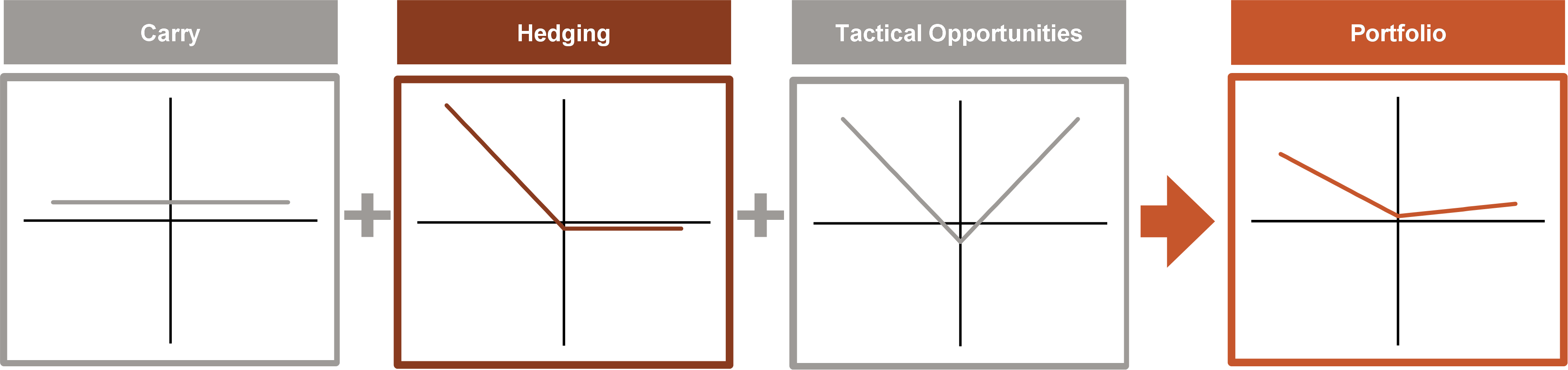

In addition to the increased inflation (volatility) since the coronavirus pandemic, many structural trends have significantly changed the market structure and behaviour. They favour ever greater upside and downside exaggerations in stock markets, while fundamentals play an increasingly minor role. The primary objective of liquid alternative investments should no longer be to generate a return, as this is available from bonds again. The primary objective should now be to diversify or hedge the portfolio - a feature that bonds no longer reliably provide. Options-based risk management, as implemented by the Berenberg Guardian Strategy, is our favoured way to address this changed market environment. With its three-pillar approach of carry, hedging and tactical opportunities, the strategy aims to mimic the payoff profile of a ‘staircase function’: it seeks a negative correlation to falling stock markets and an uncorrelated return to rising stock markets. The Berenberg Guardian Strategy thus offers reliable portfolio diversification and a valuable source of liquidity in times of crisis.

Rising inflation (volatility) leads to volatile markets and worsens the diversification of traditional multi-asset portfolios

