Current market commentary

The rapid turnaround initiated by the Fed towards a significantly more restrictive monetary policy and the increased geopolitical risks surrounding Russia have left their mark on the capital market. Highly valued growth stocks in particular came under pressure, while commodities, especially oil, were beneficiaries. The VIX climbed to over 30 and a weekly survey of American private investors showed the strongest pessimism since 2013. The adjusted positioning of market participants and especially systematics, the extremely pessimistic investor sentiment and technical indicators such as the RSI suggest that the correction should largely be behind us and the chances for a recovery in February are good. This is all the more true if there is no war in Ukraine and if the next inflation figures are not too hot. We remain overweight in equities and see the current phase of weakness as a correction in a bull market triggered by a valuation adjustment.

Short-term outlook

Over the next two weeks, more than 30% of the S&P 500 and STOXX Europe 600 companies report by market capitalisation. The so far solid Q4 reporting season is coming to an end, at least for the S&P 500, leading to increasing share buybacks again. The Year of the Tiger begins in China on 01 February and the Winter Olympics on 04 February. The Chinese stock markets are closed up to and including 4 February. The ECB and the BoE meet on 03 February. However, the ECB is likely to adopt a less restrictive tone than the Fed.

Preliminary inflation figures (Jan.) and retail sales (Dec.) for Germany will be released today, followed on Tuesday by labour market data (Jan.) for the Eurozone and industrial PMIs (Jan.) for Europe and the US. The service PMIs will follow on Thursday. Eurozone inflation (Jan.) will be published on Wednesday and German new orders (Dec.) and French industrial production (Dec.) on Friday. US labour market figures are also due then.

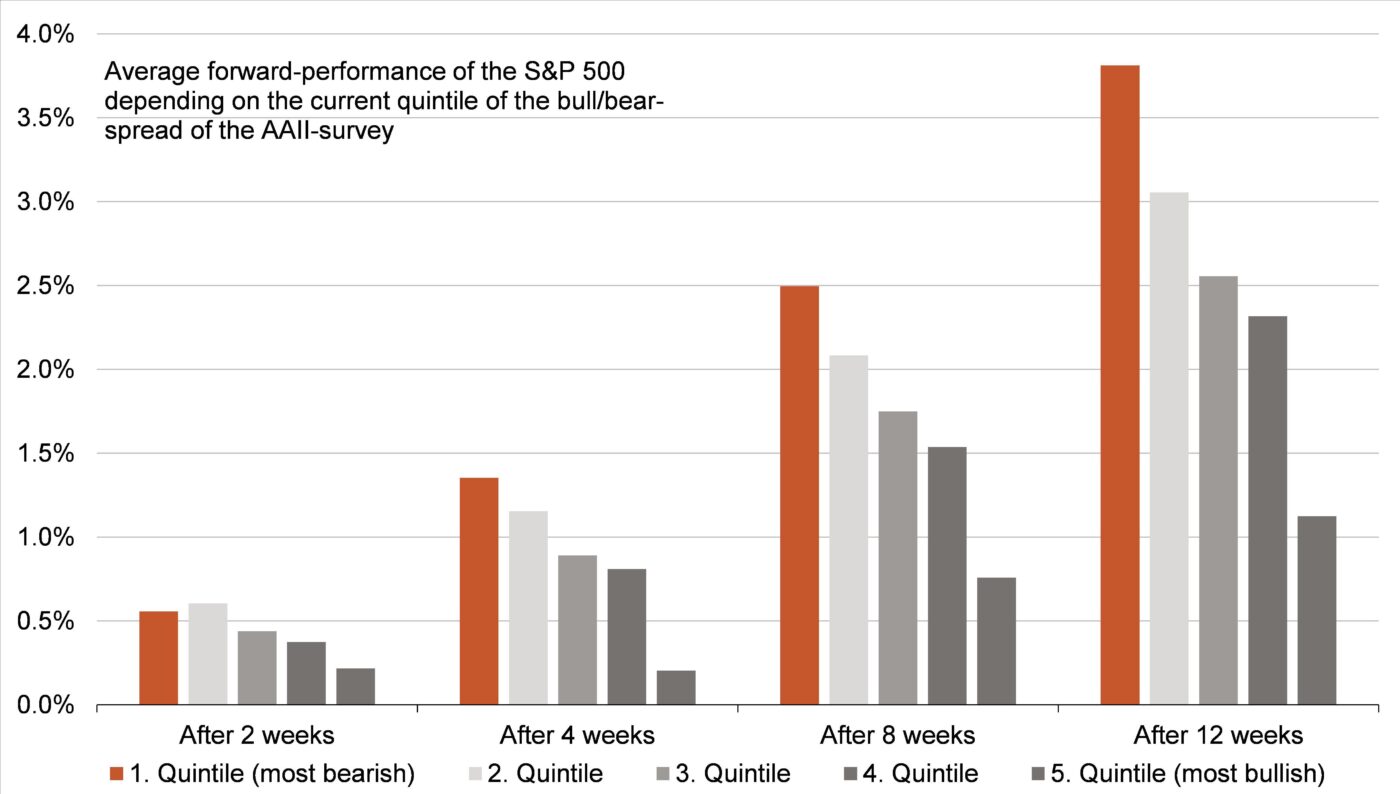

The worse the sentiment, the better the subsequent performance

- The Russia-Ukraine conflict and the Fed's hawkish tones have weighed heavily on sentiment.

- In less than 2% of cases since 1987, sentiment has been worse, according to the AAII. Historically, however, investor pessimism offers hope. Typically, stock

market performance over the following weeks is much better than when senti-ment is good. On the one hand, bad news is already largely priced in and on the other hand, there is potential for positive surprises.