Current market commentary

Last week, the central banks failed to make any major backpedalling, especially on the part of the Fed. Although the US central bank reaffirmed the current interest rate level, it held out the prospect of three interest rate cuts in the coming year and further rate cuts thereafter. Fed Chairman Jerome Powell was dovish and emphasised that inflation had already eased without a major rise in unemployment. As a result, the US dollar fell significantly and the yield on ten-year US government bonds fell below the important four per cent mark. Equities continued their rally and even commodities recovered somewhat recently. Almost all asset classes rose accordingly, driven by hopes of a less restrictive monetary policy and more liquidity in the near future. The "everything rally" is therefore likely to have anticipated much of the expected return potential for next year. We expect a (temporary) countermovement next year. The market appears to be clearly overbought at the moment.

Short-term outlook

After the big central bank week (the Bank of Japan will announce its interest rate decision on 19 December), things are likely to be quieter until the end of the year due to Christmas. From the start of 2024, however, things are likely to get more exciting. The minutes of the last Fed meeting will be published on 3 January 2024. The Economic Forum in Davos will also take place from 15 to 19 January. On Tuesday, the final consumer prices (Nov.) for the eurozone and the housing data (Nov.) for the US will be published. Wednesday will see consumer prices for the UK (Nov) and consumer confidence (Dec, Conference Board) for the US. This will be followed on Thursday by US GDP (Q3) and US initial jobless claims (16 Dec). On Friday, US household income and spending (Nov.) and preliminary US durable goods orders are due. Between the years, the US Chicago PMI (Dec.) and the PMI data for China (Dec.) will be published.

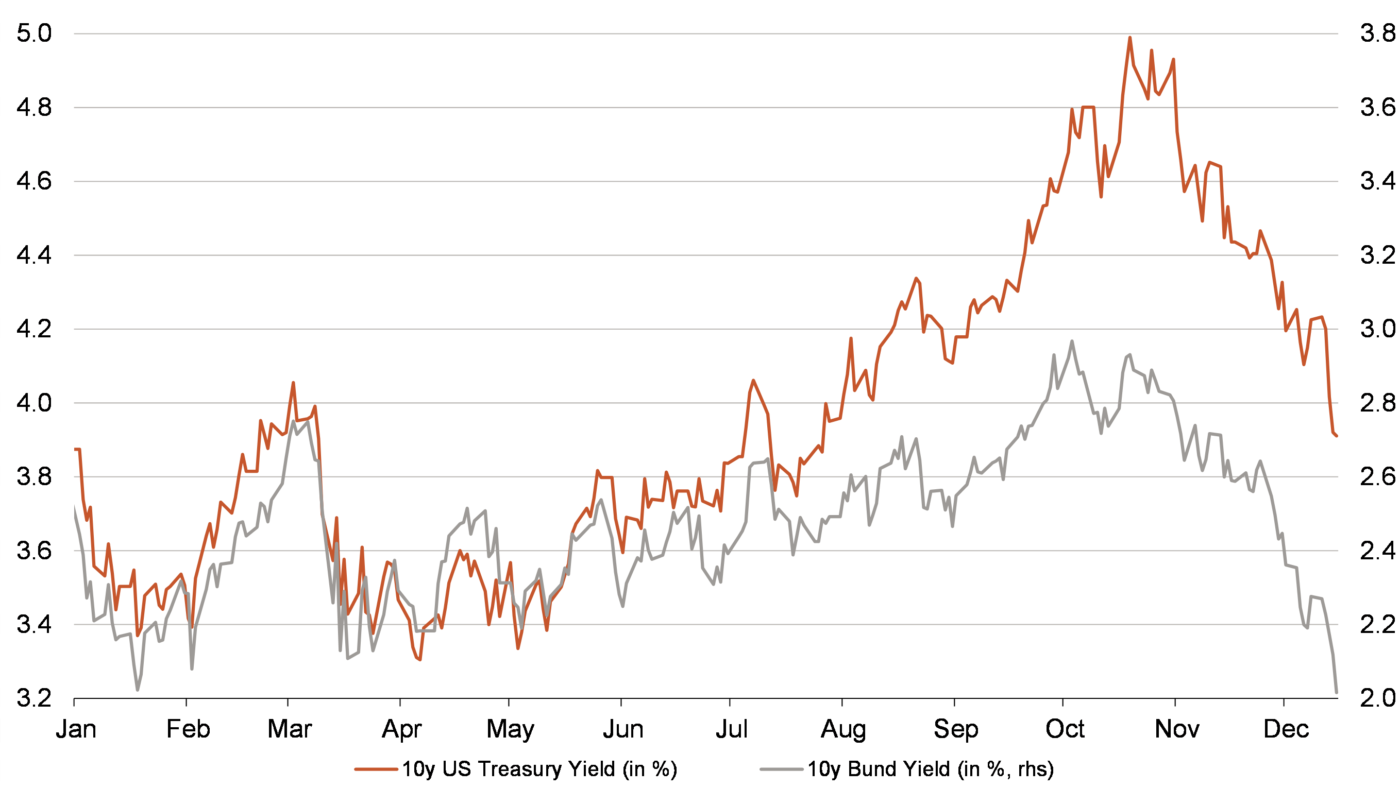

Latest rate move pulverises rise in yields since the beginning of the year

- With lower than expected US inflation data and a dovish Fed, yields on safe government bonds have fallen rapidly since November.

- As a result, yields on US Treasuries are back to the start of the year, while those on German government bonds are even significantly lower. The rate differential has widened from 1.4p to 1.9p in 2023.

- As the Fed is likely to be the first to cut interest rates, this spread should narrow. Following the extreme movement, the potential for falling yields, especially for Bunds, therefore appears limited.