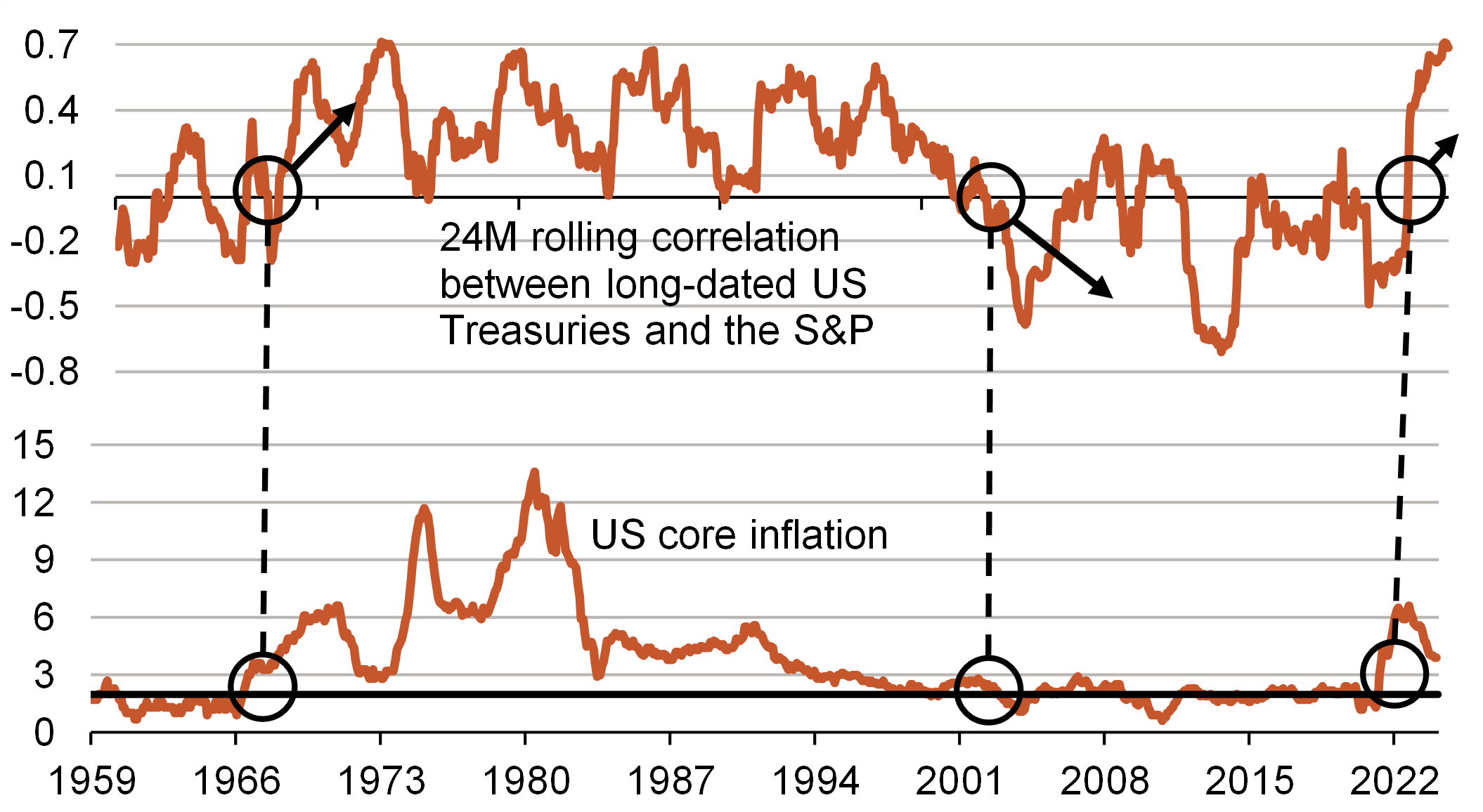

After the simultaneous decline in equities and bonds in 2022, many investors had high hopes last year that the correlation between the two asset classes would return to negative territory. The second half of 2023 impressively proved the opposite, as the diversification effect of bonds diminishes in periods of high inflation (volatility) (Fig. 1). In our view, inflation is also likely to be higher on average in the coming years than in the last decade, with significant fluctuations.

Fig. 1: High inflation (volatility) = lower diversification

High inflation (volatility) historically leads to a higher correlation between equities and bonds, and therefore less diversification within multi-asset portfolios.

