Market commentary EM equities

In the second quarter of 2025, EM equities gained significantly more than DM equities following the easing of the US-China tariff talks. This was driven by solid earnings growth, attractive valuations and improved macro data. Within EM, Latin America and Asia led the way. In Latin America, financials shone thanks to high net interest margins and robust lending. Asia was led by South Korea and Taiwan: the positive election result in Korea boosted the stock markets. South Korean defense stocks benefited from rising global defense budgets, Taiwanese tech and semiconductor companies from unbroken demand for AI. The outlook remains constructive: expectations of falling interest rates, a weaker US dollar and favorable valuations are supporting domestic earnings growth and capital inflows, while fiscal stimulus and reforms are additional catalysts. Risks remain new tariff barriers, geopolitical escalations and volatile commodity prices, which could delay the central banks' easing path.

Market commentary EM bonds

In the second quarter of 2025, US dollar-denominated government bonds from emerging markets hedged in euros performed positively at 2.1%. This was mainly due to declining credit risks, which benefited high-yield bonds in particular. Although investment-grade bonds also benefited from falling risk premiums, the US curve steepening weighed on these bonds due to their higher duration compared to HY bonds. Regions such as Latin America or Africa, which have high-yield bonds outstanding in particular, per-formed better than bonds from Asia, Europe and the Middle East, which have lower credit risks. Local currency bonds denominated in euros benefited from their high current interest rates and falling interest rates. However, the strong appreciation of the euro against the US dollar and correspondingly also against most emerging market currencies led to an overall negative performance of around -0.8% in the second quarter.

Strong euro was a burden for EM investments in the second quarter

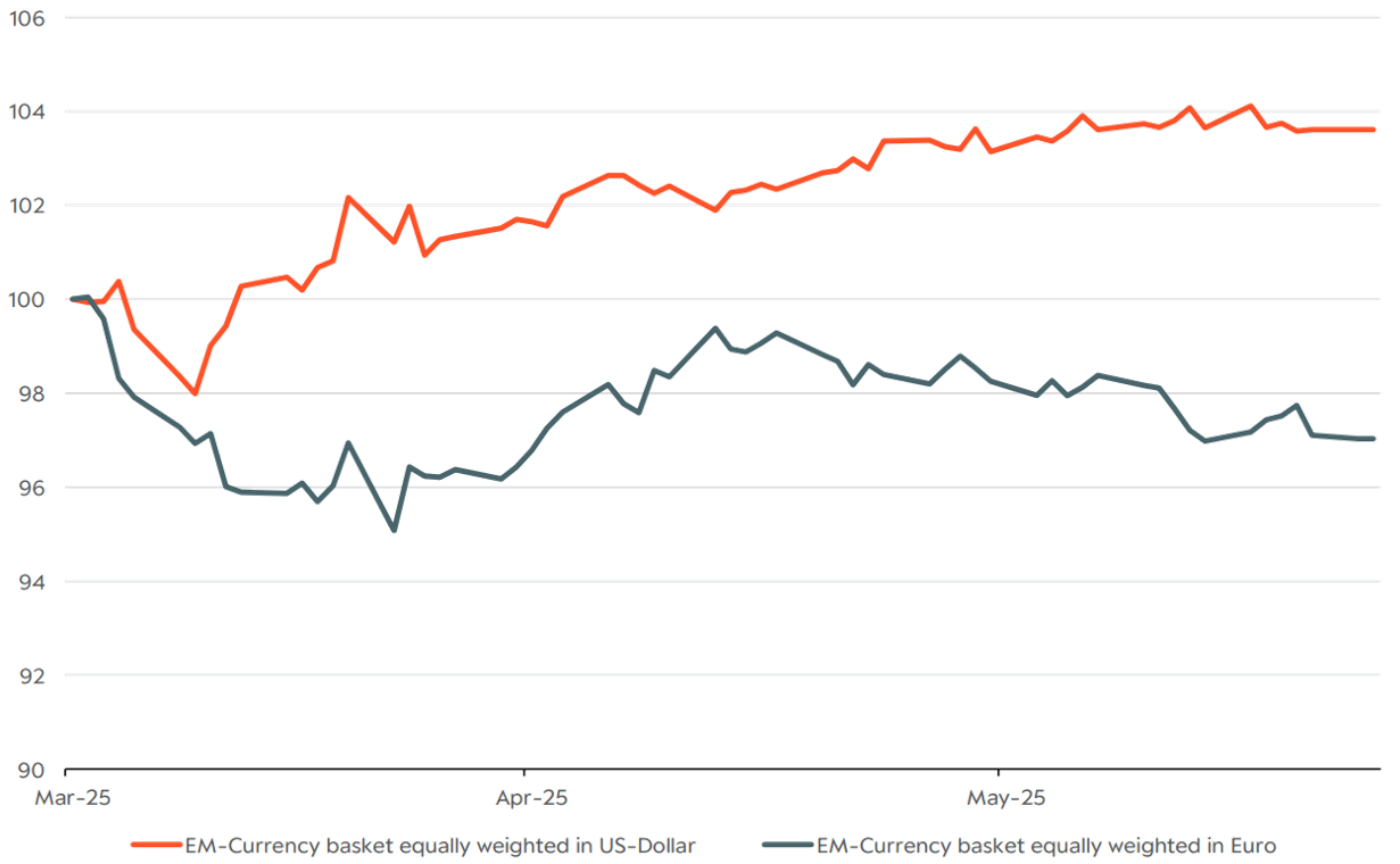

- For European investors in equities and local currency bonds from developing countries, the strong euro was a significant burden in the second quarter of 2025.

- Currencies from emerging markets performed very positively against the US dollar in the second quarter. However, Trump's tariff chaos and capital outflows from the US led to a sharp depreciation of the dollar against the euro.