Investment Strategy

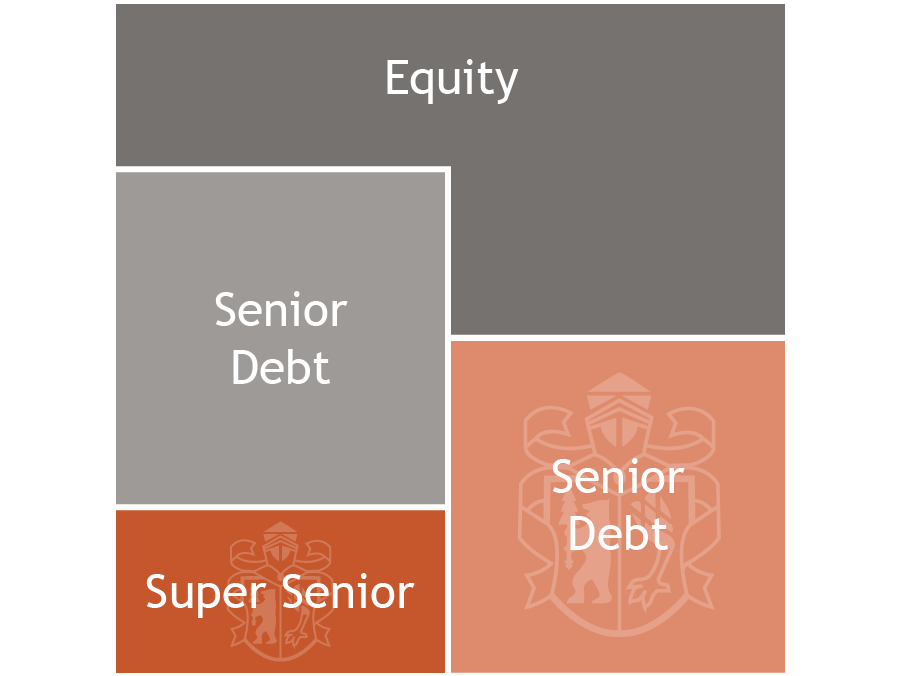

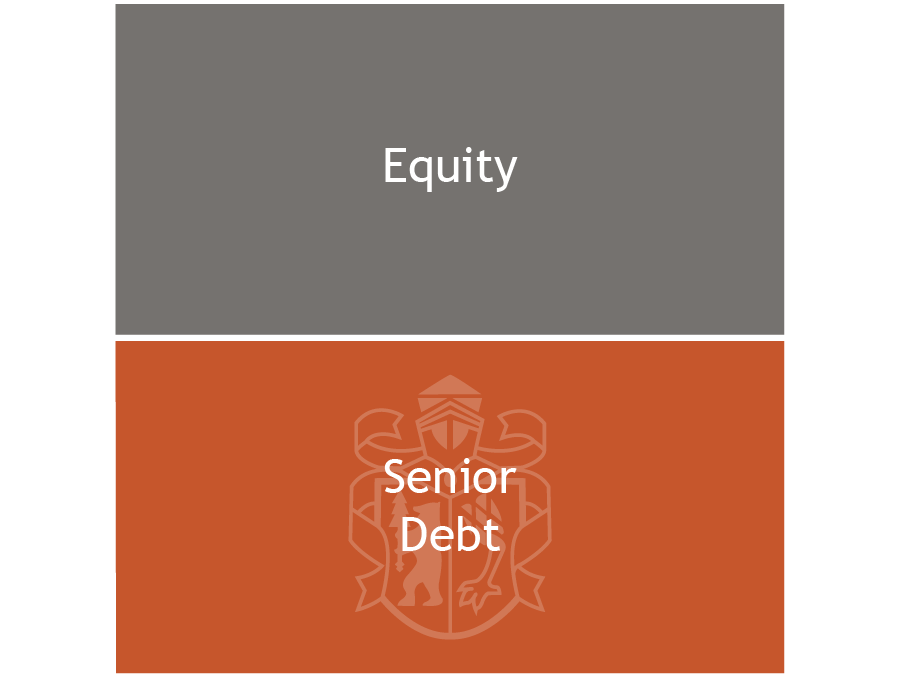

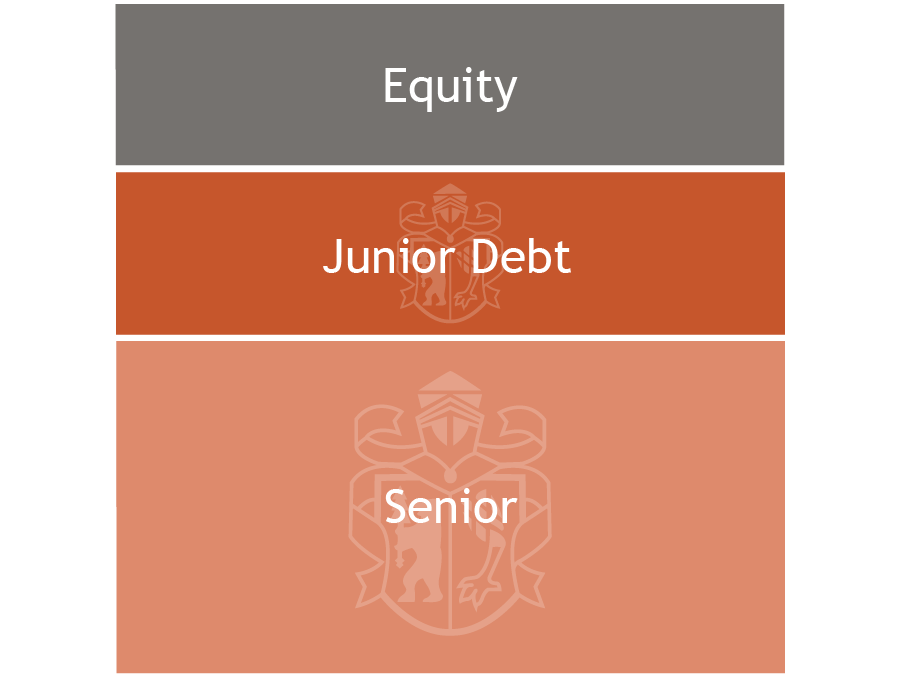

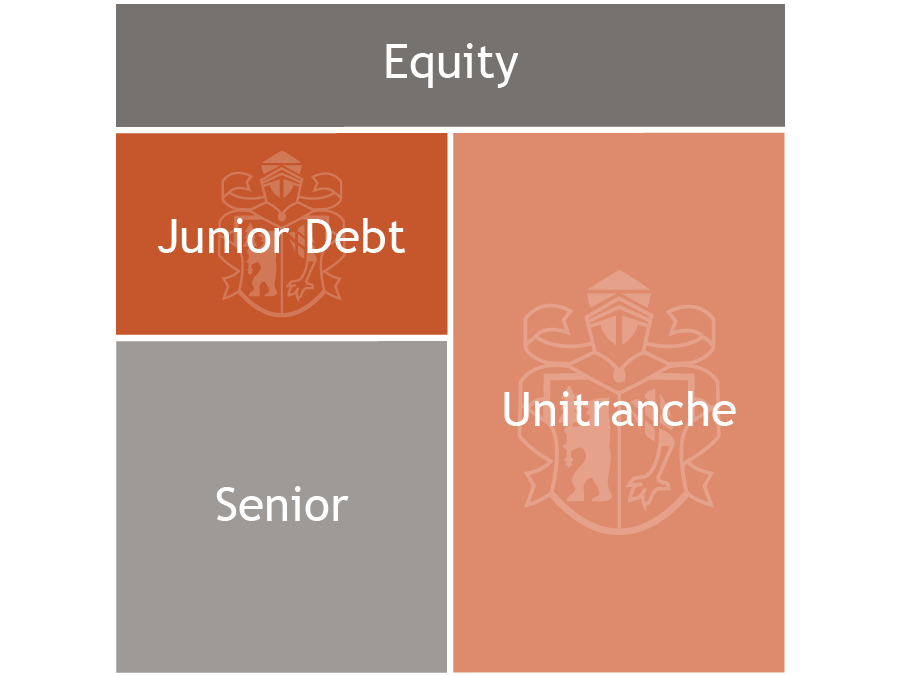

The Corporate Direct Lending Debt Funds invest in Super Senior and Senior tranches of transaction- and acquisition financings for medium-sized companies with conservative EBITDA multiples, often in context with the participation of private equity firms. The focus is on cash-flow-strong companies that are characterised by low cyclicality and are market, niche, cost or quality leaders in their segment.

The Corporate Direct Lending Debt Funds have an attractive risk-return profile with significantly higher return opportunities compared to corporate bonds.

Would you like to learn more about our corporate direct lending strategy and investment opportunities? Contact us for a personal consultation.

