Current market commentary

The stronger-than-expected US labour market data at the beginning of February led to a reassessment on the financial markets. There was a significant upward countermovement in the US dollar. Bond yields rose, especially at the short end, leading to a stronger inversion of the US yield curve. While the market is now pricing in higher interest rates for an extended period, it still expects the Fed to cut rates by 200 basis points by 2025 and US inflation to come down to 2.5%. While US equities trended volatile sideways, the recovery rally in European equities, which have more room to move upwards in terms of valuation, continued. However, volatility is likely to increase in the medium term – either because the recession feared by many market participants will occur and weigh on corporate profits, or because the economy and inflation turn out to be more robust than expected, which is likely to lead to a longer-lasting restrictive monetary policy by central banks.

Short-term outlook

After the central bank meetings, the focus of the markets is likely to turn back to the Q4 reporting season, which will be largely completed in the US by the end of February. So far, earnings disappointments have been punished less than in recent quarters – this reporting season, companies with earnings misses only fall by an average of 1%, compared to an average of 2.5% to 3% from Q3 2021 to Q3 2022 in the previous four quarters. Preliminary Q4 2022 GDP data for Japan and the Eurozone are due on Tuesday. Valentine's Day also brings the new US inflation figures for January – currently estimated by the market at 6.2% year-on-year. This will be followed on Wednesday by industrial production data for the Eurozone (Dec.) and the US (Jan.) and retail sales (Jan.) for the US. US housing starts (Jan.), producer prices (Jan.) and initial jobless claims (11 Feb) will be reported on Thursday.

Fundamentally, the air is getting thinner for US equities

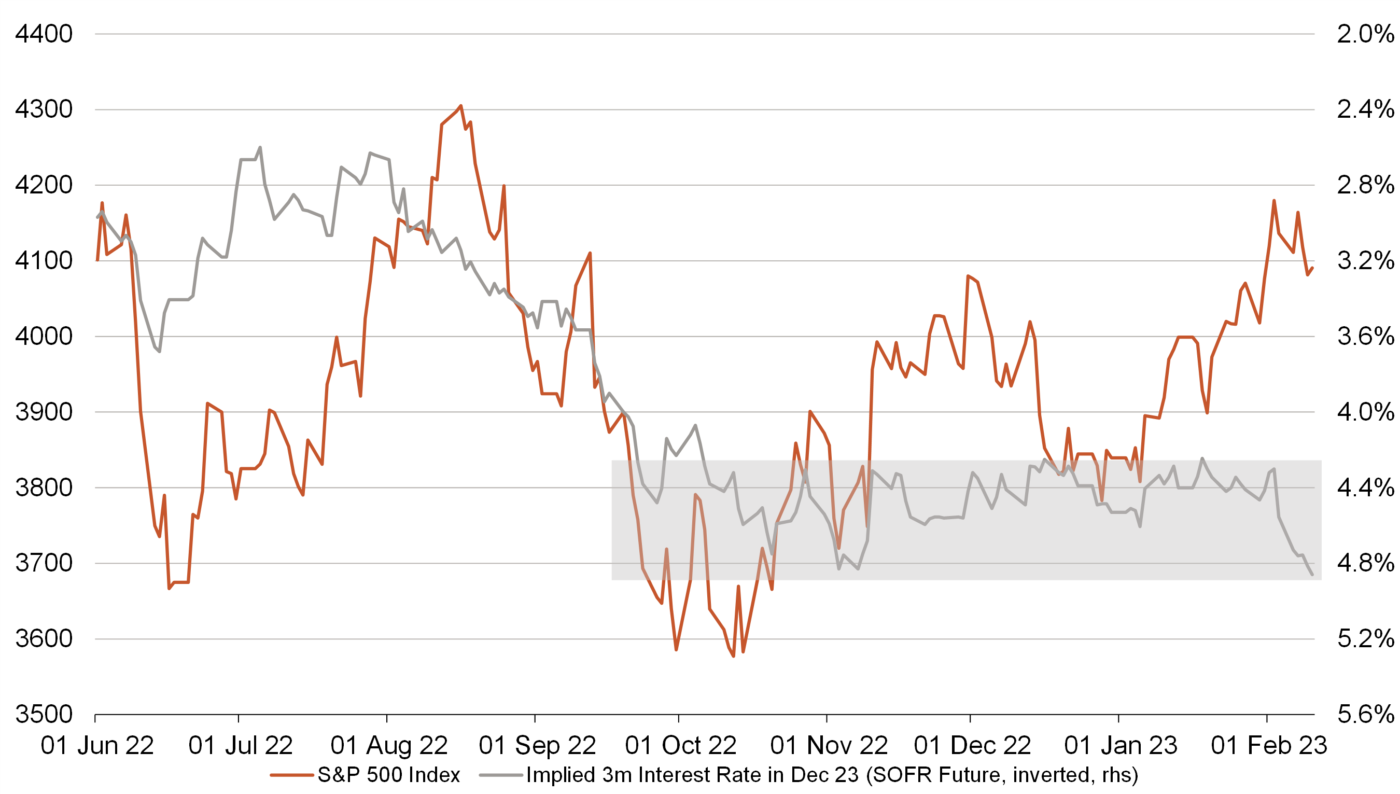

- After the strong US labour market data, bond markets are again expecting a more restrictive monetary policy from the Fed and are now pricing in higher

interest rates for longer. SOFR futures for December imply a 3m interest rate of around 4.8%. This is the highest level since early November 2022. - However, despite lower earnings expec-tations, the equity markets are now trading a good 9% higher than back then. If the bond markets are right, the air will slowly become thin for equities funda-mentally, despite technical tailwinds.