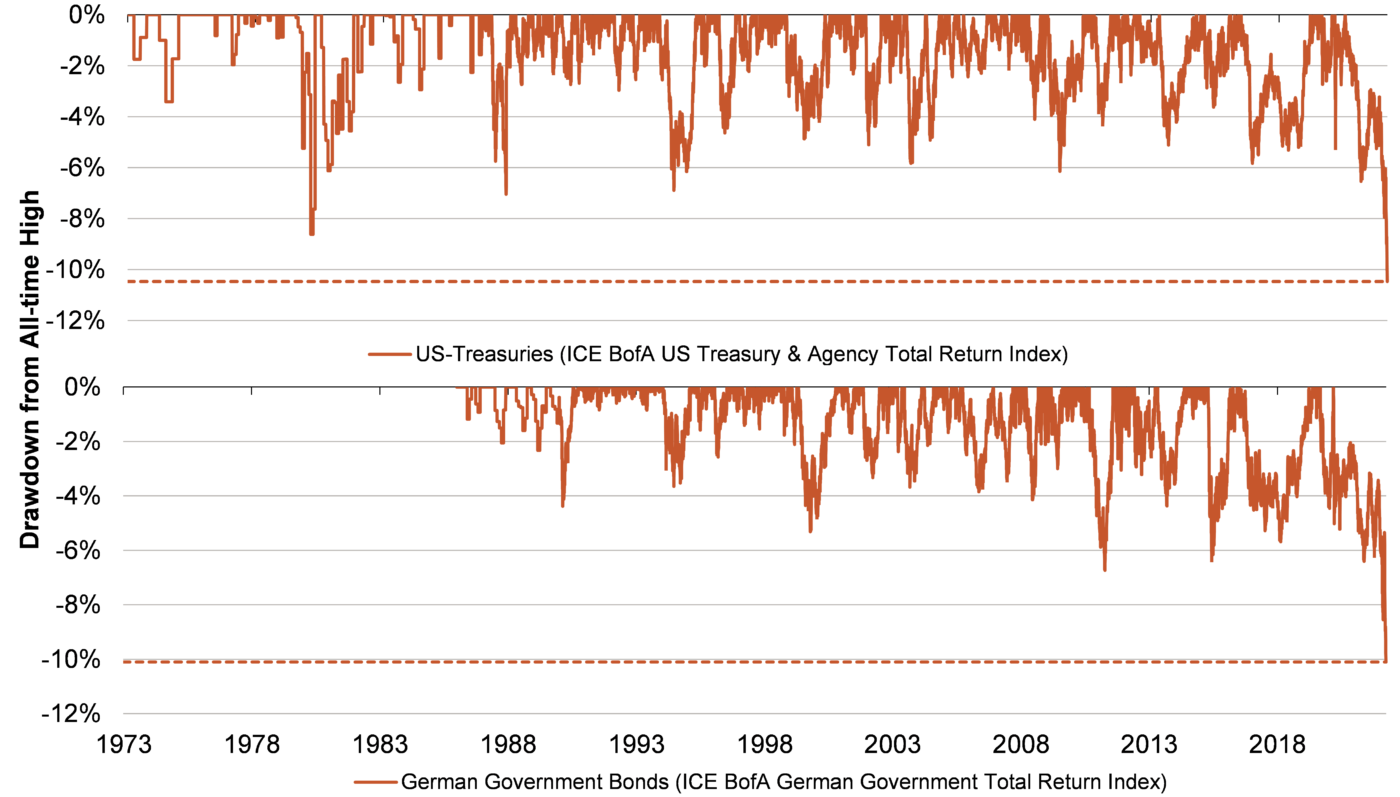

Safe government bonds with strongest drawdown in 50 years

- Safe government bonds have experienced the strongest drawdown in 50 years in the wake of high inflation and increasingly restrictive central banks. Total return indices of US and German government bonds have already lost more than 10% from their all-time high.

- Since the beginning of the year, US Treasuries have even lagged US equities.

- Multi-asset portfolios that do not in-clude commodities and alternative investments are thus poorly diversified in the current environment and are posting significant losses.