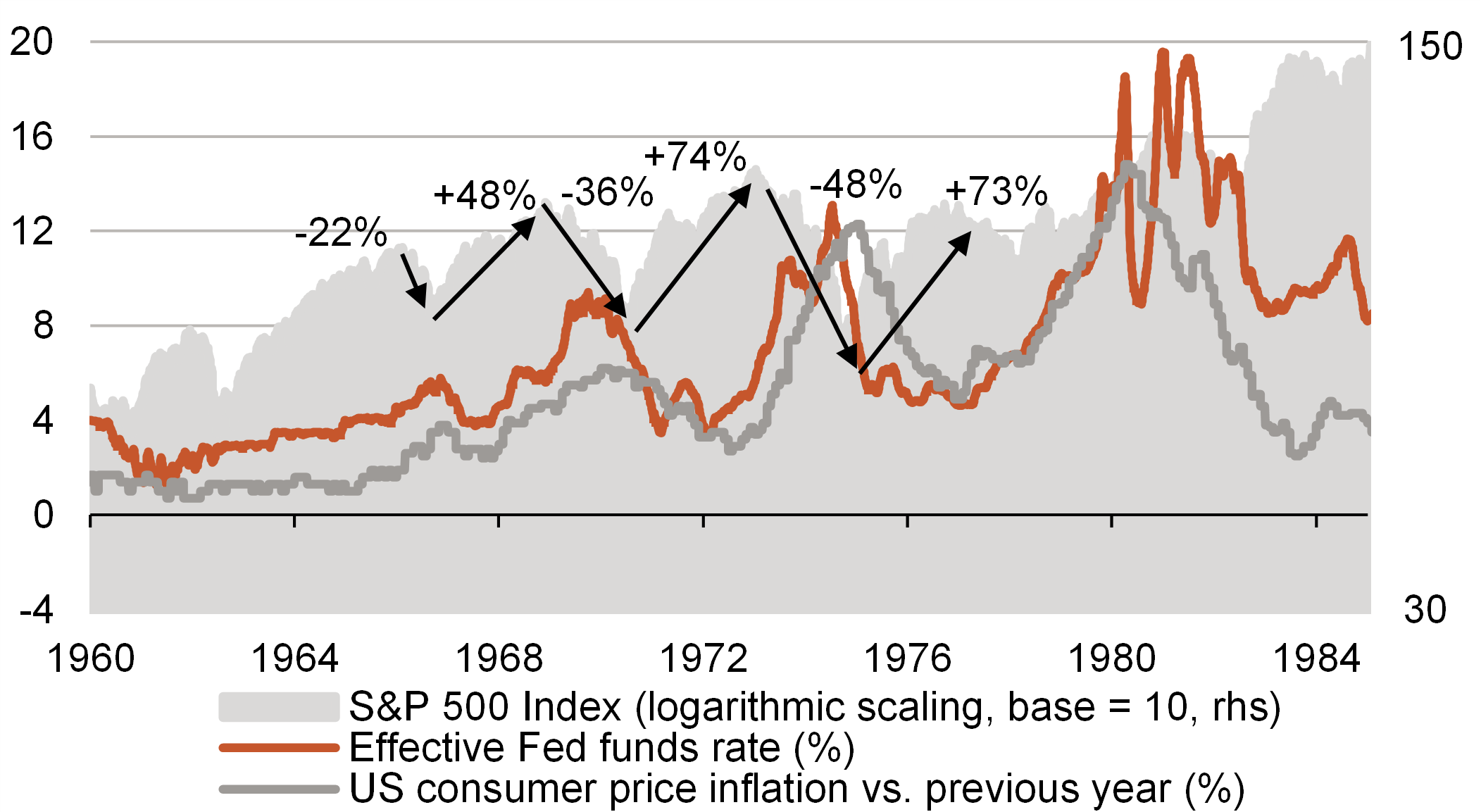

Fig. 2: Shorter monetary policy cycles = greater volatility

Shorter monetary policy cycles as a result of higher inflation volatility lead to more erratic economic cycles and therefore greater stock market volatility.

Reasons for this include increasingly loose fiscal and monetary policy, longer-term commodity supply constraints, the energy transition, deglobalisation and demographic trends that are likely to lead to increasing labour shortages.

The consequence of greater fluctuations in inflation is likely to be stronger and faster monetary policy cycles and, therefore, shorter, more pronounced and more erratic business cycles. This environment would not be entirely dissimilar to that of the 1960s and 1970s. The result would be greater planning uncertainty for companies, which would weigh on their valuations as investors would rightly demand a higher return for the risks taken. Ultimately, this should also lead to increased volatility across asset classes. The experience of the 1970s suggests that the long-term potential for stock markets in such an environment is positive, albeit limited. However, there were three bear markets and three bull markets of considerable magnitude in those years. For active investors, there were clear return opportunities during this period, while passive index investments would have lost value in real terms.

A major consequence of such an inflationary environment is a higher correlation between risky assets and safe havens, and a lower correlation between risky assets such as equities and commodities. The long-term relationship impressively shows that the correlation between stocks and bonds increases with higher inflation. Historically, a positive correlation between equities and government bonds has almost always been observed above a core inflation rate of three per cent. Bonds still make sense in a portfolio context, also because of the higher carry, which should cushion potential interest rate rises much better than in the zero-interest rate environment. However, the developments described above change the role of bonds as a reliable diversifier for equities in a portfolio, which in turn makes risk management more demanding. Multi-asset portfolios that rely solely on equities and bonds will find it more difficult to effectively reduce their volatility in this environment. Investors should therefore seek diversification in assets that are negatively correlated with stock markets, not only empirically but also by design.