Important information

This information is a marketing communication. It is intended exclusively for clients in the »professional investors« or »semiprofessional investors« client category pursuant to section 1 (19) nos. 32 and 33 KAGB. This information and references to issuers, financial instruments or financial products do not constitute an investment strategy recommendation pursuant to Article 3 (1) No. 34 Regulation (EU) No 596/2014 on market abuse (market abuse regulation) nor an investment recommendations pursuant to Article 3 (1) No. 35 Regulation (EU) No 596/2014, both provisions in connection with section 85 (1) of the German Securities Trading Act (WpHG). As a marketing communication this document does not meet all legal requirements to warrant the objectivity of investment recommendations and investment strategy recommendations and is not subject to the ban on trading prior to the publication of investment recommendations and investment strategy recommendations. This document is intended to give you an opportunity to form your own view of an investment. However, it does not replace a legal, tax or individual financial advice. Your investment objectives and your personal and financial circumstances were not taken into account. We therefore expressly point out that this information does not constitute individual investment advice. Any products or securities described may not be available for purchase in all countries or only in certain investor categories. This information may only be distributed within the framework of applicable law and in particular not to citizens of the USA or persons resident in the USA. The statements made herein have not been audited by any external party, particularly not by an independent auditing firm. Any future returns on fund investments may be subject to taxation, which depends on the personal situation of the investor and may change in the future. Returns on investments in foreign currencies may increase or decrease due to currency fluctuations. The purchase, holding, conversion or sale of a financial instrument, as well as the use or termination of an investment service, may give rise to costs that affect the expected income. Only the offering document (including the sub fund appendix if applicable), the Articles of Association of the Company and the subscription form (hereinafter referred to collectively as the »Sales Documents«) are authoritative for a decision on this investment. The Sales Documents are available free of charge in German from the Fund‘s Distributor. The business address of the Distributor is: Joh. Berenberg, Gossler & Co. KG (Berenberg), Neuer Jungfernstieg 20, 20354 Hamburg. A fund investment involves the purchase of shares in an investment fund, but not a specific underlying asset (e.g. shares in a company) held by that fund. The statements contained in this document are based either on own company sources or on publicly accessible third-party sources, and reflect the status of information as of the date of preparation of the presentation stated below. Subsequent changes cannot be taken into account in this document. The information given can become incorrect due to the passage of time and/or as a result of legal, political, economic or other changes. We do not assume responsibility to indicate such changes and/or to publish an updated document. Please refer to the online glossary at https://www.berenberg.de/en/glossary/ for definitions of the technical terms used in this document. The images used in this document are for illustrative purposes only. They do not refer to specific products, services, persons or actual situations and should not be used as a basis for decisions or actions. Date 02.06.2025

LBO market in structural change

The market share of debt funds in the LBO market is constantly growing, while the one of banks has been declining for years. The trend shows that traditional banks are increasingly replaced by debt funds, as banks have reduced their risk appetite in recent years given increasing regulatory burdens and rising multiples.In addition, there are the obvious advantages of debt fund financings, which are particularly visible in their flexibility, for example in terms of multiples, repayment profile, ticket sizes, speed or the "one-stop" solution apart from traditional bank underwriting.In the short to medium term, there is no trend reversal expected, as in addition to the decreasing risk appetite, banks often have slow decision-making and lengthy processes to adapt their business model or strategy.

Key market drivers- "Dry powder" from private equity firms drives up purchase prices and leverages- Investors looking for return in the current low interest rate environment- Generally strong market for mergers & acquisitions (M&A)- Banks withdrawing from LBO market due to regulatory hurdles and low risk appetite- Increasing competition between debt funds

Key market drivers

- "Dry powder" from private equity firms drives up purchase prices and leverages

- Investors looking for return in the current low interest rate environment

- Generally strong market for mergers & acquisitions (M&A)

- Banks withdrawing from LBO market due to regulatory hurdles and low risk appetite

- Increasing competition between debt funds

Berenberg’s USP

Focus on financing niches by segments, financing ranks and structures

Experienced asset manager with banking licence

Structuring of complex financing solutions

High transaction speed

Broad network and strong industry know-how in various asset classes

In addition to the opportunity for an attractive return, the investment also entails risks which are described in detail in the section "Special Risks" in the issuing document. For example, but not exclusively, the following risks exist:

- Risks from participation in Financings

- Dependence on Berenberg

- Risk from possible conflicts of interest

- Inflation risk

- Interest rate risk

- Investment risk

- Payment obligation arising from financings

- Risk relating to collateral sharing

- Risk of the borrower

- Risk from the general economic situation

- Liquidity risk