Current market commentary

There are increasing signs that we are late rather than early in the economic cycle. Yield curves are sharply inverted, commodity prices are rising, and at the same time more and more retailers are warning that consumer spending is slowing. US unemployment is slowly rising, also because more and more companies are filing for bankruptcy. The consequences of tighter monetary policy ("long and variable lags") are now becoming increasingly visible. At the same time, many investors are no longer as cautiously positioned as they were at the beginning of the year. Systematic strategies in particular have an above-average equity exposure. And the options market also indicates that investors are complacent. For example, the VIX recently reached its lowest level on a weekly basis since 2019. Against this backdrop, we remain cautious and underweighted in equities so that we can also take advantage of the opportunities that arise in the event of a sell-off.

Short-term outlook

The next two weeks will be dominated by the central banks. The ECB meets on 14 September. The US Fed and Bank of England will follow on 20 and 21 September. The market currently expects the Fed to pause on interest rates. Another rate hike seems more likely for the BoE, for the ECB not until October. In terms of the economy, the ZEW economic expectations (Sep.) for Germany on Tuesday and the inflation figures (Aug.) for the US on Wednesday are likely to be decisive. The market currently expects US inflation to rise by 0.5% month-on-month. Wednesday will see the release of industrial production data in Europe and monthly GDP (Jul.) for the UK. Thursday, in the US, retail sales (Aug.), initial jobless claims (Sep. 9) and the producer price index (Aug.) provide insights into the robustness of the US consumer, labour market and price changes from a seller's perspective. This will be followed on Friday by industrial production data (Aug.) for the US and China.

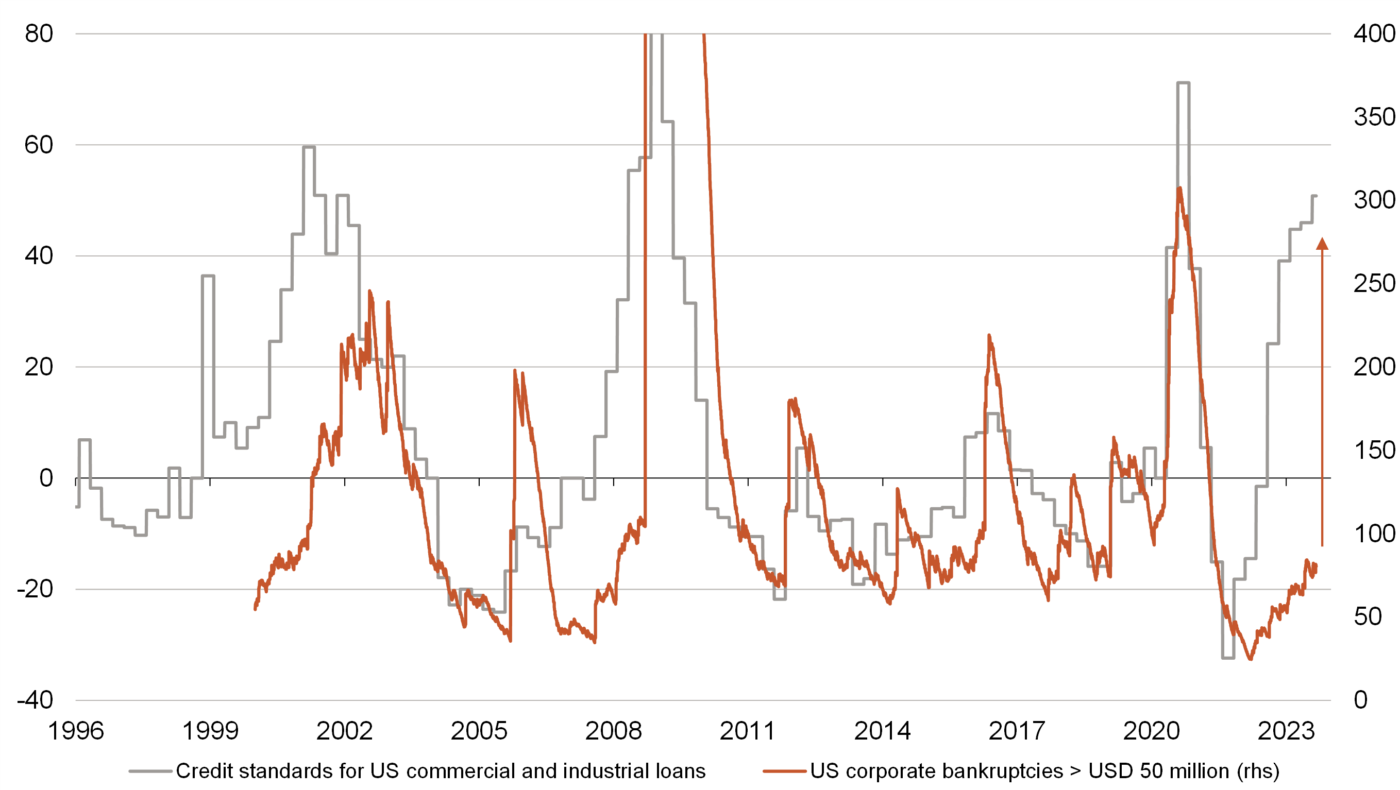

The effects of tight monetary policy become visible – insolvencies rise

- The effects of monetary policy often only make themselves felt in the economy with long and variable lags.

- The number of bankruptcy filings is now increasing, but is still low despite the significant increase in credit stand-ards of US banks. Historically, however, this gap has always closed within 6-9 months.

- Although only comparable to a limited extent, the high-yield bond market seems too carefree to us, with extremely

low volatility and low spreads. Investors should therefore only take on credit risks selectively.