Changed market environment impacts risk management

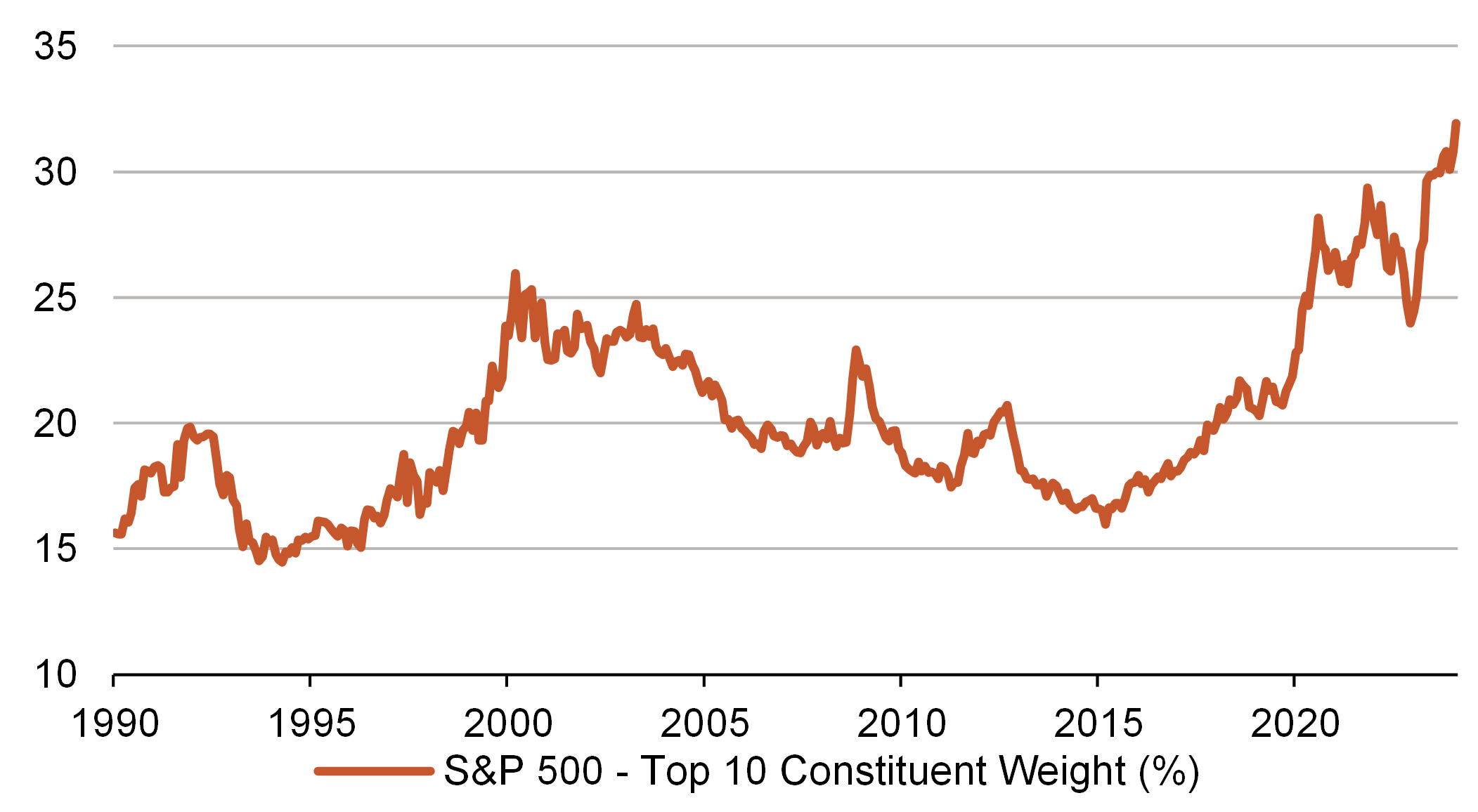

Many structural trends have significantly altered the market structure and behaviour since the global financial crisis. In our view, five developments stand out, alongside the higher correlation between risk assets and safe government bonds: (1) the increase in passive investing, (2) the growing dominance of derivative markets, (3) the prevalence of pro-cyclical behaviour among many investors, particularly systematic investment strategies, coupled with fewer anti-cyclical value investors, (4) the high concentration of major stock indices such as the S&P 500 (Fig. 3), and (5) the extensive share buyback programs.

