Current market commentary

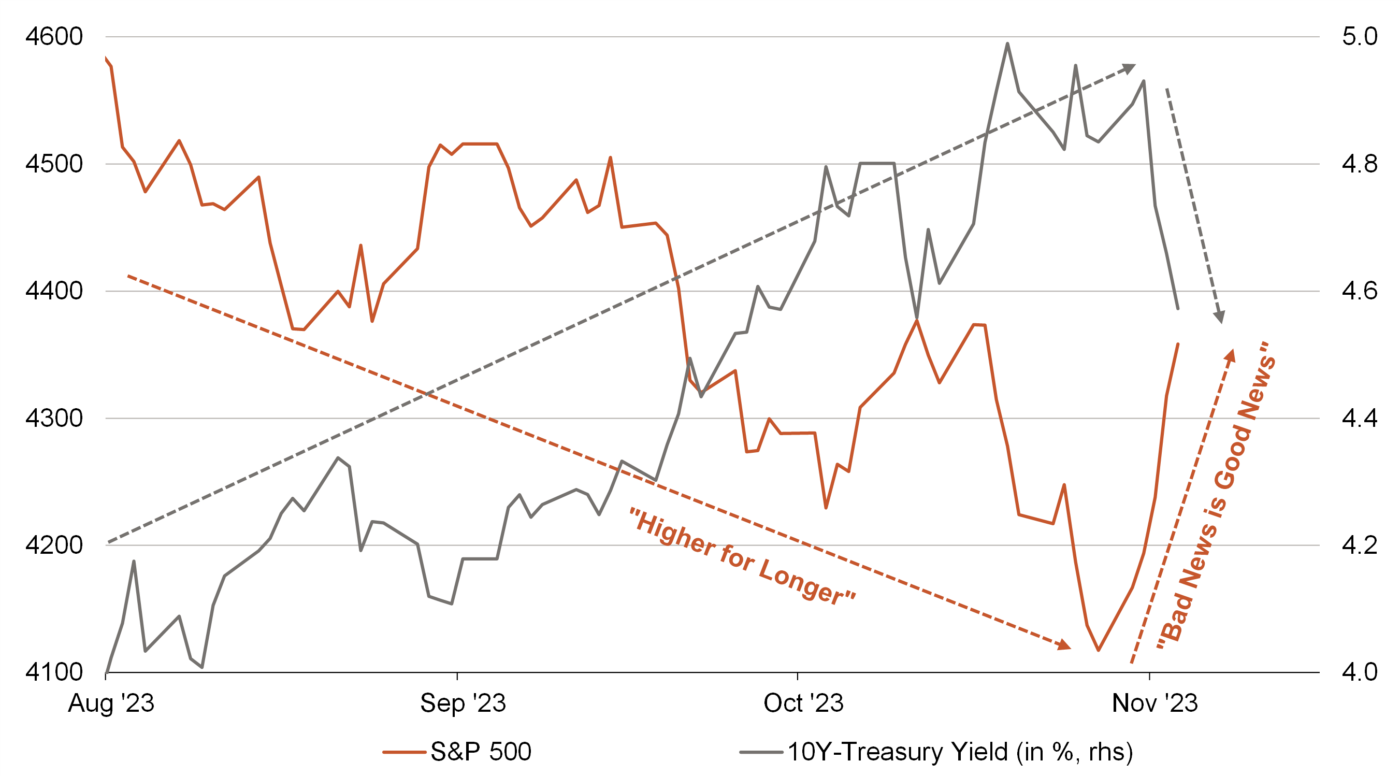

After equity markets fell in October due to geopolitical concerns and rising interest rates, there was a technical countermovement of the oversold markets last week. In addition to solid Q3 company results, the fact that interest rates have recently fallen significantly has helped. For example, 10-year US yields have fallen more than 50p from their October peak, supported by a slightly dovish Fed and the US Treasury, which is now increasingly looking to refinance at the short end. After the Fed meeting last Wednesday, volatility also came down as it often does as uncertainty eased. The VIX fell from 21 to 15, forcing systematic investors back into the market. We used the sell-off at the end of October to reduce our equity underweight and added to US equities. These are usually particularly supported by increased share buyback programmes at the end of the year. Fundamentally, however, we remain sceptical.

Short-term outlook

The next two weeks are likely to be quieter on the (monetary) policy front. The major central banks will not meet again until mid-December, and the political scene will only get exciting on 13/14 November at the Asia-Pacific Economic Cooperation (APEC) 2023 summit. In the markets, the bulk of the S&P 500 companies should have completed the Q3 reporting season in the next two weeks. After that, US corporate file buyback programmes are likely to pick up steam. The October Purchasing Managers' Indices (PMIs) for the eurozone countries are due today. Data on German industrial production (Sep.) and the US trade balance (Sep.) will follow on Tuesday. On Thursday, US initial jobless claims (Nov. 4) provide insights into the US labour market. Friday will see GDP figures (Q3) for the UK and preliminary US consumer confidence from the University of Michigan (Nov.).

So no „higher for longer”?

- Following recent weaker economic data and subsequently less hawkish central banks, interest rates have fallen significantly and the stock markets have risen sharply. So instead of "higher for longer", "bad news is good news" has once again been the order of the day. However, the rally is likely to have been driven not least by short covering.

- Even if less interest rate pressure is good for equities in the short term, the poorer macro data should not be cause for euphoria. Bad news remains bad in the medium term.