Current market commentary

Global equities recently traded near their highs for the year, much to the dismay of many pessimistic investors. Falling inflation, the averting of a banking crisis, still positive seasonality and a better-than-expected Q1 reporting season so far have buoyed global stocks - equity volatility has fallen sharply, and valuations have risen significantly. Unusual in the rising market is the underperformance of cyclical versus defensive stocks since the banking turmoil. It indicates some scepticism among equity investors. The bond market is also expecting a less rosy outlook, reflecting the inverted yield curve, higher risk premia, high credit default swaps (CDS) on US Treasuries and Fed rate cuts already priced in. Who is right? We remain cautious, as the risk-reward ratio does not look very attractive, especially after the rally. A lot of positives are already priced in, while risks such as the real estate crisis, credit crunch, US debt ceiling and US/China conflict are being neglected.

Short-term outlook

The next few weeks continue to be dominated by the Q1 reporting season. Already 84 companies (17% of the S&P 500) have reported. Of these, 79% have beaten earnings estimates so far, with a median of 6%. On the central bank side, the Bank of Japan will announce its next interest rate decisions on Friday (28 April), the Fed on Wednesday (3 May) and the ECB on Thursday (4 May). The economic situation remains intriguing. The ifo business climate survey (Apr.) will be published today. Meanwhile, for the US, new home sales (Mar.) and consumer confidence (Apr.) on Tuesday, new orders for durable goods (Mar.) on Wednesday and initial jobless claims (Apr. 22) on Thursday will provide insights into the health of the US economy. After Thursday's GDP data (Q1) for the US, these will follow on Friday for the Eurozone, Germany, France, and Italy. In the US, household purchases and expenditures (Mar.) and the Chicago Purchasing Managers' Index (Apr.) will also be released on Friday.

Equities at this year's high, recently driven by defensive stocks

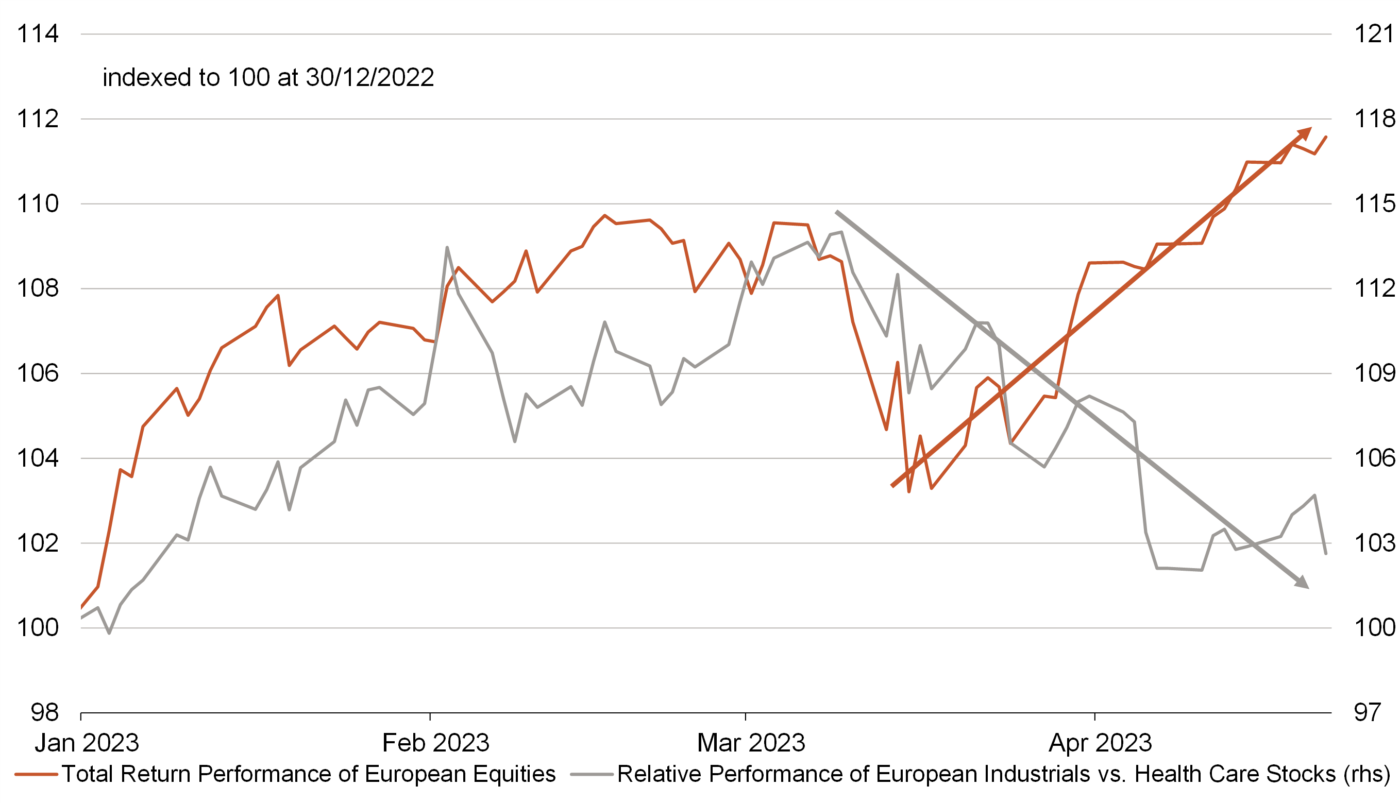

- European equities hit a new high for the year last week, just a month after the turmoil in banks.

- However, there has been a clear change of favourites since then. Defensive healthcare stocks have significantly out-performed cyclical industrial stocks, un-like in the period before. Investors are therefore less complacent than the re-covery at the index level would suggest.

- Nevertheless, the overall market per-formance is surprising given the multitude of risks. However, all good things come to an end.