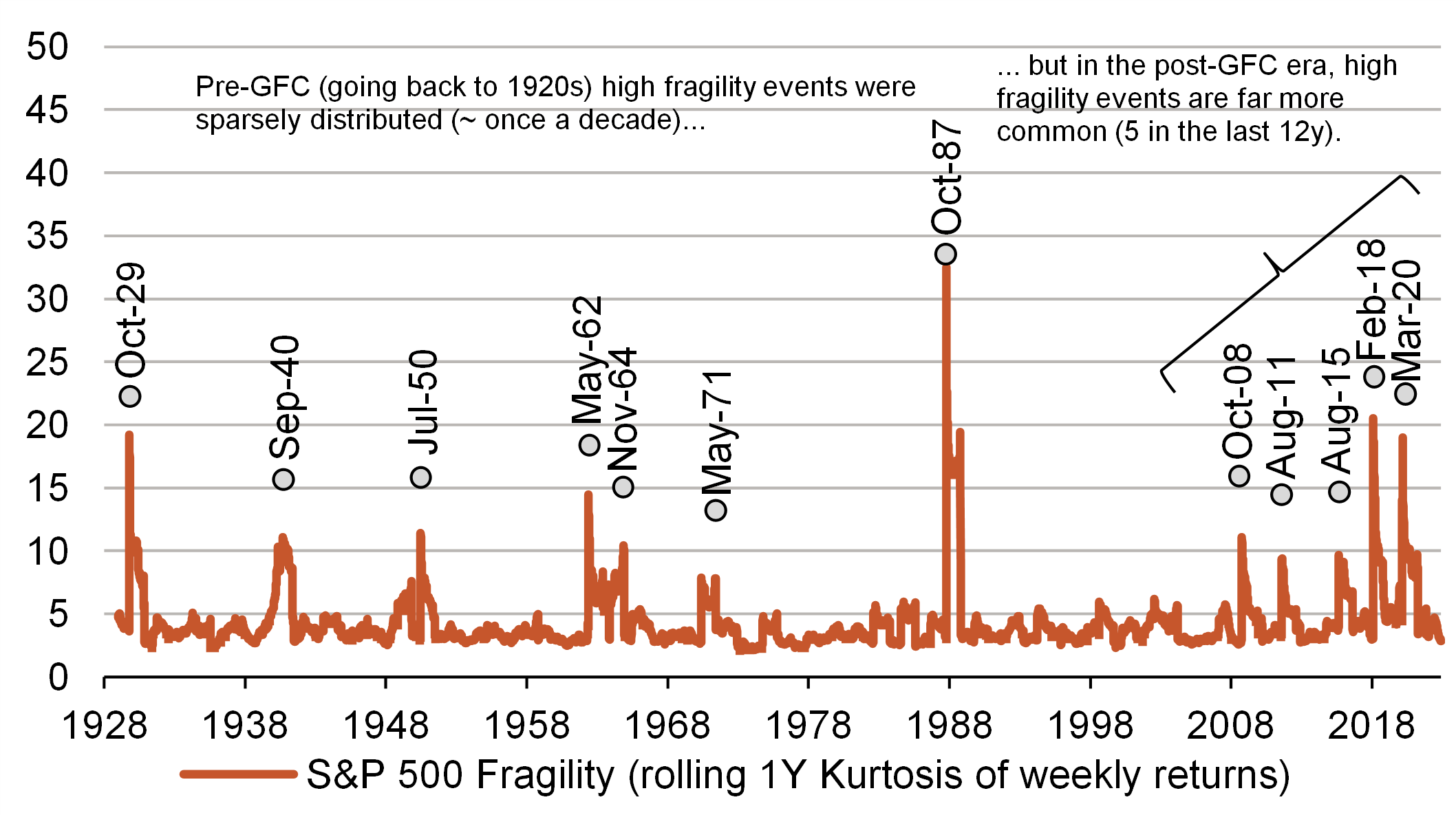

These changes increasingly favour sharp movements and regular overreactions (Fig. 4) both upwards and downwards in the stock markets, while fundamental factors play an ever-diminishing role. Accordingly, it is important for investors to be able to act flexibly, recognize opportunities, and utilize degrees of freedom—both countercyclically and beyond the benchmark. Due to these structural trends, investors should not only focus on broad diversification but also invest in assets that are reliably negatively correlated, especially during market upheavals, to avoid significant portfolio losses. What we mean by this is the construction of a true multi-asset portfolio.

Effective diversification through option strategies

Effective diversification goes far beyond historical correlation metrices and focuses on fundamental return drivers. Many approaches that appear uncorrelated in normal times show strong tail correlations during market crises, thus providing no protection when it is needed most. This means that diversification is often disappointing when it is most needed, as correlations between many assets increase during market stress (e.g. covid shock). This type of correlation is particularly dangerous because investors often misinterpret low correlations in normal times as evidence of efficient diversification. True diversification proves its worth in falling markets by effectively limiting losses. Investments that have favourable correlations only in bull markets contribute little to the overall risk management of a portfolio. An effective way to address these challenges is to use option strategies that benefit from falling markets and rising volatility. Unlike strategies that may exhibit positive correlations in stress scenarios, such strategies are structurally negatively correlated to falling markets.

Fig. 3: S&P 500 increasingly less diversified

Share of the top 10 holdings in the S&P 500 market capitalisation, monthly data

Fig. 4: Number of extreme movements increases

Kurtosis is a measure of the curvature of the distribution. A distribution with a high kurtosis has "fat tails", i.e. high or low values (here weekly returns) occur more frequently.

