Current market commentary

The last two weeks have been all about "Bad News is Good News". Eurozone PMIs signalled contraction and US economic growth was now negative for the second consecutive quarter – the US is in a technical recession. Meanwhile, central banks continued to raise interest rates, the ECB by 50Bp, the Fed by 75Bp. However, Powell said from now on data-driven to decide on further interest rate steps. Hopes of a short recession, coupled with looser financing conditions in the near future, led to a rally across all asset classes. Investors should focus more on earnings stability and growth and less on valuations in this environment, and our quality-growth style should work better again. However, we believe it is too early to sound the all-clear on equities. Profit expectations are still ambitious, cost pressures are high, inflation is not yet on the decline, the Fed has not yet turned around and the energy crisis is smouldering.

Short-term outlook

After the last two weeks were dominated by the interest rate decisions of the Fed and ECB, more calm returns to the central bank front for the next two weeks. Only the Bank of England will publish the July inflation report and the new interest rate deci-sion on 4 August. The Q2 reporting season remains in full swing. With 50% of the companies in the S&P 500 and Stoxx 600 having already reported, the second half will follow until mid-August. Geopolitically, things are also getting exciting. In times of energy shortages, OPEC+ will decide on further production levels on 3 August. After the final purchasing managers' data (Jul.) for the US, Europe and China are pub-lished today, US industrial orders are due on Wednesday, the US trade balance on Thursday (Jun.) and US labour market data on Friday (Jul.). In the following weeks, inflation data (Jul.) and preliminary US consumer confidence (Aug.) will be released for the US and Europe.

Switch of favourites due to expected "Fed pivot" with rate cuts in 2023

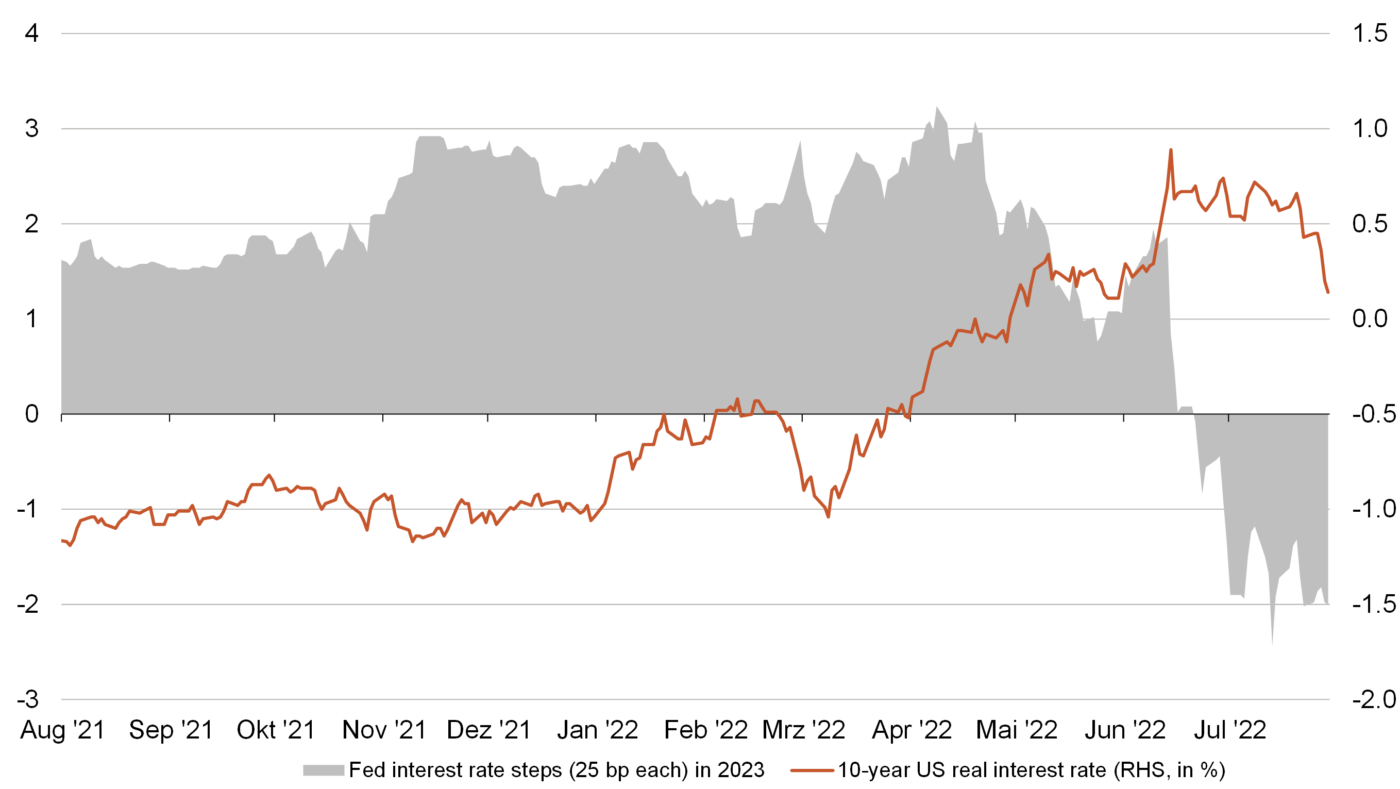

- The Fed raised rates faster and more sharply than expected at the beginning of the year. A sharp rise in real rates and the burden on all but especially highly valued assets followed.

- With the recession looming and after the big rate hikes, the market now expects a Fed turnaround and rate cuts rather than hikes in 2023. This led to falling real

rates and a change of favourites in the market: from winners since the beginning of the year to losers and thus also from value to growth and quality stocks.