Current market commentary

The combination of cooling macro data and inflation figures has led to falling interest rates and fuelled Goldilocks hopes – i.e. that the Fed will actually manage a soft US landing. As a result, shares have risen sharply, also favoured by a falling US dollar and oil price, which has further loosened financial conditions. The decline in equity and interest rate volatility has led to the more underexposed quant strategies being pushed back into equities and bonds. The scenario of a "technical" year-end rally that we have outlined in recent weeks therefore appears to be materialising, especially as the major share buyback programmes are only just getting underway and systematic strategies are not yet fully invested – risk parity strategies in particular could now increasingly demand equities if the positive correlation between equities and bonds eases somewhat. Fundamentally, however, the risk remains that economic disappointments could also weigh on equities at some point.

Short-term outlook

In regards to the central banks, the market is likely to be looking forward to the publication of the minutes of the Fed's last meeting on 21 November. On the political front, the parliamentary elections in the Netherlands on 22 November and the OPEC+ meeting on 26 November will be intriguing. The US stock markets will be partially closed on 23 November due to Thanksgiving. As the Q3 reporting season draws to a close, investors are likely to turn their attention back to economic data. On Wednesday, US consumer confidence from the University of Michigan (Nov) and initial jobless claims (18 Nov) will be published. Thursday will see the preliminary PMI data (Nov) for some eurozone countries and the minutes of the last ECB meeting. The German Q3 GDP figures and the ifo business climate (Nov.) will follow on Friday. The following week will see Q3 GDP and ISM data (Nov.) for the US and inflation data for the eurozone countries.

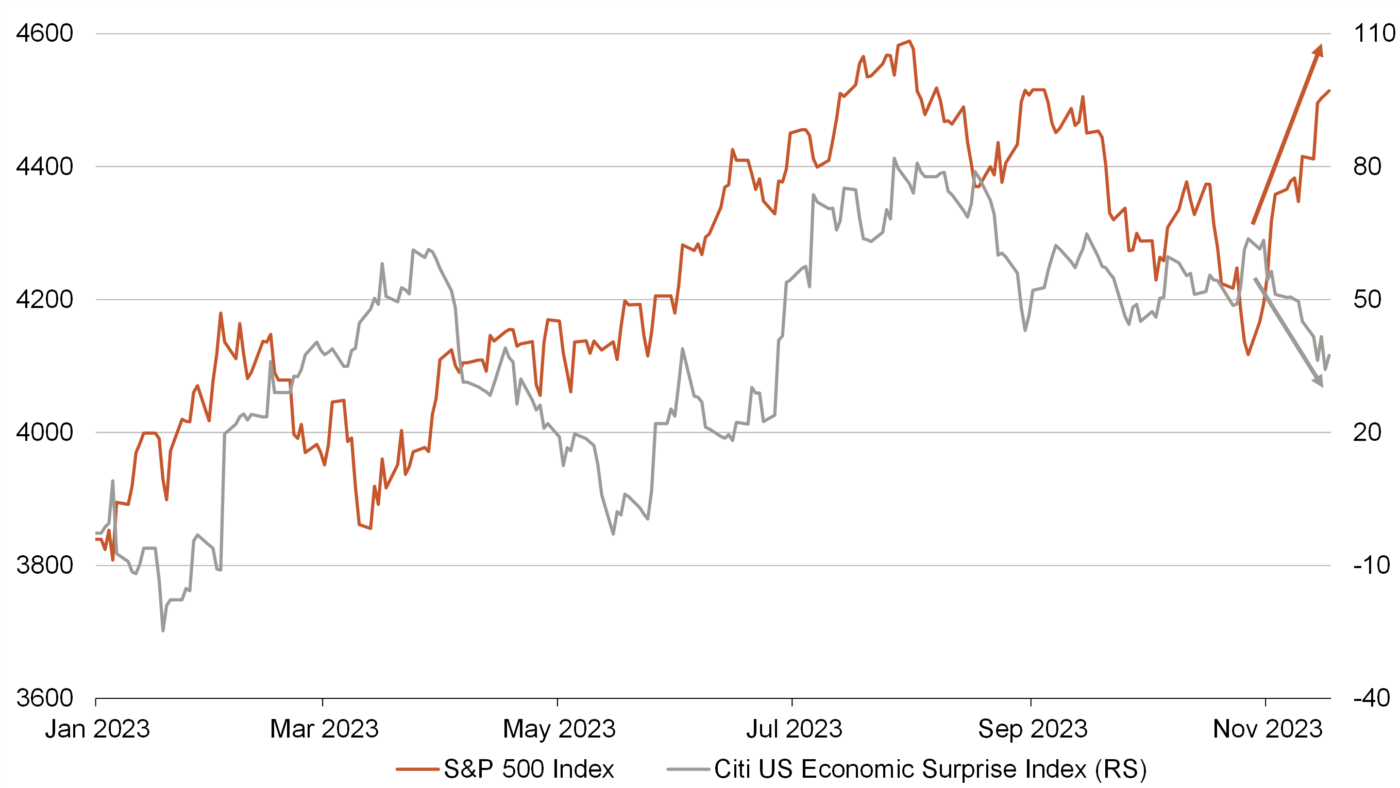

Equity markets cannot celebrate economic disappointments forever

- After months of robust US economic data, the positive economic surprises have recently waned. Investors are therefore hoping for a change of direction in Fed policy soon and are now pricing in four interest rate cuts for 2024.

- Not only the bond markets but also the equity markets are celebrating the prospect of falling interest rates. However, if the economic disappointments gather pace, this could quickly turn from a tailwind for valuations into a drag on earnings.