Current market commentary

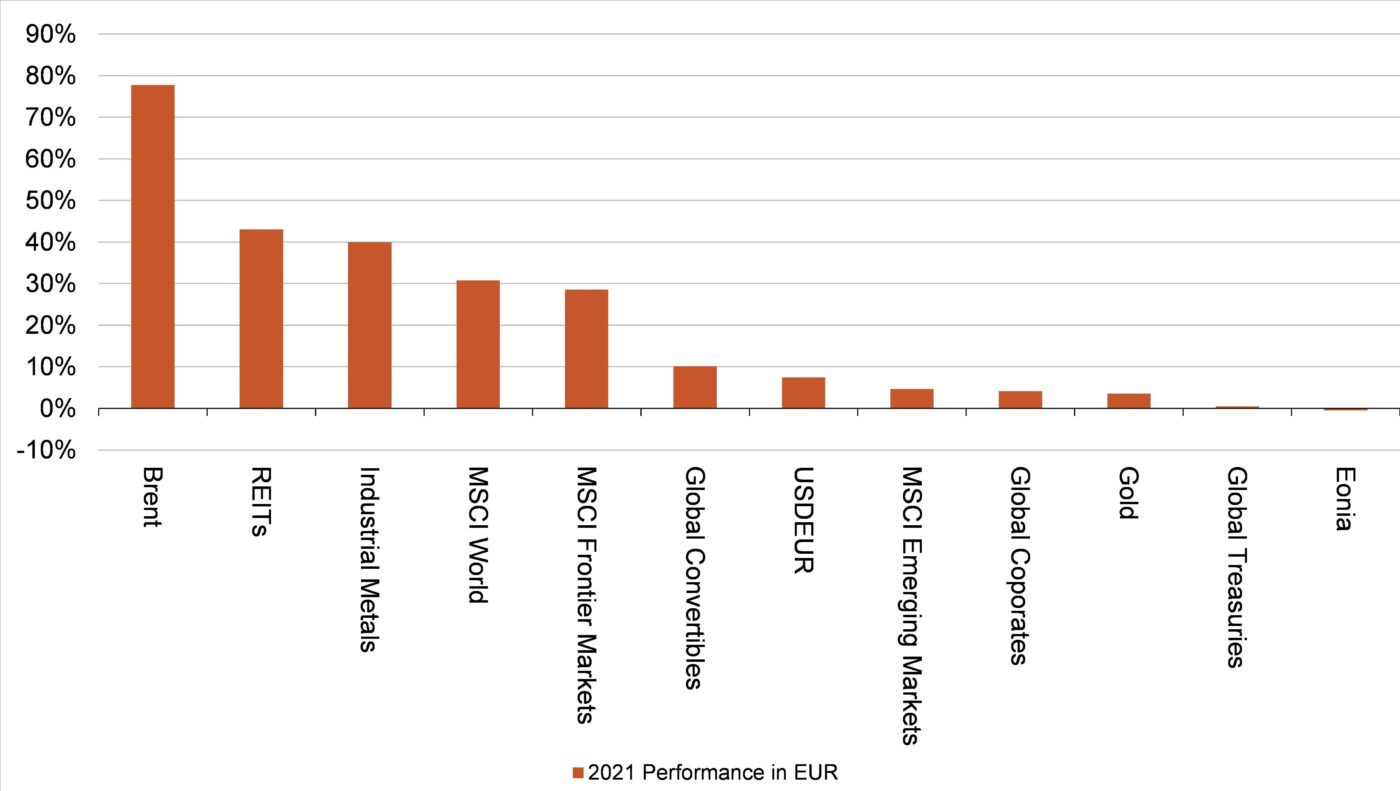

The rapid and strong increase in real interest rates has led to a clear dispersion in capital markets. Long-dated bonds as well as highly valued (growth) shares and defensive shares with earnings development priced far into the future lost massively in value, while commodities (especially energy) and value shares were able to gain. The US dollar has also lost value since the beginning of the year - not surprising given the one-sided positioning of hedge funds and a strong investment consensus for a further appreciation of the US dollar this year. Our economists now expect four US interest rate hikes this year, as does the market. So that is already priced in. Is the rotation out of growth and into value accordingly over? Relative performance at least suggests that the pendulum could soon swing back in the other direction. In addition, the market is likely to focus more on fundamentals again in view of the upcoming Q4 reporting season.

Short-term outlook

The Q4 reporting season has picked up speed with the release of figures of the first US banks. Over the next two weeks, more than 40% of companies by market capitalisation report from the S&P 500 and more than 10% from the STOXX Europe 600. However, given the market's interest rate fears, the ECB meeting on 20 Jan and the Fed meeting on 26 Jan are likely to be even more exciting.

The ZEW index (Jan.) for Germany and the Empire State index (Jan.) for the USA will be published on Tuesday. The German and British consumer price indexes (Dec.) will follow on Wednesday and the French Insee business climate index (Jan.) and the US Philadelphia Fed index (Jan.) on Thursday. Retail sales (Dec.) for the UK will be released on Friday. In the following weeks, the preliminary Markit Purchasing Managers' Indices (Jan.) for Europe and the USA as well as the Ifo Index (Jan.) and Q4 eco-nomic growth for Germany will be published.

The back and forth of styles continues

- The new year began with a sharp rotation in equity markets. Driven by the rapid and strong rise in interest rates due to the more restrictive rhetoric of the US Federal Reserve, highly valued growth stocks experienced a noticeable correction, while value stocks gained in this environment.

- In the short term, a countermovement becomes more likely. Style volatility is therefore likely to continue.

- A balanced portfolio should therefore continue to pay off in 2022.