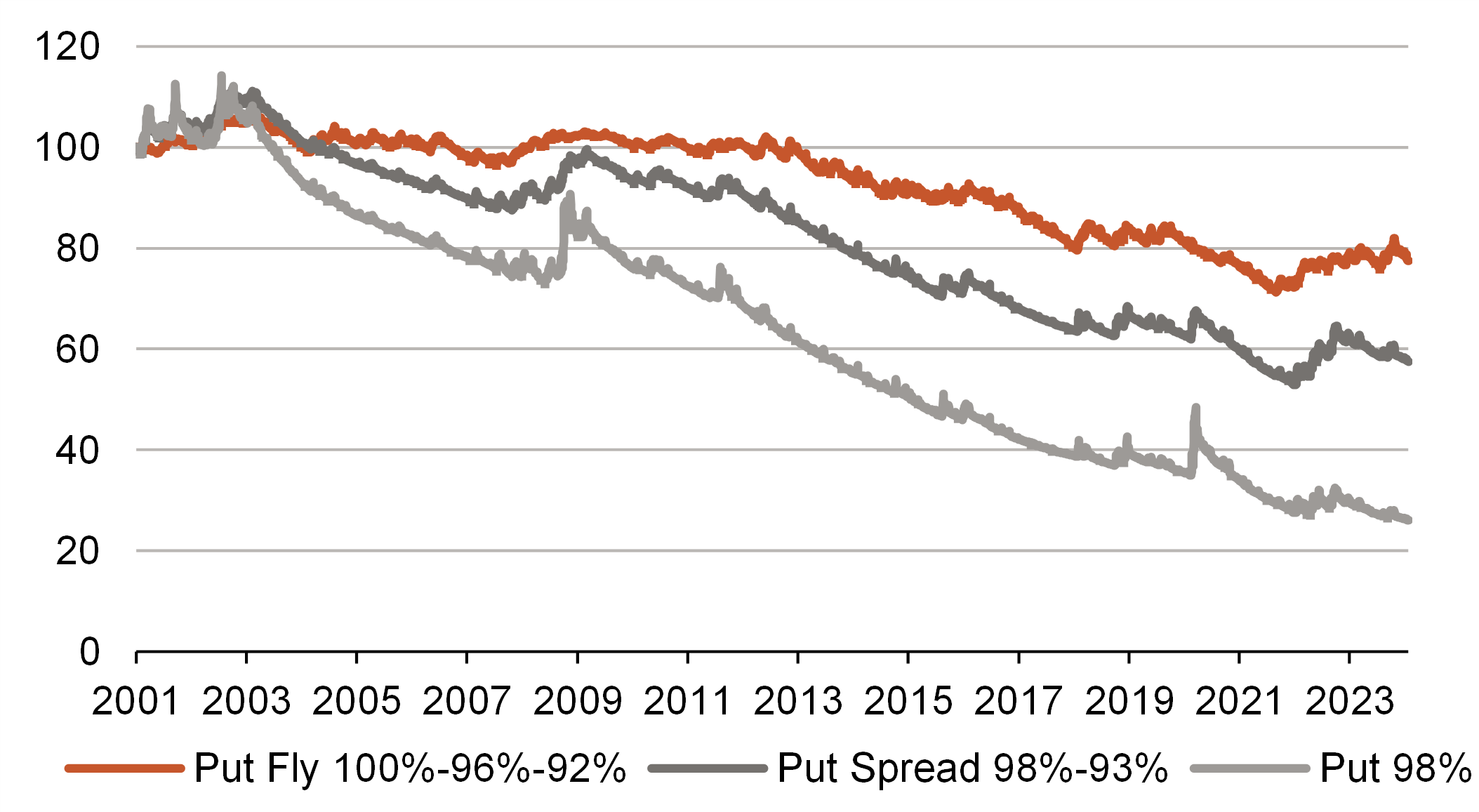

A common criticism from investors regarding the use of put options in a portfolio is the "negative carry," which diminishes portfolio returns in good times, similar to a recurring insurance premium (Fig. 5). A fixed hedging budget spread across various calendar months (e.g., 4% p.a.) not only allows the investor to know the costs of their hedging strategy in advance but can also significantly limit the negative carry during periods of high interest rates. To maintain some convexity, the focus should be on selecting the most cost-effective hedges (highest level of protection given the options budget). In particular, by combining fundamental analysis with quantitative models, taking into account factors such as the macro environment, market positioning, liquidity and leverage, the most effective and cost-efficient options can be selected, adjusted where necessary and ultimately monetised.

