Current market commentary

Both the Nasdaq 100 and the S&P 500 recently reached new all-time highs. They were boosted by a weak US dollar, AI and interest rate cut fantasies, and non-fundamental flows. Quant strategies in particular have recently had to continue to stock up on equities, driven by falling volatility and improved price momentum. We estimate that this support is likely to continue until at least mid-July, also benefiting from record-breaking share buy-back programs. So, barring any major external shocks, the stock markets are unlikely to fall, especially since the first two weeks of July are historically among the two best weeks of the calendar year. With the passage of the US tax plans (“One Big Beautiful Bill”), the ongoing fiscal stimulus should continue to support the economy and the markets. The debate over the US debt ceiling is thus also off the table. Accordingly, we remain overweight in equities (for the time being). The upcoming Q2 reporting season and Trump's expiring tariff deadlines are likely to give the market new impetus in the near future, which we will then analyze carefully.

Short-term outlook

Following the recent focus on US labour market figures, we can expect the release of several consumer price indices and the start of the US reporting season, which traditionally begins with the banks. However, the main focus this week is likely to be on the 90-day tariff pause, which ends on 9 July. So far, US President Donald Trump has made only a few trade agreements, and most negotiations are proceeding slowly.

On Monday, European retail sales figures for May will be published. These will be followed by consumer price indices (June) for China on Wednesday and for Germany on Thursday. Chinese GDP for the second quarter is expected the following week on Tuesday. The consumer price indices for June in the US and the UK will also be published later in the week. UK labour market data (May) and US retail sales figures (June) will be released on Thursday. The following week will conclude with the release of the Michigan Consumer Sentiment Index (July) on Friday.

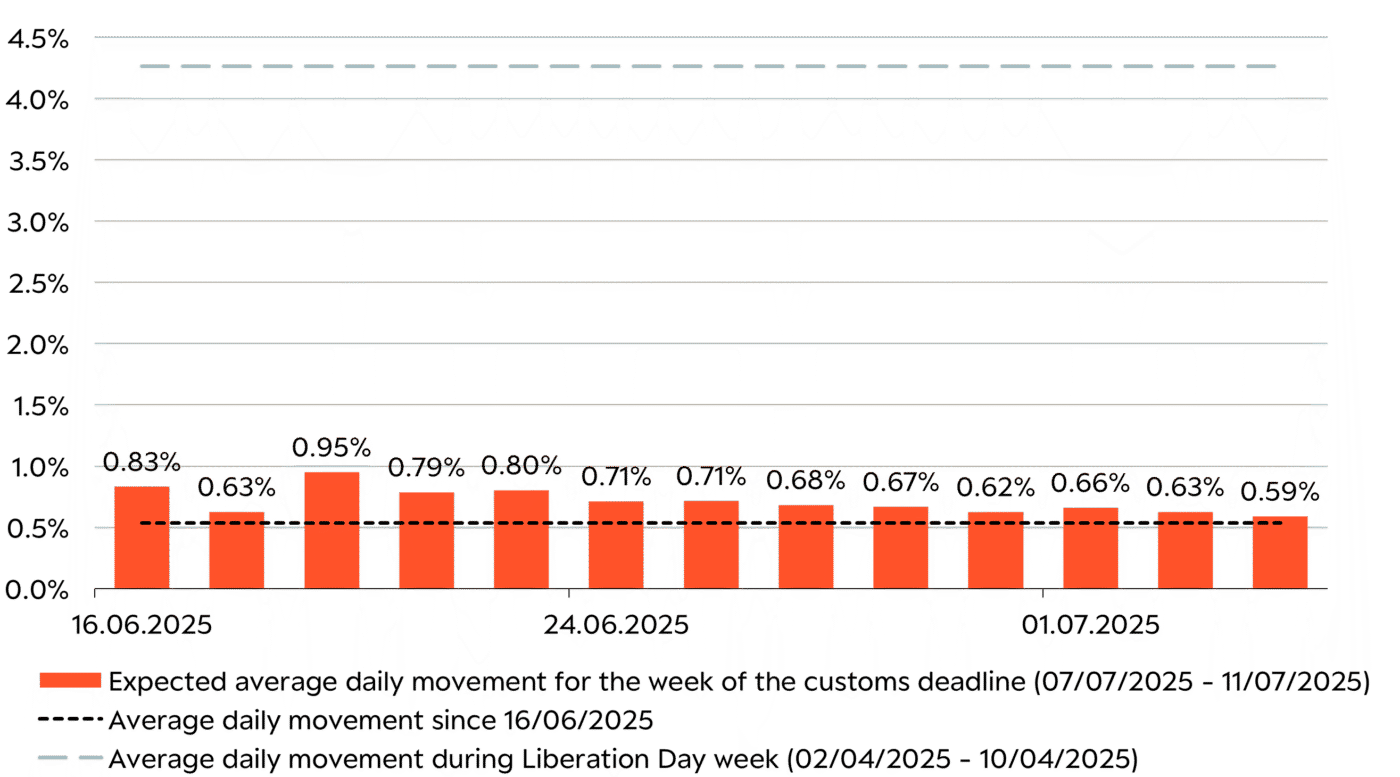

Stock markets are (too) relaxed about the deadline for the tariff pause

- The deadline for the tariff truce is fast approaching. Nevertheless, the stock markets are surprisingly relaxed about this week.

- The S&P 500 is currently pricing in an average daily movement of around 0.6%, which is hardly higher than the fluctuations of recent weeks. In the days around Liberation Day, however, the fluctuations were more than seven times higher.

- There is therefore significant potential for surprise if no amicable agreements are reached.