Current market commentary

Both the US Federal Reserve and the ECB raised key interest rates by 25bp last week and emphasised the data dependency of upcoming central bank decisions. In contrast, the Bank of Japan surprised the financial markets: although it left interest rates unchanged, it announced that it would handle its interest rate policy more flexibly in future. Accordingly, the Japanese yen strengthened, and interest rates rose worldwide – long-term rates by even more than short-term rates. The better-than-expected economic data in the US also contributed to rising rates. Bonds fell accordingly. Commodities, on the other hand, were among the big winners and thus continued their recovery of the last few weeks, spurred also by China's willingness to support the domestic economy more in the future. Equities also gained. Here, emerging markets were able to catch up somewhat with developed markets. Since the beginning of July, the asset classes that disappointed in H1 have thus tended to perform better than the H1 outperformers.

Short-term outlook

The coming weeks continue to be dominated by the Q2 reporting season. Already 243 companies (49% of the S&P 500) have reported. Of these, 79% have beaten earnings estimates so far, with a median increase of 6%. On the central bank side, after last week's Fed and ECB rate decisions, the Bank of England will announce its next rate decision on Thursday (3 August).

On Monday, German retail sales (Jun.) as well as preliminary GDP data (Q2) and the harmonised consumer price index (Jul.) for the Eurozone will be released. This will be followed on Tuesday by the manufacturing purchasing managers' indices (Jul.) for China, Spain, Italy, the Eurozone and the US. In terms of US labour market data, the US releases the change in non-farm employment (Jul.) on Wednesday, before announcing initial jobless claims (Jul.) on Thursday and the unemployment rate (Jul.) and hourly wages (Jul.) on Friday.

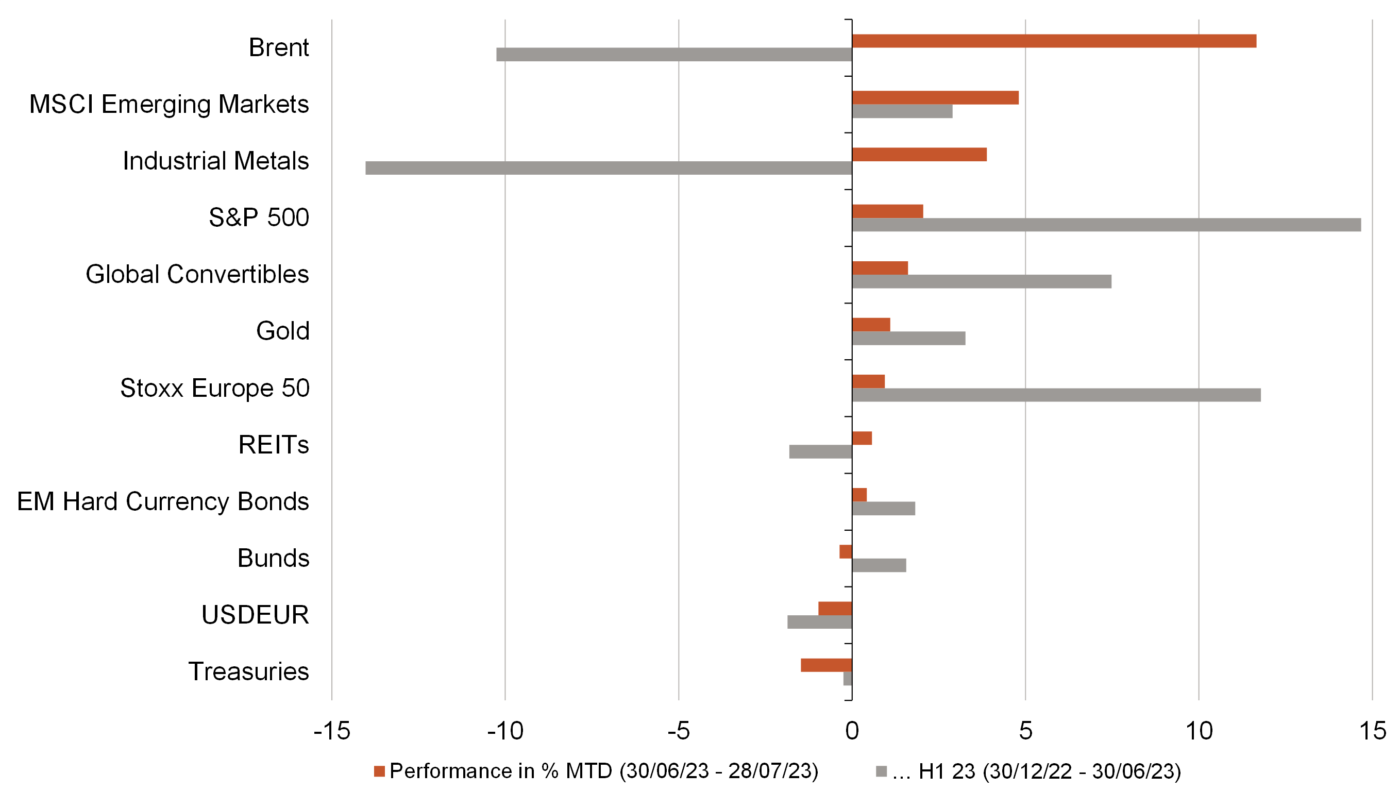

The second half of the year starts with a change of favourites

- Since the beginning of the second half of the year, there has been a change of favourites on the markets. The (relative) losers from the first six months have so far been among the big winners.

- Especially cyclical commodities such as oil and industrial metals, but also emerging market equities are benefiting from the improved economic outlook in the US and stimulus expectations in China.

- Government bonds and gold have had a harder time in this environment.