Current market commentary

In view of the continued strong US economic data and following hawkish tones from key Fed members, interest rates have recently risen further. A reduction in the US key interest rate for March has been almost completely priced out. Unlike in the last two years, however, higher interest rates do not appear to be weighing on equities - on the contrary, valuations have risen further and the DAX and S&P 500 have reached new all-time highs. And shares in China have at least been able to recover recently after the government announced massive stimulus packages to support the domestic stock markets. A relative loser of the still young year is gold, which is suffering from the stronger US dollar and higher interest rates. However, we are confident that, as in previous cycles, precious metals should also be among the relative winners should the first interest rate cuts materialise. The same should also apply to second-line stocks, which are still lagging behind this year.

Short-term outlook

The Q4 reporting season is in full swing - of the S&P 500 companies reporting so far (approx. 55%), almost 80% have beaten earnings expectations. On a political level, the 2024 super election year is picking up speed in February with elections in El Salvador, Azerbaijan, Pakistan, Indonesia, Belarus and Cambodia. Since February, the focus has also been on the primaries in the USA, where elections have taken place in almost 40% of all US states by Super Tuesday (5 March). On Tuesday, the CPI figures (Jan.) for the US and the ZEW survey (Feb.) for Germany are due. GDP figures for the eurozone follow on Wednesday and industrial production (Jan.), labour market (Feb.) and preliminary retail trade data (Jan.) for the US on Thursday. Friday sees the publication of US producer price inflation (Jan.) and the preliminary sentiment indicator (Feb.) from the University of Michigan. In the following week, the preliminary purchasing managers' indices (Jan.) for the US and the eurozone as well as the US Fed minutes are published.

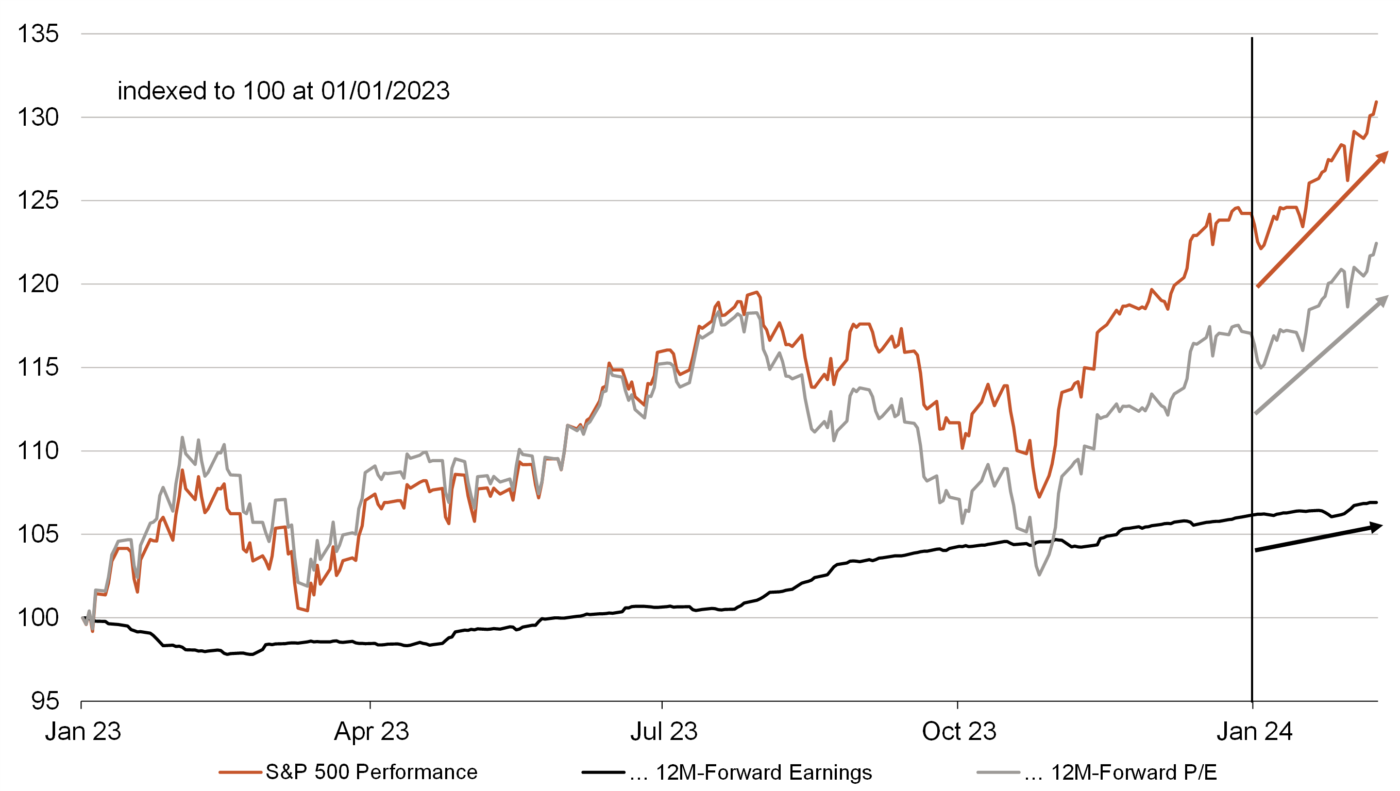

The earnings of US mega caps are rising, but so are their valuations

- Despite the recent rise in interest rates, the S&P 500, which is usually sensitive to interest rates, has climbed to new alltime highs, as the "Magnificent 7" in particular once again on average demonstrated their strong earnings growth during the reporting season.

- However, the rise in earnings estimates has contributed just under a fifth to the year-to-date performance. The increase is mainly driven by a valuation expansion. Despite rising earnings, with rising valuations the expectations for future earnings growth are also rising