Current market commentary

The stock markets have been treading water for weeks now. The higher real interest rates in combination with economic concerns are capping the upside potential, especially since the expected corporate profits are also tending to be reduced and not increased despite a more robust than expected US economy. The multiple geopolitical tensions are also not helpful and have recently rather boosted gold and oil. At the same time, the US economy remains robust and support from non-fundamental ETF savings plans continues – and should continue until US unemployment rises and less money flows into retirement savings. Otherwise, positioning among discretionary as well as systematic investors in equities is likely to trend neutral. Among trend-following strategies, the large short positioning in bonds seems vulnerable should interest rates start to fall. At the moment, it is mainly long-term interest rates that are rising, which is at least beneficial for the steepener position in our multi-asset strategies.

Short-term outlook

This week, the Q3 reporting season enters its most intense week with 162 companies in the S&P 500 (over 30% of the index), particularly financial and healthcare companies, providing insights into the robustness of the US economy. Of the 86 companies reported so far, 74% beat analysts' earnings expectations. On the (monetary) policy front, things should get exciting with the ECB meeting on 26 October and the G7 trade meeting on 28-29 October. On Tuesday, the preliminary purchasing managers' indices (PMIs) for the eurozone will be published (October). This will be followed on Wednesday by the ifo Business Climate for Germany (October) and US New Home Sales data (October). On Thursday, the markets will focus on the publication of GDP figures for the US (Q3), new orders for durable goods (September) and initial jobless claims (21 October). This will be followed on Friday by data on US household income and spending (September).

Only commodities price geopolitical tensions

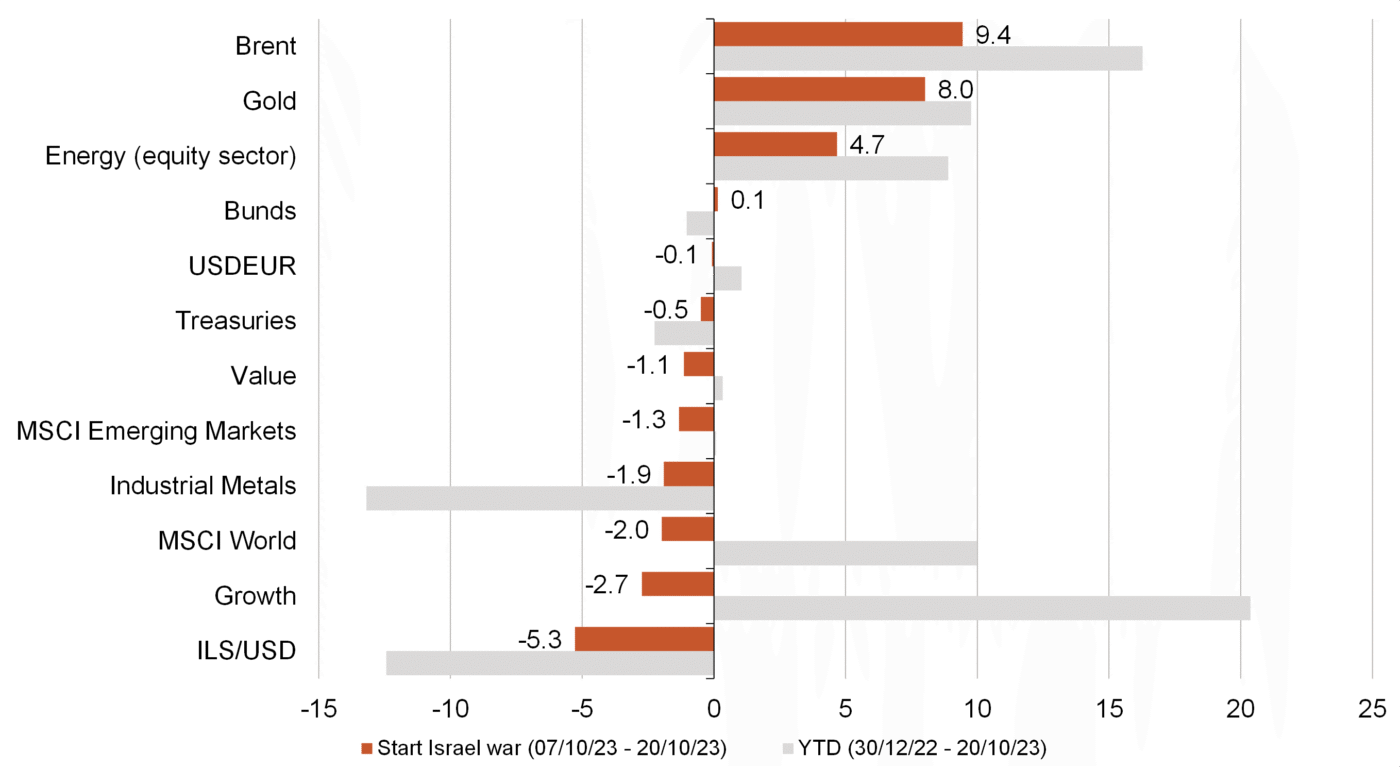

- While the Israeli war is keeping the world politically on tenterhooks, the financial markets are still taking a wait-and-see approach.

- At the moment, they tend to treat the war as a local conflict. Accordingly, risk assets have only lost slightly since the conflict intensified in early October. Under the surface, however, the flight into safe havens such as gold and the increased oil price show the higher uncertainty. Without international escalation, however, the global economic consequences are likely to remain limited.