Current market commentary

After a strong first quarter, the stock markets fell slightly in April. In addition to the tax season in the US, the increased geopolitical risks in the Middle East are also likely to be responsible for this. In April, US liquidity is also threatening to decline somewhat (higher Treasury supply with high duration, more tax payments at the same time). Below the surface, the rotation continued. Tech and other growth stocks tended to be sold, while banks and commodity sectors were in demand. The oil price has risen by around 20% since the beginning of the year, copper by almost 10%. The increased risk of inflation while economic data remains robust is making it more difficult for the US Federal Reserve to cut interest rates as planned. Accordingly, some Fed members attempted last week to dampen market expectations for interest rate cuts this year. A rate cut in June is currently being priced in with a probability of 55%.

Short-term outlook

This week will be particularly exciting in terms of (monetary) policy in Europe. The ECB will meet for the third time this year on 11 April, and the market is not expecting a change in interest rates. The Eurogroup and the ECOFIN Council will meet on 11 and 12 April. The spring meetings of the IMF and the World Bank Group will also take place from 17 to 19 April. Data on industrial production (Feb.) and exports (Feb.) will be published for Germany today. On Wednesday, the consumer price index (Mar.) for the USA and the minutes of the last Fed meeting will be published. On Thursday, the consumer price index (Mar.) for China as well as producer prices (Mar.) and initial jobless claims (Apr. 6) for the US will be published. On Friday, the final consumer price indices (Mar.) for Germany and France, monthly GDP (Feb.) for the UK and preliminary consumer confidence from the University of Michigan (Apr.) are on the agenda.

Low index volatility, strong rotations below the surface

- Since the beginning of the year, the stock markets moved upwards almost in a straight line. The risk/return ratio of the MSCI Europe is almost 1:1.

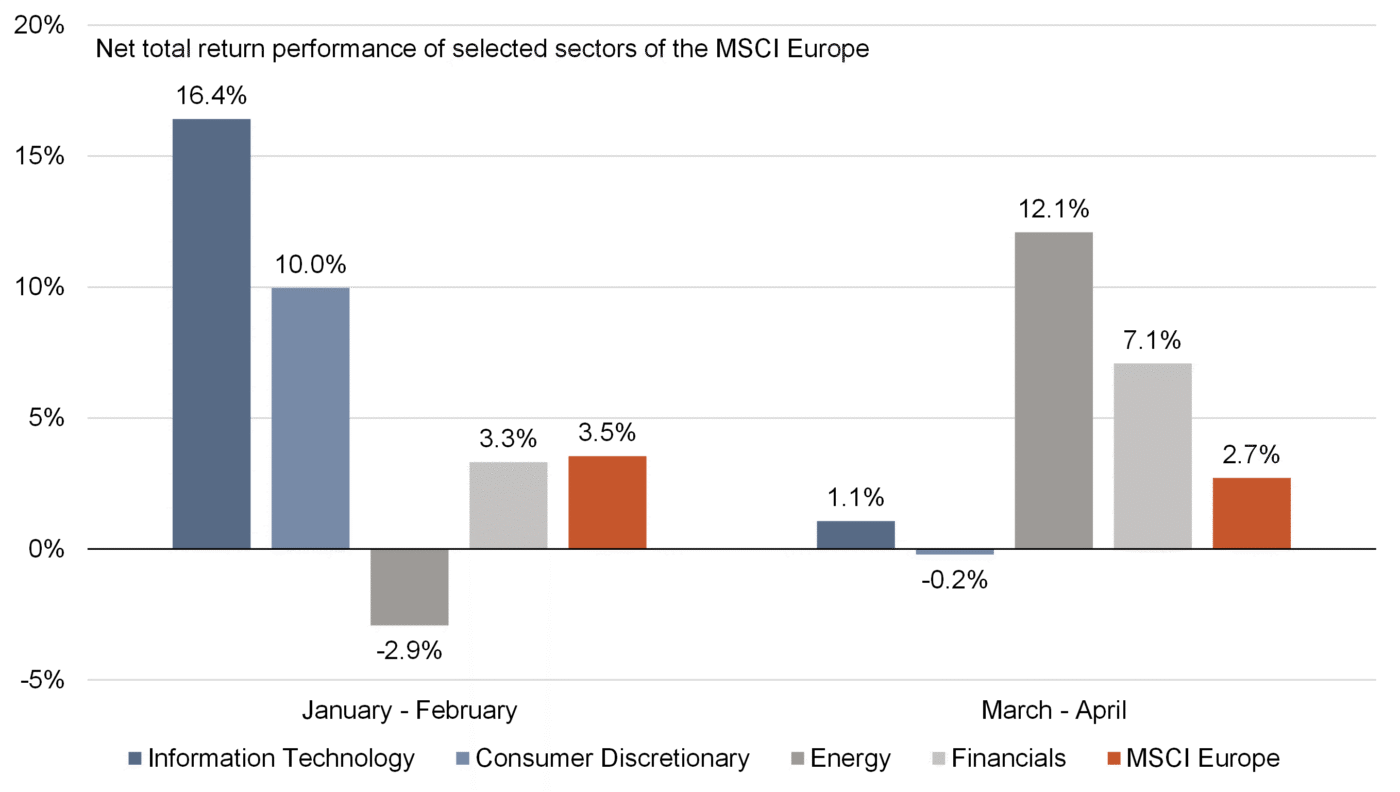

- Beneath the surface, however, there have been major rotations. While the technology and consumer goods sectors performed well at the beginning of the

year, the energy and financial sectors have done so recently. The resulting low volatility at index level therefore belies the changing outlook for the market in

terms of growth, inflation and monetary and geopolitical policy.