Current market commentary

Hawkish Fed comments, stronger than expected inflation figures in Europe and a recovery in commodity prices have led to a rise in bond yields. US 10-year government bond yields have risen by 50 basis points since the beginning of August. Equity markets came down as well. An exception was energy stocks, which benefited from falling oil inventories and statements about a possible OPEC+ production cut. Now that the reporting season is over, stock markets are likely to be more macro-driven again and volatility is likely to increase – not least because of a stronger quantitative tightening by the Fed from September onwards. The market's focus is clearly on central banks and the upcoming inflation figures. Downside surprises should lead to a recovery rally, upside surprises should lead to a sell-off.

Short-term outlook

After Fed President Powell's hawkish speech on Friday, market participants are eagerly awaiting the central bank meetings in September. The ECB already meets on 8 Sep-tember, the BoE on 15 September and the Fed on 21 September. In addition, the US stock market is closed on 5 September (Labour Day).

This week all eyes are on the August inflation data, US labour market data and the purchasing managers' indices (PMIs). On Tuesday, preliminary inflation data for Ger-many (Aug.) will be released, as well as Eurozone economic confidence (Aug.) and US consumer confidence (Aug.). French and EUR inflation data (Aug.) will follow along with China PMIs (Aug.) on Wednesday. On Thursday, German retail sales (Jul.) will be followed by Eurozone and US PMIs (Aug.). US labour market data (Aug.) and German exports (Jul.) will be published on Friday.

Back and forth in the bond market amid uncertain monetary policy

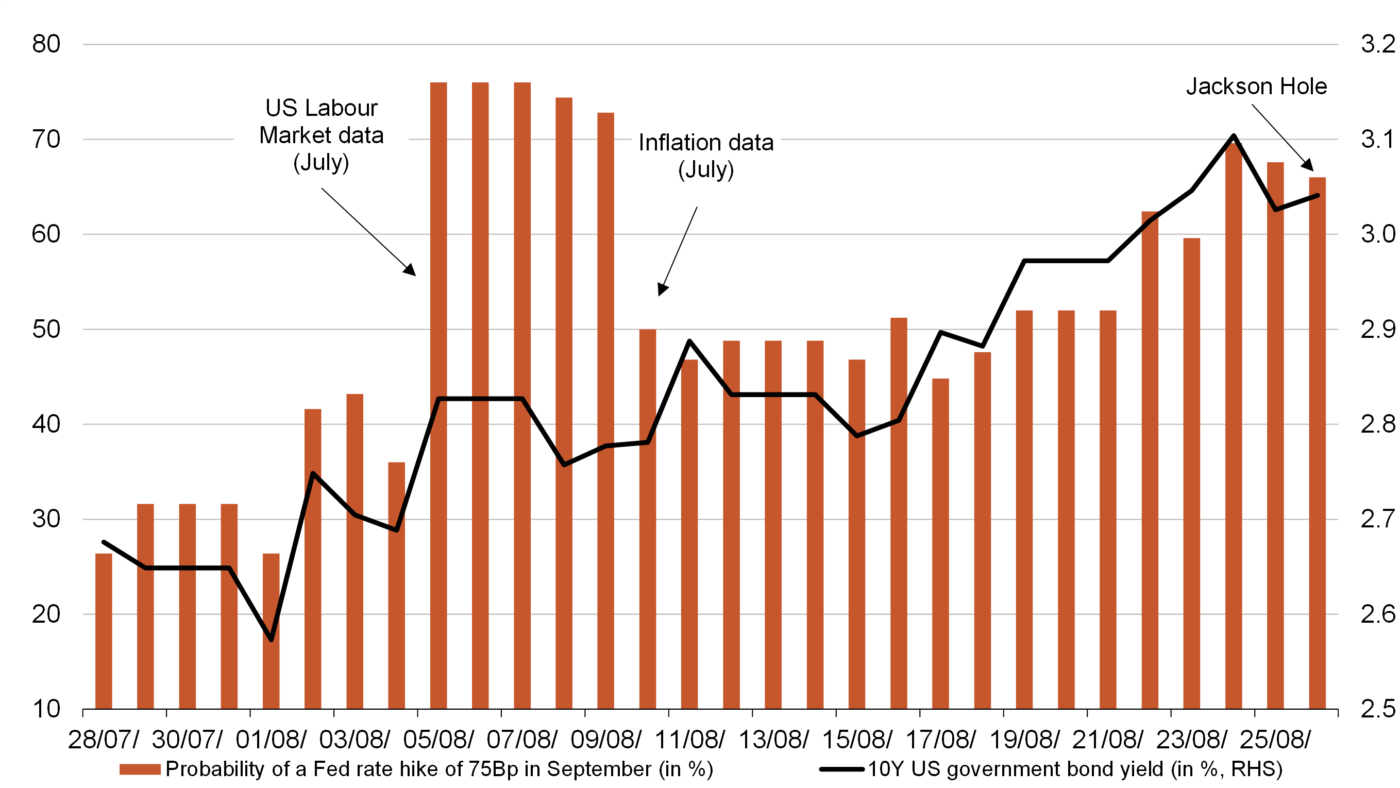

- Market reacts increasingly data-driven regarding US monetary policy. At the end of July, the priced probability of a 75bp hike by the Fed was still below 30%. The rise to almost 80% with the July labour market data lasted only briefly. Most recently, the probability has risen significantly again thanks to hawkish Fed comments.

- US yields reacted significantly. At the beginning of August they were still below 2.6%, but then jumped to over 3%. Bond volatility is likely to remain elevat-

ed in the future.