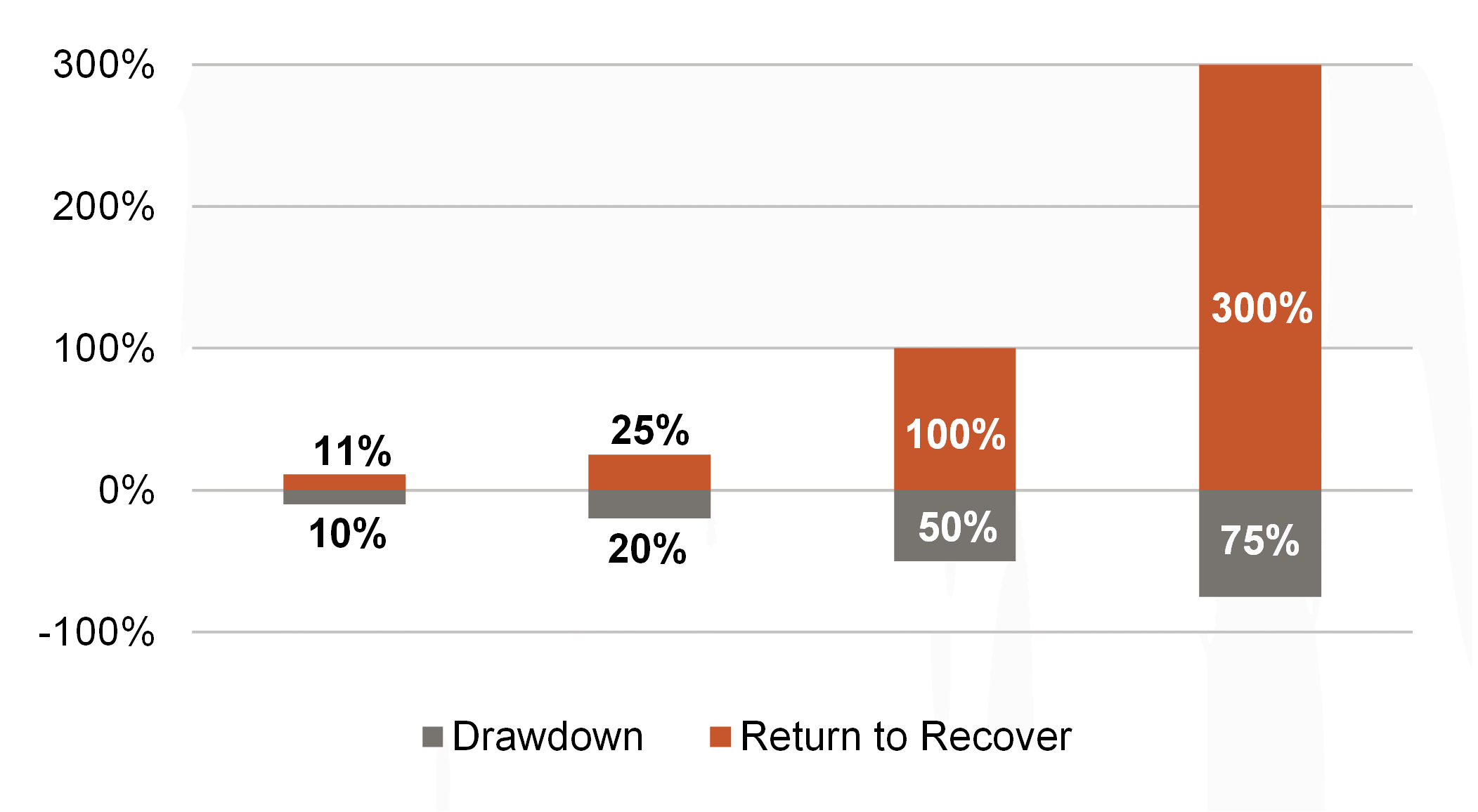

Such options-based risk management not only ensures a diversified portfolio but can also contribute to higher long-term wealth growth. Many real-world examples disprove the notion that high returns necessarily come with high risks. A portfolio experiencing a 50 percent loss requires a 100 percent return to break even, while a 75 percent loss necessitates a 300 percent return (Fig. 6). This disproportionate impact of large losses reduces the capital base and consequently the compounding effect, which is crucial for achieving decent long-term returns. Thus, investments with high average returns can lead to lower long-term wealth growth due to their high risk, as larger losses outweigh the benefits of higher average returns.

Portfolios with the highest long-term growth are often those with lower but more consistent returns, achieved through strategic risk reduction. It is therefore important for long-term investors, such as institutional investors, to address the lack of diversification between bonds and equities in their portfolios and to consider alternative solutions. Risk management through options is not just a defensive tactic, but a fundamental diversification strategy to ensure long-term growth and stability.

Fig. 5: Systematic hedging strategies cost money in the long term

Backtest of systematic hedging strategies on the S&P 500. The options (strikes in % of spot) have a maturity of 1M and are held to maturity.

Fig. 6: Losses outweigh gains

The performance required until full recovery increases exponentially with the loss, as the capital base is reduced.

Berenberg Guardian Strategy as a reliable diversifier

In response to these challenges, we have developed the Berenberg Guardian Strategy. From the unpredictability of stock and bond markets to the growing demand for funds that can weather financial storms and capitalise on market dislocations, the Berenberg Guardian Strategy aims to fill these gaps with an intelligent approach. The strategy combines discretionary and systematic decision making. The objective of the Berenberg Guardian Strategy is to be negatively correlated with falling stock markets and uncorrelated with rising stock markets, enabling the fund to generate positive returns with low volatility and low drawdowns over rolling one-year periods. The Berenberg Guardian Strategy thus offers reliable diversification as well as a source of liquidity in times of crisis.

