Current market commentary

The Russian invasion of Ukraine last Thursday was accompanied by a sharp sell-off in risk assets (especially Russian equities) and strong demand for safe havens such as gold as well as other commodities. Uncertainty due to the war and its implications for the economy and inflation is likely to remain elevated in the short term and thus should not lead to a sharp drop in volatility. However, even a slight fall in volatility should ensure that hedges are covered and systematic strategies are likely to demand equities. In light of positive economic signals from China, positive earnings revisions, upcoming clarity on Fed policy, pessimistic investor sentiment and low positioning, we have used the sell-off to slightly increase our equity exposure as a first step – also against the backdrop of geopolitical tensions in the recent past, the opening breakout has often marked a turning point in markets.

Short-term outlook

On 1 March, US President Joe Biden will hold the annual State of the Union speech. The Russia-Ukraine war is likely to play a role. Fed President Powell addresses the US House of Representatives and the US Senate on 2-3 March and the ECB meets on 10 March. Both dates should provide more clarity on future monetary policy, especially against the backdrop of a war in Europe. On 5 March, the National People's Congress will take place in China.

The industrial purchasing managers' indices (PMI, Feb.) for the USA, the Eurozone and China as well as German retail sales (Jan.) and preliminary inflation data (Feb.) will be released on Tuesday. Preliminary inflation data (Feb.) for the Eurozone will follow on Wednesday. The service PMIs (Feb.) for the US, the Eurozone and China as well as US new orders (Jan.) and Eurozone labour market data (Jan.) will be released on Thursday. US labour market data (Feb.) and French industrial production (Jan.) are due on Friday.

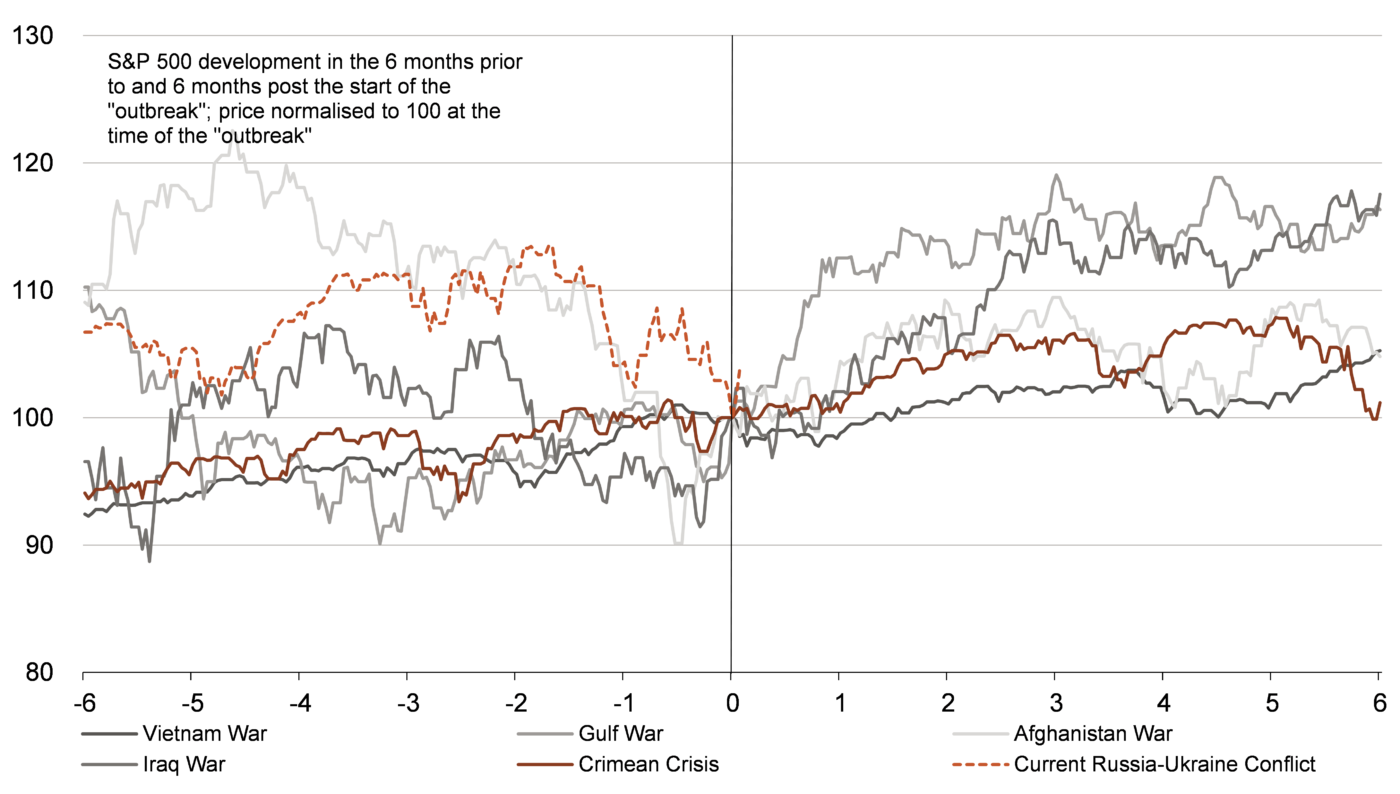

Stock markets usually fall before war breaks out, not afterwards

- If you look at past geopolitical conflicts, stock markets usually fell before war broke out. Immediately after the escalation, markets usually rose again.

- This is because while markets have already priced in potential damage to society and the economy beforehand, there is increasingly more clarity about the effects after the outbreak of war.

- In the following 2 to 6 months, the S&P 500 even recorded a positive return in very case of the conflicts shown here.