Current market commentary

Global stock markets initially performed well in recent weeks thanks to a strong reporting season and solid macroeconomic data. The S&P 500 reached new alltime highs, while European indices fluctuated sideways. However, the chaos surrounding the trade war and weak US labour market data ultimately weighed on the stock markets. Trump's tariff policy also caused surprises on the commodity markets. Contrary to expectations, copper imports remain largely tarifffree, causing the COMEX copper price to fall by more than 20%. The coming weeks are likely to be tougher. Positive triggers such as the passing of the One Big Beautiful Bill Act, deals in the tariff dispute and the reporting season are ebbing away. At the same time, discretionary and systematic investors have increased their positioning. In addition, August and September are historically difficult months on the stock markets, and risks such as the threat of secondary sanctions against Russia or weaker US growth remain. On the other hand, the starting position is solid, with positive US earnings revisions and robust economic data so far. The next two months are likely to be more volatile.

Short-term outlook

The US tariff policy remains the dominant topic on the markets alongside the ongoing reporting season. The introduction of most tariffs was scheduled for 1 August, but has been postponed again and is currently announced for 7 August. All deals negotiated by Trump include significant punitive tariffs. On 7 August, the Bank of England's interest rate decision will also be of interest in terms of monetary policy.

On Tuesday, the purchasing managers' indices (July) for China, the eurozone and the US will be published. Retail figures (June) for the eurozone will be announced on Wednesday. This will be followed on 9 August by the consumer price index (July) for China. The following week, the labour market figures (July) for the UK and the US consumer price index (July) will be released on Tuesday. On 14 August, GDP data (Q2) for the UK, the eurozone and Japan are expected. Retail data (July) for the US and China will follow on 15 August, together with the Michigan Consumer Sentiment Index (August).

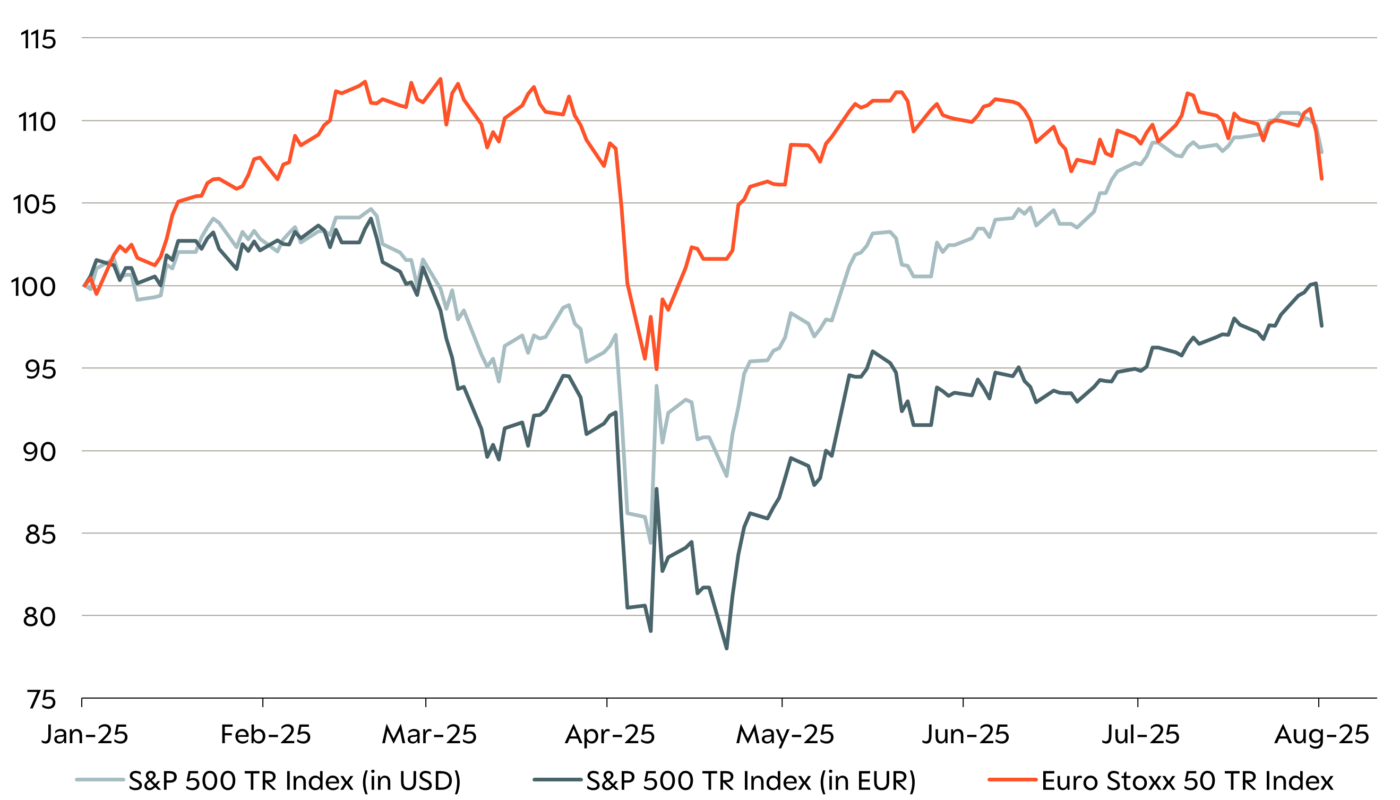

US stock market has caught up, but only in local currency

- European equities are still ahead in terms of a single currency since the beginning of the year, but the US stock market has recently caught up, especially in local currency terms.

- A solid US reporting season, especially for the Magnificent Seven, and not least thanks to the weak dollar, positive growth surprises in the US and a deal in the tariff dispute that was less favourable for Europe have reduced the performance gap in recent weeks.