Current market commentary

Globally central banks are becoming more restrictive - the market is pricing in six 25bps rate hikes by the Fed and nearly two by the ECB for 2022 after higher US inflation data and a more hawkish ECB - while the Russia-Ukraine conflict continues to weigh on markets. The back-and-forth at investment style level continues, with value stocks still ahead. Regionally, equities from Europe and especially the UK have outperformed their US counterparts. Interest rate hikes should now be largely priced in, which is why we see recovery potential for equities in the medium term. This is also supported by the fact that inflation rates are likely to fall from the second quarter at the latest, investor positioning has declined significantly, market pessimism is very high, the Q4 reporting season is solid and equities remain attractive relative to bonds. However, despite solid earnings growth, return potential is likely to remain limited in times of more restrictive central banks and falling valuation levels.

Short-term outlook

The Q4 reporting season is coming to an end in the next few weeks. More than 350 companies in the S&P 500 have already published their figures and were able to exceed earnings expectations by more than 5% on average. Politically, the Russia-Ukraine conflict and the increasing economic opening steps are likely to occupy markets. On 17-18 February, the G20 finance ministers and central bank governors will meet in Jakarta.

Tomorrow, preliminary Q4 GDP figures for Japan and the Eurozone will be released, as well as the Empire State Index (Feb.). This will be followed on Wednesday by Eurozone and US industrial production data, US retail sales and the Fed's January minutes. US housing data and the Philadelphia Fed Index will be released on Thursday. In the following week, the preliminary purchasing managers' indices (Feb.) for Europe and the US, US and German consumer confidence (Feb.) and the German Ifo index (Feb.) are due.

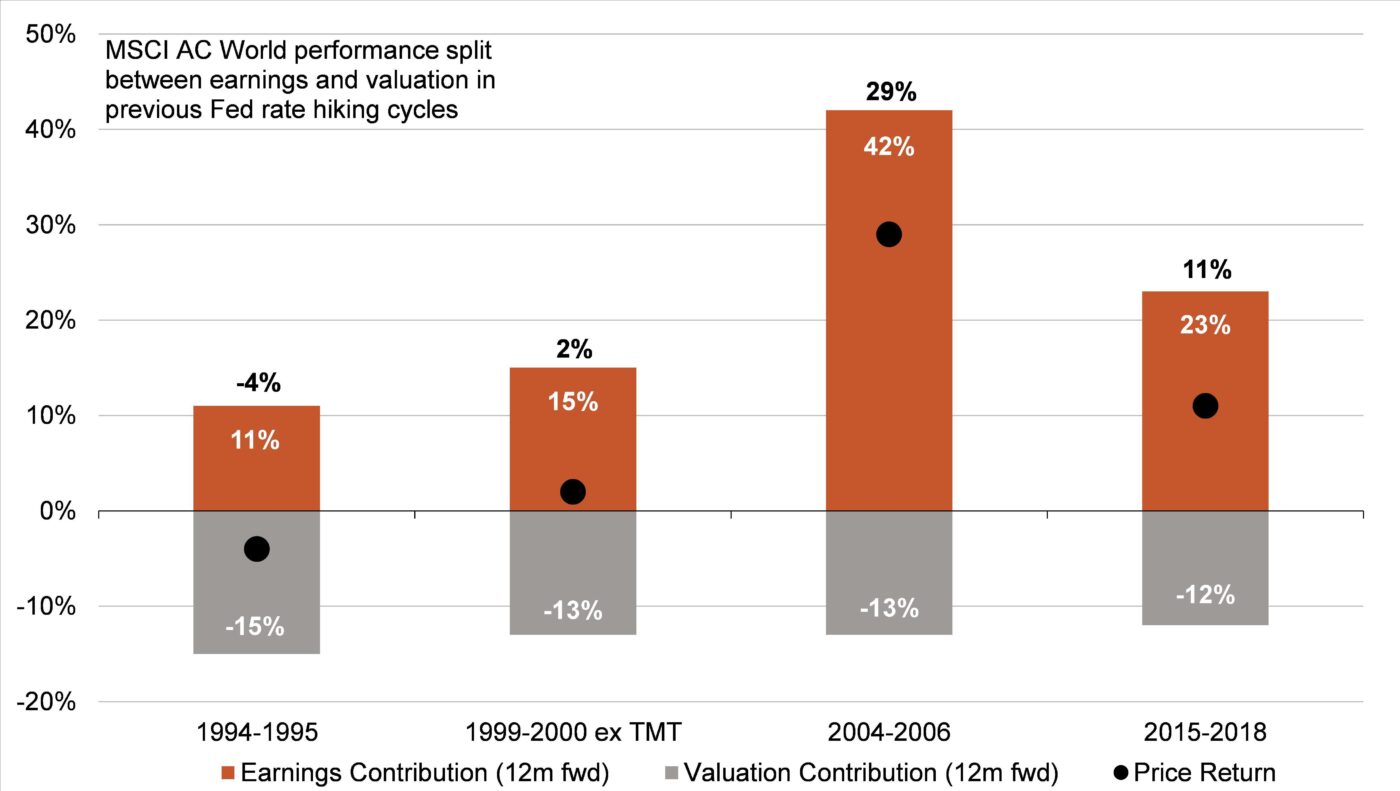

Interest rate hiking cycles put the brakes on equity returns

- In past interest rate hiking cycles, equities have always experienced a valuation contraction. This is because the discount rates for future corporate profits typically rise with rising key interest rates. Nevertheless, global equities managed to generate a positive return in 3 out of 4 cases thanks to solid earnings growth.

- Earnings should continue to grow in the coming cycle if the economy remains robust. However, the return potential remains limited with valuations likely to fall.