Current market commentary

The month of September was driven by broad-based losses in almost all asset classes: triggered by once again higher government bond yields – especially in the US – global equity markets as well as corporate bonds and emerging market bonds closed strongly in the red. US 10-year government bond yields jumped 46bps in September and 78bps in the third quarter. A number of US economic data releases were again better than expected in September. The sharp rise in oil prices, hawkish comments from the Fed at the September meeting, market concerns about soaring US debt and strong government bond issuance did the rest. Most recently, however, the oil price gave back some of its gains. Diversification has hardly paid off so far this year. Only when interest rates stop rising (so strongly and quickly) should there be a recovery for many capital market segments.

Short-term outlook

The Q3 reporting season begins this week with the first business figures from US companies on Friday. Over the next two weeks, about 18% of the companies in the S&P 500, measured by market capitalisation, report. At the index level, Q3 earnings growth is expected to be 1.1% year-on-year – the first positive year-on-year result since Q3 2022. On the political front, the annual meeting of the IMF and World Bank (9-15 Oct) and the Swiss parliamentary elections (22 Oct) will take place. On Wednesday, US producer prices (Sep.) and German inflation data (Sep.) will be released. Thursday will see US inflation data (Sep.) and the weekly release of US jobless claims (12 Oct.). Friday will see the release of the University of Michigan Sentiment Indicator (Oct.) and Chinese inflation data (Sep.). The following week, US housing market data and Chinese GDP (Q3) are due.

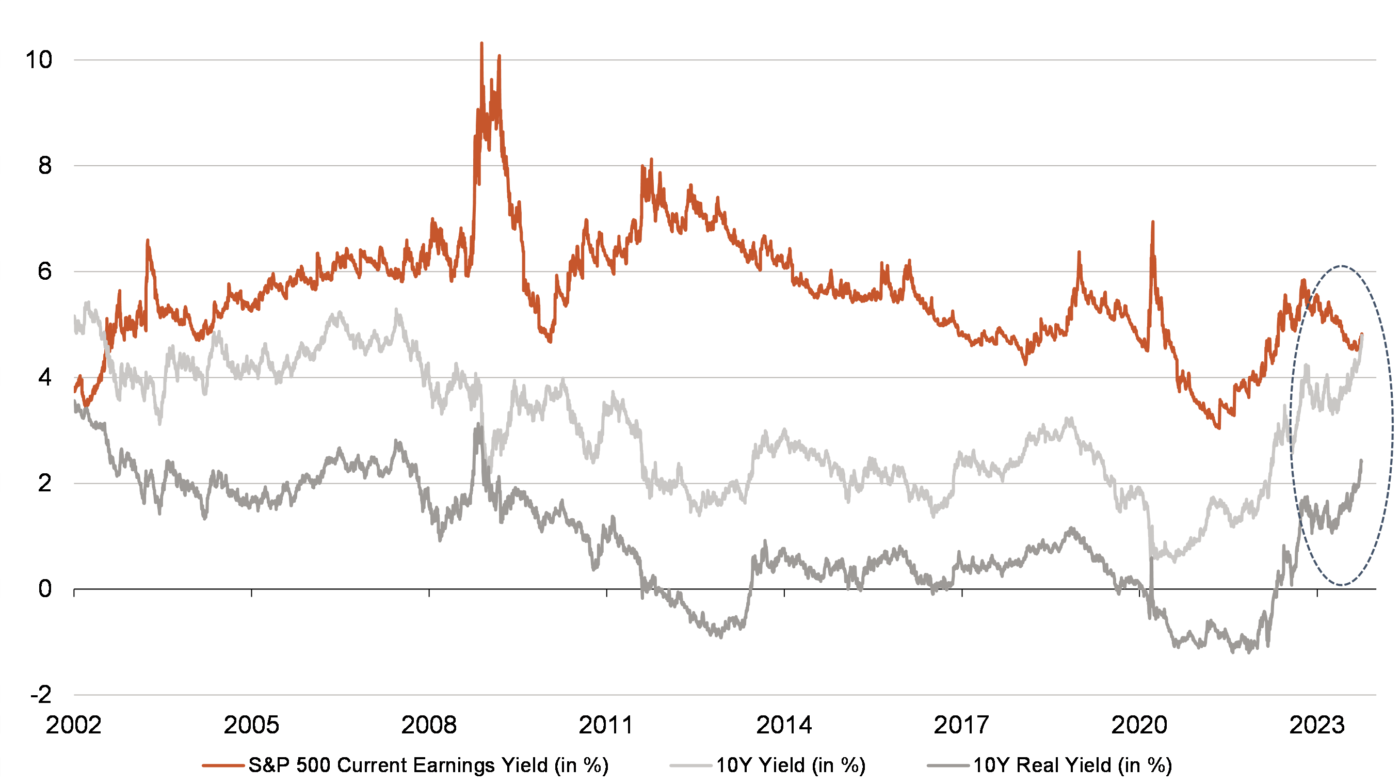

Attractiveness of US equities has declined compared to bonds

- With the recent rise, the yield on 10-year US government bonds is about to exceed the earnings yield on US equities for the first time since 2002.

- If both values equalise, equity investors are left only with the hope of rising profits to compensate for the risk assumed. The equity risk premium appears very low.

- Bonds have gained significantly in relative attractiveness, especially as the rise in yields has been driven by higher real interest rates rather than rising inflation expectations.