Our approach differs from other hedging strategies, which often incur high costs in good times, by focusing on three pillars: (1) carry, (2) hedging and (3) tactical opportunities.

The Carry Pillar

The Carry Pillar is a carefully designed bond portfolio with a short duration, high credit quality, and no currency risk. Up to 20 percent of this component is held as cash. The bonds themselves consist of short-term government bonds, covered bonds, and investment-grade corporate bonds with a maximum maturity of three

years. The bond portfolio is structured as a ladder with a duration of approximately one year. The Carry Pillar ensures a fundamental level of safety and stability while also serving to finance the hedging budget of the Hedging Pillar.

The Hedging Pillar

The innovative hedging approach of the Berenberg Guardian Strategy differs both in its focus and its investment process from many other hedging products. In the Berenberg Guardian Strategy, we primarily focus on hedging moderate selloffs with a historically much higher probability of occurrence. Additionally, while we heavily rely on quantitative analysis, we ultimately make investment decisions discretionarily, considering factors such as the macro environment, market positioning, and liquidity. To control the costs of hedging, we employ a budgeted approach. Approximately 90 percent of the budget is invested in liquid short-term index options, which hedge drawdowns of up to ten percent. We select the most cost-effective hedging strategies depending on the volatility environment with a comparably high probability of occurrence while maintaining low path dependence. Our aim is to maximize the protection for the available hedging budget. The remaining ten percent of the budget is opportunistically invested in tail hedges whenever they are cheap and the market appears particularly vulnerable.

The "Tactical Opportunities" Pillar

The Tactical Opportunities Pillar of the Guardian Strategy aims to provide additional returns by exploiting market opportunities, dislocations and disruptions. This means investing in opportunities where we have a high conviction and see an asymmetric riskreturn profile, regardless of whether we are in a crisis or in a normal market environment. We allocate capital very selectively. If we do not identify suitable opportunities, this pillar may remain inactive. Patience, risk management, and the magnitude of allocations are crucial for us. As in the hedging pillar, we only invest with a very clear budget. Examples of tactical allocations include macro disruptions, market imbalances, relative value trades, or seasonal patterns.

Fig. 7: Target payout profile of the Berenberg Guardian Strategy

Schematic representation of the innovative three-pillar concept

Summary

The Berenberg Guardian Strategy stands out for its discretionary decisions within a clearly defined framework, based on a unique blend of fundamental and macroeconomic analysis on one hand and quantitative analysis on the other. The strategy offers reliable portfolio diversification with its negative correlation to falling stock markets and serves as a valuable source of liquidity in times of crisis. The innovative three-pillar approach enables the fund to benefit from both macroeconomic disruptions and market inefficiencies.

Authors

Ulrich Urbahn

Ulrich Urbahn has been working for Berenberg since October 2017 and is responsible for quantitative analyses and the devel-opment of strategic and tactical allocation ideas, and is involved in capital market communications. He is a member of the Asset Allocation Committee and portfolio manager of the Berenberg Variato. After graduating in economics and mathematics from the University of Heidelberg, he worked for more than 10 years at Commerzbank, among others, as a senior cross asset strate-gist. Mr Urbahn is a CFA charterholder and was part of the three best multi-asset research teams worldwide in the renowned Extel survey for many years.

Philipp Loehrhoff

Philipp Löhrhoff joined Berenberg in 2021 and is a portfolio manager in the Multi Asset team. In his previous roles he worked closely with institutional investors to structure, develop and place bespoke hedging and investment solutions. He is an expert for quantitative investment strategies as well as cross asset solutions with a particular focus on equity and fixed income. He spent several years at Goldman Sachs, BNP Paribas and Natixis in London. Philipp holds a Master‘s degree in Finance and Economics and a Bachelor’s degree in Econometrics and Mathematical Economics from the London School of Economics and Political Science (LSE).

Ludwig Kemper

Ludwig Kemper has been working as a strategist since 2019 and as a portfolio manager since 2021 at Berenberg’s Multi Asset unit. His responsibilities include the generation of investment ideas and the preparation of analyses to support investment decisions. Ludwig focuses on the commodities sector and derivatives markets. Previously, he completed a dual study programme at Berenberg in cooperation with the Hamburg School of Business Administration. In his rotations, he worked in investment banking, equity research and asset management. He received his Bachelor's degree as valedictorian of his class. Ludwig is a CFA charterholder.