Current market commentary

After the growth outlook has dominated the markets in the past months, inflation is now once again investors' main focus. Initially, inflation concerns still prevailed as a result of the strong ADP labour market figures, but with the recent lower-than-expected US inflation data, hopes emerged that after another 25bp interest rate hike from the Fed has taken place next week, the cycle of interest rate hikes will finally come to an end. Stocks as well as bonds rose strongly, volatility and the US dollar fell. In the coming weeks, we expect the reporting season to take investors’ attention. Although analysts have significantly lowered their Q2 earnings estimates, their expectations for the second half of the year and 2024 still seem ambitious. The outlook of the companies is therefore likely to be crucial. With high valuations, pronounced investor positioning and after strong YTD performance (e.g. the Nasdaq-100 is up by +43%), we therefore consider a more defensive portfolio orientation to be sensible.

Short-term outlook

Over the next two weeks, more than 50% of the companies in the S&P 500 and the STOXX Europe 600 by market capitalisation will report their earnings. On the central bank side, the situation looks set to become more interesting on 26 July at the Fed meeting and on 27 July at the ECB meeting. In addition, the Spanish elections will take place on 23 July. Today, besides the Empire State Index (Jun.), Q2 economic growth, industrial production (Jun.) and retail sales (Jun.) figures for China are due. Retail sales (Jun.) and industrial production (Jun.) figures for the US follow on Tuesday, and inflation data (Jun.) for the UK and US housing data (Jun.) are expected on Wednesday. On Thursday, Chinese interest rates, French business confidence (Jul.) and the Philadelphia Fed Index (Jul.) data will be released, and on Friday, we expect Japanese inflation data (Jun.). Next week, the Ifo index (July), European inflation data (July) and purchasing managers' indices (July) for Europe and the US will be published.

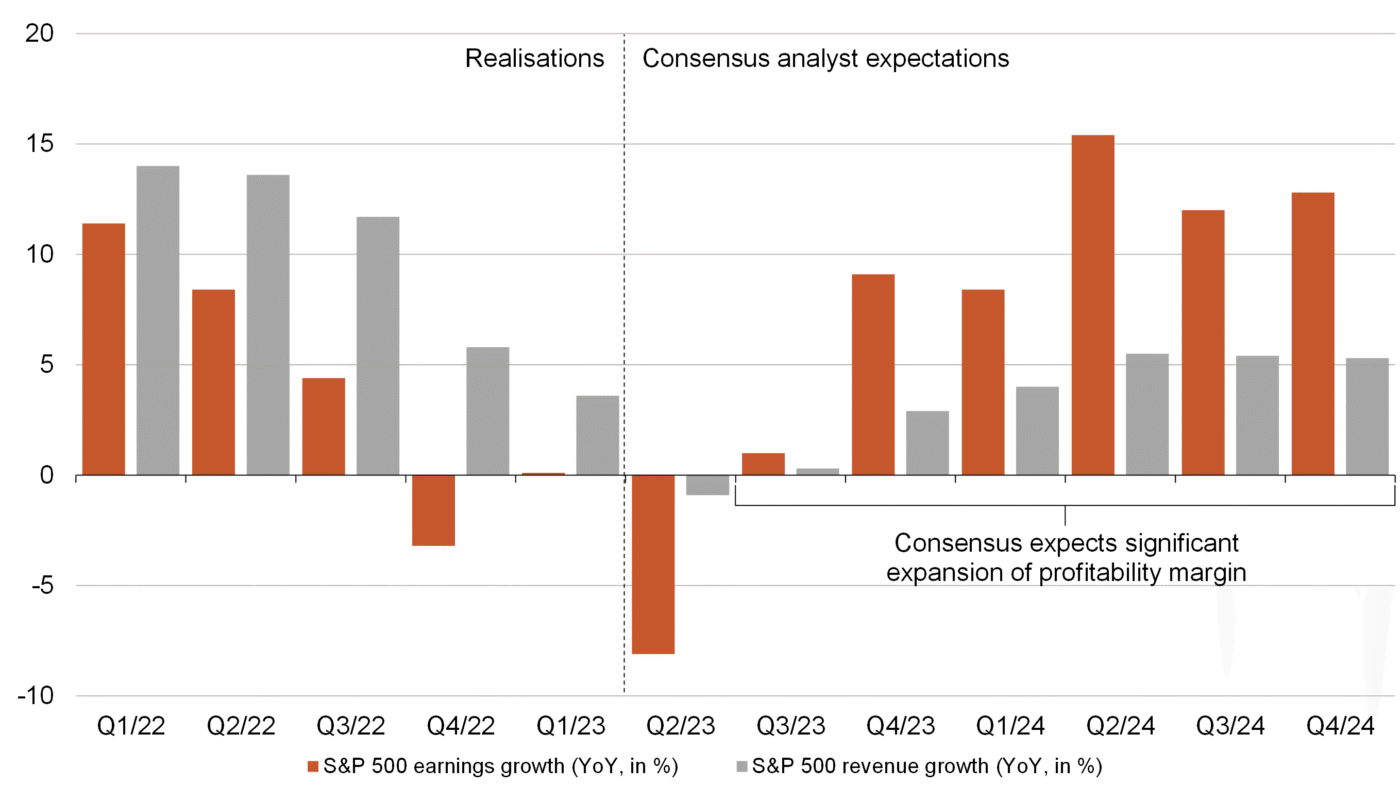

Earnings expectations pick up from Q4. That seems optimistic.

- With the Q2 reporting season, fundamentals are coming into focus. Earnings for the S&P 500 are expected to fall by more than 5%. Low expectations, the more robust economy in Q2 and the weaker US dollar create opportunities for positive surprises.

- However, analysts are very optimistic for Q4 and beyond, which we consider challenging amid slowing growth, declining inflation and rising labour costs. The outlook given by companies should therefore be interesting.