Current market commentary

The combination of positive inflation surprises and restrictive central banks continues to cause high volatility in financial markets. The S&P 500 has recently moved towards previous June lows, but unlike the Stoxx 600 it has not fallen below them. At the same time, bond yields have risen significantly, especially at the short end, so yield curves have flattened further – a sign that market participants increasingly expect a recession. Fed fund futures are now pricing in a key interest rate of 4.6% for March 2023 – two interest rate hikes more than a fortnight ago. Accordingly, it is becoming increasingly difficult for the Fed to surprise hawkishly. At the same time, investor sentiment and positioning is extremely low. In our view, opportunities are increasingly present. Investors with a defensive positioning should consider whether it is time for a more balanced positioning – both in equities and bonds. We have taken a step in this direction.

Short-term outlook

After the last two weeks were dominated by global interest rate policies, the next two weeks will be more calm on the central bank front. Politically, things are likely to get interesting next week after yesterday's Italian parliamentary elections and in the following week during the Chinese bank holidays week (Golden Week). In times of energy shortages, OPEC+ will decide on 5 October on further production levels.

On Monday, the economic focus will be on the ifo Business Climate (Sep.) for Germany and ECB President Lagarde's hearing before the EU Parliament. On Tuesday, the US will release preliminary durable goods orders (Aug.), consumer confidence (Sep.) and new home sales (Aug.). On Thursday, market will eagerly await initial jobless claims and final quarterly US GDP. On Friday, the focus will be on eurozone labour market data (Aug.) and PMI data (Sep.) for China.

US central bank surprises hawkishly and puts markets under pressure

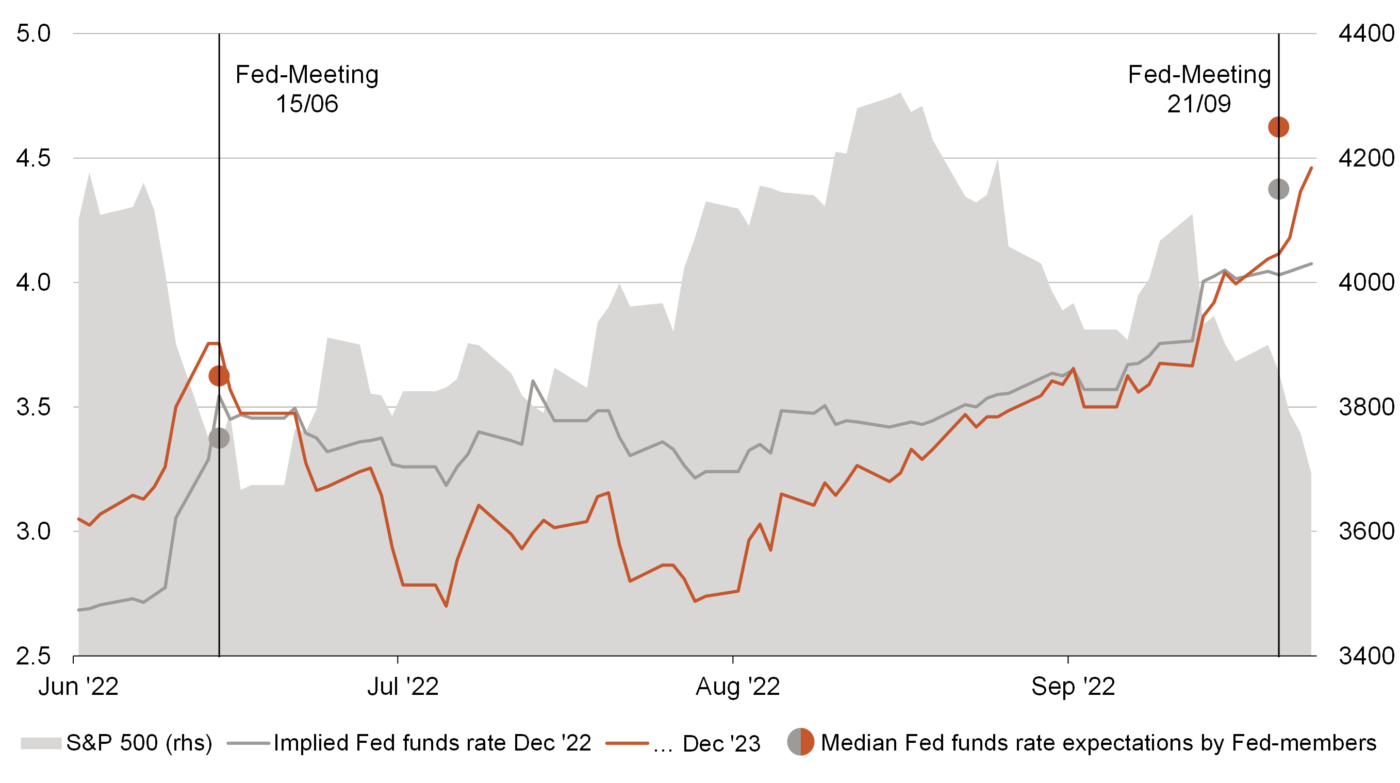

- Economic data is more robust than expected and inflation remains stubborn. Accordingly, the market has sharply raised its interest rate expectations in recent weeks and now even expects key interest rates to rise for the full year '23.

- Fed members raised their forecasts by 1% compared to the June meeting. This time, they exceeded expectations and put further pressure on markets. Further

negative surprises have thus become more difficult. This is positive for markets.