Current market commentary

The combination of weaker US labour market data and moderate inflation figures has led to falling bond yields. The market is now even pricing in a small probability that the Fed will take a big step in September and cut key interest rates by 50 basis points. Other asset classes also benefited from this. US stock indices reached new all-time highs, with small caps in particular posting significant gains. Market breadth has improved noticeably, not least due to an increase in takeover bids. Gold and silver, which we bought or added to in our multi-asset strategies at the end of August, also posted strong gains, supported by a weaker US dollar. The notoriously volatile month of September has been favourable so far, but this carries the risk of complacency. However, analyses show that many active fund managers remain underinvested and that there has been increased demand for hedging recently. There is no euphoria among discretionary investors. In our view, this should limit the potential for a setback.

Short-term outlook

After last week's inflation and labour market data from the US provided more insight into the development of the US economy, investors will be focusing on the Federal Reserve's interest rate decision on Wednesday. Signs of a weakening labour market and inflation in line with expectations are likely to prompt the central bank to cut its interest rate for the first time in nine months. Following today's release of Chinese industrial production figures (Aug), Tuesday will see the publication of the German ZEW economic expectations (Sep) and US retail sales (Aug). On Wednesday and Thursday, in addition to the Fed, the Bank of Canada and the Bank of England will announce their interest rate decisions, and consumer prices for the eurozone (Aug) will be released. The following week, preliminary PMIs for the eurozone, the UK and the US will be reported. At the end of the week, initial jobless claims in the US (Sep) and the Michigan Consumer Sentiment Index (Sep) will follow.

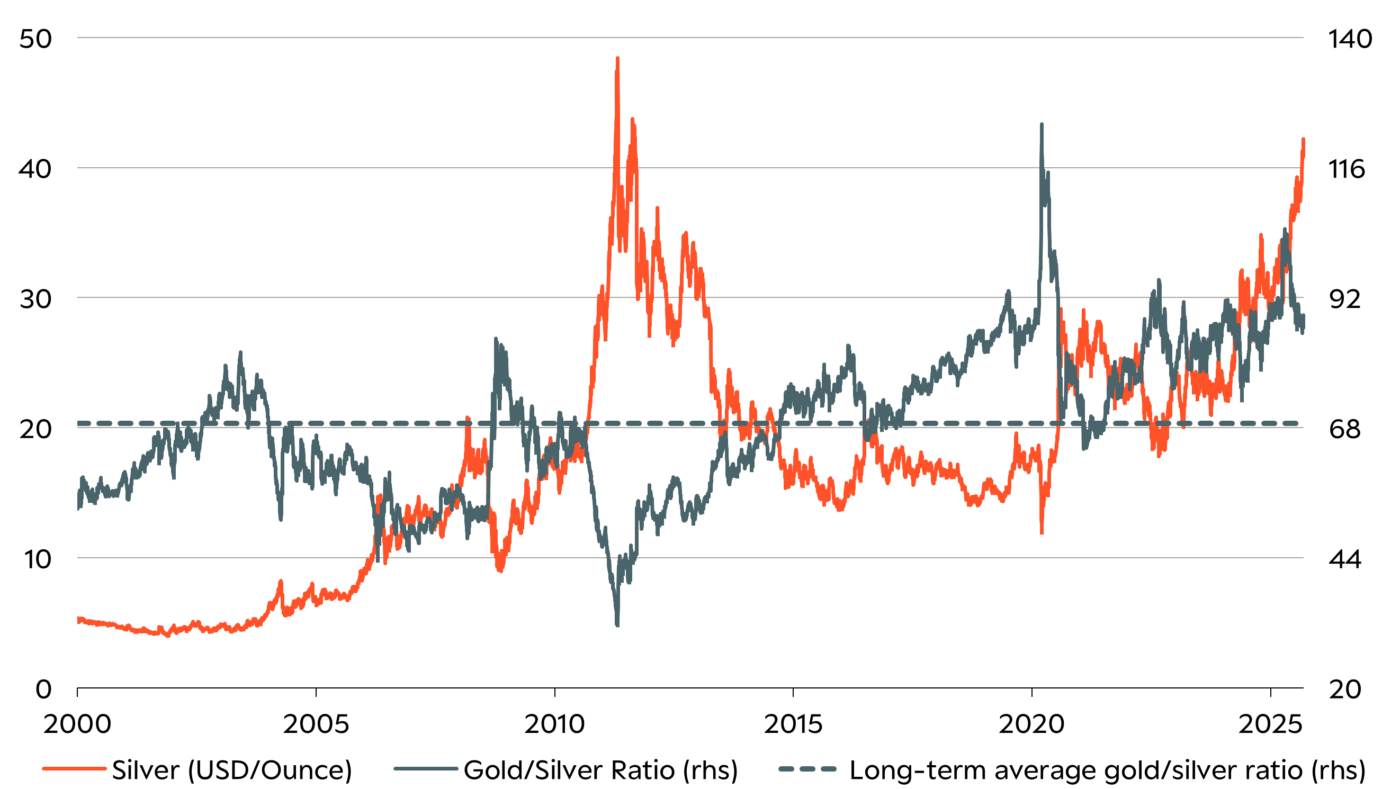

Silver still undervalued against gold despite price rally

- The price of silver has risen significantly in recent weeks. In addition to initial unofficial purchases by central banks in the Middle East, rising ETF holdings and a weaker US dollar also provided support.

- Despite the price increase, silver remains cheap relative to gold. The gold/silver ratio is around 25% above its long-term average. In addition, the silver market is likely to show a supply deficit for the fifth consecutive year in 2025.